Welcome, subscribers!

We’re back with another batch of new ideas. We have a couple of turnaround stories and a few high quality businesses currently on sale. Hope you enjoy them!

If you enjoy what we do, please consider forwarding to a friend or colleague who might also appreciate our work.

This week, we present 5 new stocks, including:

A niche industrial technology leader excelling with a "trifecta" business model—providing essential consumable components, high switching costs, and recurring revenue. Despite challenges in a third segment, the company's core operations show consistent profitability and long-term growth potential.

A pharmaceutical services firm with deep competitive advantages and strong historical growth, currently experiencing a cyclical downturn. Positioned to benefit from long-term trends in drug development, with optional upside from reshoring and AI-driven innovations.

A global defense contractor focused on advanced testing and engineering solutions. Well-positioned to benefit from increased defense spending in key regions, the company operates a disciplined acquisition strategy and maintains a conservative balance sheet.

A turnaround story in the consumer brand space, driven by new leadership and strategic hires. Early signs of financial stabilization, including balance sheet improvements, inventory management, and gross margin recovery, point to potential long-term success.

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

Bronte Capital went into great depth on Spirax Engineering (SPX-LON), a UK-based global leader in thermal energy management and niche industrial technologies that has become one of the firm’s biggest positions. We include Bronte’s thoughts in their entirety below.

Spirax Engineering

More than half the stocks we like as longs have the following three characteristics:

i. They do a small part of a big thing. They are in some sense the critical ingredient in a big process, and they can charge by the value they bring to the big process.

ii. There is some difficulty in switching the part/product for a competitor product (a high switching cost), and

iii. They sell a consumable product rather than a capital item. We call the combination “the trifecta”. Business with a full trifecta range from okay to outright delicious.

Spirax Engineering is a collection of three full trifecta businesses. Two of these are outright delicious. The third will – as explained below – range somewhere from okay to good but it is unlikely to be as good long term as the main two businesses.

We found Spirax Engineering years ago by a standard Bronte method. We looked for companies that were excessively profitable. We call this the “magical mysterious margin search”. Spirax Sarco (as the company was then called) had magical margins.

Companies with magic margins tend to fall into three buckets – all interesting to us:

a) Deeply cyclic companies making high margins because the product is in scarce supply. (These margins tend to go away.)

b) Flat out frauds faking their accounts (which we may wish to short), and

c) Companies with surprisingly good businesses we did not expect.

We will go out of our way to explore these companies. In this case we paid them a visit.

We wound up in the CFO’s office – a lovely living room in a country house in Gloucestershire. The room had been used as an American military court during the War and was lightly decorated artefacts of military justice. Here was a CFO who did not need Wall Street because his company has generated sufficient capital to find people like us. Financing his business just wasn’t that hard.

We realized we had walked into a trifecta of the highest quality in a place we did not expect it. (Steam systems for heat transfer and pumps for moving fluid around.)

The business was trading 4 times sales – which at the time we thought a little expensive – but we bought some anyway. 4 times sales was about 27 times earnings – but, as you will see, our-back-of-the-envelope valuation for this stock is a sales multiple and three times would be very attractive.

That was 2015 – and, at least for a while, we regretted not buying more as the stock went from under 60 pounds per share to over 160 pounds per share. At peak this was priced at just over ten times sales.

The company has however fallen (for reasons explained below) back to about 3.3 times sales and we have been buying aggressively (though so far without profit).

At the time Spirax Sarco had two main businesses – a big one in steam processing (Spirax) and a smaller one in peristaltic pumps (Watson Marlow). Let’s explain both.

Spirax steam processing

If you take a litre of water and put it on a high-powered stove it might take a minute to boil. It might take a further ten minutes to evaporate. There is (typically) more than ten times as much energy in the steam as in the boiling water.

You can then pipe that steam to a condenser, condense it under pressure and transfer that energy accurately to wherever you want. If you let the water condense at three times atmospheric pressure it will drop that energy at 133.6 degree centigrade (272.4 F). As the pressure is the same everywhere in the condenser the temperature can be controlled over the condenser. This transfer of energy can be made very accurate.

At the end however you have a mixture of steam and hot water. If you vent that to the atmosphere you waste a lot of energy (mostly steam). You will want to separate the steam from the water and pump the steam back into the system. The device for separating the steam from water is called a “steam trap”. Even then you will have superheated water (at 133C) and if you vented that to the atmosphere it would flash boil, and the energy lost through evaporation would reduce the temperature rapidly to 100 c. You would prefer to put this through a heat exchange system and recover that energy.

Done correctly, this saves 10 to 15 percent of the energy in the system. Steam production is about ten percent global industrial energy (which is a huge number) and Spirax products might be able to save one percent of global industrial energy.

The core device here is a steam trap – and steam traps are the foundation product of Spirax Sarco. Steam traps are consumables. Steam is abrasive and every six months or so you remove the old steam traps and put on new ones.

Spirax’s business proposition is that they have a very large number of decentralized steam engineers. These engineers will help you design and manage your steam system. (It is vanishingly unlikely unless you are run a big operation that you will have a steam engineer in house.) The steam engineer will also sell you consumable products in your system. He will also be available if you have problems (though if you follow the maintenance schedule you are unlikely to have problems). If you want to swap out his parts for someone else’s you probably need to redesign your system. And, besides, you would not do that because it is mission critical if your steam system goes down and the steam traps you buy on Alibaba do not come with a locally positioned steam engineer.

Note the full trifecta here.

i. The parts they sell (mostly steam traps) are small parts of a very big thing and they save a lot of energy giving them much pricing power,

ii. The switching cost is huge (you might need to redesign your steam system, but at a minimum you lose access to the engineering services on which you rely), and

iii. The product is consumable.

This is the full trifecta. You can find in this (linked) almost 40 years of Spirax accounts. The margin was mid to high teens up to about 2010 and has been above twenty every year since 2010, except 2012 and the most recent period. The return on equity has been in the twenties almost every year since 1990 though it is currently around 16-17. For most of this period steam was the only significant business.

Watson Marlow and peristaltic pumps

An even better business is Watson Marlow and the peristaltic pump business. This was a small business inside Pfizer once – and was purchased for less than 20 million dollars in 1990. The business now has over 100 million pounds in pre-tax profit. It was a good purchase.

A peristaltic pump is a seemingly simple device. You have a roller that squeezes a tube and pumps fluid.

It could hardly be simpler.

There are however advantages.

i. The liquid that you are pumping never touches any metal part of the pump and thus cannot be contaminated by or contaminate the pump. This allows you to pump very clean liquids (eg pumping medicine to fill syringes) or pump very dirty liquid (toxic waste management). A new tube is effectively a new pump.

ii. The pump can be made very accurate. We have seen pumps that can pump 500 liters plus or minus 10ml. This is more accurate than you could easily measure the fluid.

iii. The pump can be very gentle. There are pumps for food processing in Japan that pump egg yolks without breaking the yolks.

iv. If the tube is highly specified, the pump can have a very reliable life – the life determined by the number of times the tube can be safely squeezed.

An extreme use for a peristaltic pump is pumping blood around whilst someone is having open heart surgery. High accuracy and high reliability are required. And before surgery starts you use a new tube – which is effectively a new pump – and there is no risk of cross contamination with the previous patient.

The main uses for peristaltic pumps are biotech processing and wastewater management.

We recently visited a bioprocessing trade show (in Boston) and there were many players trying to sell their bioreactors. These were machines filled with sophisticated plastic bags with many tubes coming in and out for adding reagents and other processing needs.

Here is an image of one from Sartorius (the industry leader).

In every bioreactor from every producer other than Avantor the peristaltic pumps were supplied by Watson Marlow. Avantor bioreactors embedded pumps from the distant number two player (Flexiplus). That was because Avantor owns Flexiplus.

Watson Marlow is ubiquitous in labs we have travelled. We were taken on a lab tour at Regeneron. They are standardized on green Watson Marlow pumps and there were hundreds of them. We saw a very few Flexiplus pumps on a tour of a research lab at Vertex Pharmaceuticals, but everything else was Watson Marlow.

There is a lot of technology in the tubes. Some of these tubes were lined on the inside with Teflon for instance (yes we know – forever chemicals). They provided no measurable contamination for the fluid they transported. And the tubes cost hundreds of dollars each.

Likewise, larger diameter acid resistant tubes for waste processing are typically $160 each. Note again – a pure trifecta business. These tubes are:

i. A tiny part of a big valuable process

ii. Somewhat locked in, often very locked in by FDA approved manufacturing processes and

iii. Consumables.

Watson Marlow has secured heavily reliant and very valuable customers.

We asked many people (including competitors) why the bioprocessing industry had standardized on Watson Marlow and it turns out that they have become the trusted third party. There are many steps in bioprocessing from culturing the cells that produce your product to separation and purification. Each of these steps has different industry leaders and fluids need to be transferred between the process stages. A good company (such as Regeneron) will typically buy the kit for each stage from the best player and need to connect all of this equipment. Watson Marlow is the neutral player embedded into everyone’s connection systems. It is a truly lovely position which might be challenged if (say) Sartorius were, by acquisition, to solidify their best-of-breed status in every step in the process. This seems unlikely.

Watson Marlow has typically had margins nearer 30 percent than 20 percent – and is the main reason why Spirax margins expanded notably in the last fifteen years. It is a very good business indeed.

The less good third business – electrical heating

The first thing that is “wrong” with Spirax at the moment is that they are building a third business and, so far, it has been difficult. The third business is in very technical electric heating.

If you want to dump a lot of energy at 130 centigrade nothing beats a steam system. But if you want to do very small amounts of energy and/or operate in temperatures above about 250 centigrade and you want to do it very accurately you would use an electrical system.

A typical (though extreme) use might be delivering a gas into a semiconductor manufacturing process at precisely 325 degrees centigrade.

The electrical business was fragmented. Sometimes people with engineering skills would set themselves up as the arbiter of equipment from four of five manufacturers. More often customers would need an in-house engineer to manage or design these processes.

Spirax, with four acquisitions summing up to about a billion dollars, has consolidated this business and are trying to change the distribution so that it is similar to their steam business. They are training engineers to sell their products, trying to standardize the equipment and effectively offering heat equipment as a service. Their argument is that people do not need this complicated widget and that complicated widget. Rather they need say gas delivered over a system accurately at 325 degrees centigrade.

There are a few problems. The companies that need extremely accurate electrical heating have their own engineers. Moreover, the equipment is complicated. Through an expert network we found the electrical people disdainfully talk about the steam equipment (mainly steam traps) as tonka truck style equipment. Spirax’s manufacturing plants are complicated, and the company has said that its highest current priority is fixing a plant in Ogden Utah. They tell us (and we believe them) that the constraint on how much equipment they can sell is the production ability of the plant in Ogden. [The Ogden plant has very poor “Glassdoor” reviews by current and former employees.]

The electrical business has 15 percent margins – up from the low double digit – but nowhere near as good as the rest of Spirax. Moreover, the return on equity on the billion dollars invested here is high single digit – a long way from Spirax’s normal mid-twenties return on equity.

There is guidance to get this margin up to Spirax levels (twenty percent margins by 2027). We believe them. If the Ogden problems are the constraint on sales then there will be a very sharp profit increase.

Even then the return on investment will be lower than rest of Spirax. There are clearly lots of consumable elements here (very accurate heating equipment becomes inaccurate over time and needs kit replaced) but it does not have the gloriously simple but irreplaceable consumables of the pump business or even the tonka-toys of the steam trap business.

This business will find its way as a weak trifecta. Not a bad business – but not delicious like the other Spirax businesses.

The other Spirax problem – a bioprocessing cycle

There has been a notable post-covid bioprocessing bust. This is a growth industry. Volumes that looked like they could never go down went up faster than normal around covid and then started declining. Stocks like Sartorius lost well over half their value.

Spirax’s 2022 annual report disclosed that 25 percent of their revenue was from bioprocessing, mainly from Watson Marlow but also from Spirax Sarco (for steam sterilization and other processes). By the 2023 annual report that number had dropped to 18 percent. Bioprocessing revenues thus dropped by a hundred million pounds. This is the fattest margin part of Spirax.

Watson Marlow pre-tax profit dropped from 160m pounds to 94 million pounds. And the margin went below 25 percent (having been well above 30 percent). When a growth stock derates it is not a nice place to be.

Anyway – there is a real question as to whether bioprocessing as a growth industry was overstated – or whether the covid cycle was mostly a temporary inventory cycle and the growth will continue. Spirax management believe the latter and we do too, but it is not consensus.

We are confident the bioprocessing area is growing again even though this is not visible in the numbers from the last half. In October our biotech/pharma analyst Thomas alongside John went to a bioprocessing sales show in Boston. We asked every salesperson the same question: how were your numbers last month versus one year ago and two years ago. In every instance we got the same answer – up on a year ago, down on two years ago. We are about as sure as we can be that growth has resumed – though it is hard to tell whether this is low single digit growth or the low double-digit growth the industry has had for decades.

There was an interesting exchange in the questions at the recent Spirax investor day. We are going to quote it in its entirety as it goes to the heart of the problem. The exchange is between Andrew Douglas, an analyst from Jeffries who has a hold on the stock and Nimesh Patel (the CEO) and Martin Johnston (the interim managing director of Watson Marlow).

Andrew Douglas: The second question is on Watson-Marlow. You've talked about 10% growth and not just today but just broadly in Biopharm markets. Is that a number that's historically been the growth rate and you're just naturally assuming it goes back to that rate? Or is that the rate that we're kind of seeing today which is being offset by the de-stocking, so near net-net, we get some good growth but it actually doesn't seem like it's good growth because the de-stocking was coming through and taking it off? And how can we find that number? Because to be frank, no one in this room kind of believes it's now growing at 10%. So, I'd be interested in your view of how we can get there.

Nimesh Patel: Martin, do you want to take that one? We've historically, I think, publicly talked about historical Biopharm rates being around 12-14% before we went into the COVID. Martin and his team have obviously been tracking the market data through many sources. But Martin can elaborate on that.

Martin Johnston: Yeah, sure. So I guess the point to make is that the fundamentals of Biopharm haven't changed. COVID was a huge issue for a few years but there's a big shift that still continues to this day of traditional stainless steel dissipating and the increase of single use, that carries on. Peristaltic pumps are absolutely poised and continue to take advantage of that. The other point is that Biopharm is still growing. There's an increase in the number of drugs coming through the pipeline. That in the long term is going to continue, and also there's the transition to personalised medicines. So we're kind of at a pivot point of medical breakthroughs. The mRNA vaccine was the first step towards that. And yeah, that's going to continue for 10, 20 years. So we've got confidence in that 10% growth rate, definitely.

Andrew Douglas: And is that market still going at 10% this year? Is that still true?

Martin Johnston: I believe so, yes.

Nimesh Patel: If I could add to that, we're talking about 10% growth but it won't be 10% every year necessarily. Some years will be slightly below, some years will be slightly higher. So we recognise that. The other thing I'd say is the way to satisfy yourselves because like you, I ask some difficult questions about come and prove to me, mostly to Martin, right, prove to me that it's 10%. If you break it down – there's a lot of research out there. So if you look at monoclonal antibodies, you look at growth in cell and gene therapies, if you look at all the vaccines, if you look at the constituents that make up where we serve, right, how we serve the Biopharm market, you'll find research out there which will get you to 10%. This isn't something that's particularly proprietary to us. We've looked out there at all of the research to satisfy ourselves that those are the growth rates.

The degree of skepticism is palpable. The analyst asserts that “to be frank, no one in this room kind of believes it's now growing at 10%. So, I'd be interested in your view of how we can get there.” The company simply asserts that it is true. And I doubt many believe management – because the stock popped very briefly after they gave good forward guidance and then fell yet again.

If Spirax’s bioprocessing sales are growing greater than ten percent the company’s margin problems will go away rapidly. But most of biopharma is just not growing that fast. The XBI – an equal weighted biopharma stock index that is a widely used proxy for conditions in the industry – is flat on the year.

That said, the management – including a newish CEO who has no reason to lie – assert about ten percent current growth when the market perception would allow him a much lower number.

How we value this

Bronte’s usual view is that a stock note should be fifteen pages on the business, one page on the management and one sentence on the valuation.

We would normally just think this is likely to wind up as a 23 percent margin business on average (matching historical percentages with a slightly higher weight of fat margin Watson Marlow and a lower weight of electrical heating). We would then value it as a multiple of sales with three times sales valued out as follows:

$100 of sales would – at 3x sales – have a value of $300. It would also have $23 of pre-tax margin (at a 23 percent margin). This would be $17 of post-tax margin (assuming what is typically a corporate tax take). That would put it on a PE of about 17 times – which is under-market for a much better than average business, So 3x sales was relatively cheap.

The stock is about 3.3 times sales now – and is thus an under-market multiple for a way better than market business – and you should probably buy it without being completely committed.

This quick valuation is a bit dirty for our readers. But an alternative would be to produce what we think is a very modest guess for 2027 earnings.

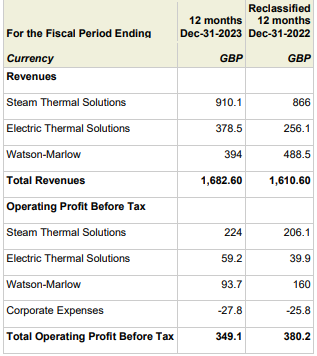

Here is a segment breakdown for the past two years.

Steam solutions has grown a couple of points faster than nominal GDP for decades – and there seems no reason to think that will stop in the next few years. Assume 5% growth until 2027. Also assume the margin is unchanged at about 24%.

Assume Watson Marlow goes back to the 2022 numbers – which is an underestimate if we believe the management about the growth rate of bioprocessing. And assume 2022 margins as well.

Assume electrical solutions is really constrained by the problems at Ogden (and we believe them on this) and the margin goes to the 20% level they are guiding (we are slightly more skeptical of that). Then assume revenue in 2027 of 500 million pounds at 20 percent margins.

Assume corporate costs go to 38 million (which is a sharp jump for a company that is traditionally cost conscious).

These we do not think are unreasonable assumptions.

Given the market cap is now 5 billion pounds (and EV somewhat larger) and it will generate cash between now and then which will fund a dividend and a reduction of the debt to trivial levels – we do not think the current price unreasonable.

It is not a steal. But it is certainly not bad in a market that is generally very expensive.

If it were 25% cheaper it would be one of the “desert island stocks”. (Buy 15 of them in your life, never sell and you will get plenty good returns forever.) It is not a desert island stock now – but for what we think is a superlative quality business that should grow for the next 15 plus years it is just fine.

Yes – if it fell a further 25% we would buy a fair bit more. But we do not think this will happen. The stock has not traded at 3x sales since the last financial crisis.

We have 4 more ideas for our paid subscribers.

Note: If you’re still on the fence about subscribing, consider asking your employer to fund the purchase.

We’ve provided a potential script below!

Hi [manager’s name],

I’d love to expense my subscription to Elevator Pitches! It’s a newsletter full of the best stock pitches curated from the letters of professional investors. Here are two examples (here and here) of the types of posts they deliver each week. The paid subscription will give me access to every stock write-up they surface.

Because the newsletter is an educational resource, I was hoping that it’s something that can be expensed to [insert company name]. It is $90 for the whole year, which is a steal considering all the insights and learnings I will get from it.

Thank you so much for considering