Welcome, subscribers!

Investor letters from the second quarter are still hitting our inbox, and we’re back sharing the best of what we find.

If you find value in what we do, please consider forwarding to a friend or colleague who might also appreciate our work.

This week, we highlight 10 new ideas, including:

An out of favor small cap regional theme park operator

A midcap bank with a hidden gem that could soon be monetized

A pitch from one of the world’s best investors for two visionary-led companies

Keep reading to learn more.

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

Voss Capital initiated a new position in theme park owner/operator, United Parks & Resorts (PRKS). In Voss’s view, the travel industry is out of favor with investors, which makes today the right time to go shopping. We include their detailed thesis below.

New core long: United Parks & Resorts (PRKS)

Travel & leisure stocks remain deeply out of favor and, outside of cruise operators, remain well below their pre-covid valuation levels. Headlines such as the WSJ’s recent article titled “Americans Are Skipping Theme Parks This Summer” offer a glimpse of the current lousy sentiment. We think the misleading headlines along with dour vibes surrounding the US consumer are offering up an opportunity in United Parks & Resorts (PRKS), f/k/a SeaWorld, which contrary to headlines had positive year-over-year attendance growth in Q2. As veterans of concentrated small cap equity investing, we feel like we know a good roller coaster when we see one.

A Brief History

The origin of this storied company starts with Adolfus Busch (of Anheuser-Busch fame) and his desire to develop beautiful gardens across the country. For decades these parks, adjacent to his breweries, were used as a marketing tool to build the Anheuser-Busch brand. Over the years, animals and rides were added to the attractions. Busch Gardens Tampa Bay (opened in 1959) and Busch Gardens Williamsburg (opened in 1975) still operate and are among PRKS largest venues. In 1989, Busch Entertainment acquired the theme park division of Harcourt Brace Jovanovich and with it, SeaWorld.

Two decades later InBev acquired Busch Entertainment as a part of Anheuser-Busch in mid-2008. Being the pragmatic operators they are, AB Inbev began a non-core asset divestiture program to de-lever the business. Blackstone saw this as an opportunity and made a timely acquisition of Busch Entertainment in 2009. Blackstone surely did their homework and took comfort that this was a resilient business even as the United States was barreling into the worst economic outlook in a generation. The economic storm blew over and operational improvements were made leading to an IPO of the newly named SeaWorld Entertainment in 2013.

The current chapter of the saga began around 2017 when Scott Ross of Hill Path Capital was added to the Board (soon to become Chairman). Hill Path began to drive further operational improvements and took bold capital allocation actions, creating the current attractive set up.

The Business

PRKS now owns and operates 12 theme parks under seven different banners across five states: SeaWorld (in Orlando, San Antonio, San Diego, Abu Dhabi (licensed)), Busch Gardens (Tampa Bay, Williamsburg, VA), Discovery Cove (Orlando), Sesame Place (San Diego, Philadelphia suburb), Adventure Island (Tampa Bay), Aquatica (Orlando, San Antonio).

Many of the company’s parks are located in geographic locations where they can operate on a year-round basis. About 60% revenue is generated in Florida, 16% in California, and 13% in Virgina. Their key markets with the exception of San Diego have shown employment growth well above the national average over the last two years and have positive demographic outlooks.

PRKS is a relatively straight forward business. About 55% of PRKS revenue comes from selling admission tickets, and about 40% of attendance comes from season ticket holders. The remaining ~45% of revenue comes from in-park spending, which include merchandise sales at their retail shops, food & beverage purchases at their restaurants, customized photos, reserved seating at shows, cabana rentals, lockers, games, and other ancillary income.

As referenced, Hill Path has been very focused on driving revenue while at the same time being maniacal about removing unnecessary costs from the business, evidenced by EBITDA margins improving from 29.2% in 2018 to 41.3% on a TTM basis.

The Current Opportunity

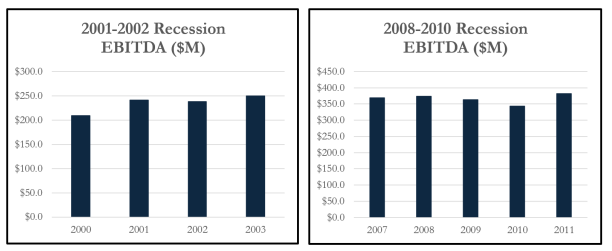

As mentioned, Theme Park operators are being misconstrued currently and are a popular way to express a bearish view of the US consumer—PRKS has over 18% of its float sold short, after all. We take a different view as they have historically held EBITDA flattish through even the nastiest of recessions. In 2002, EBITDA decreased 1.2% before rebounding to a new high in 2003. In 2010, EBITDA bottomed out at 8.2% lower than the 2008 highwater mark before quickly rebounding to a new record high in 2011.

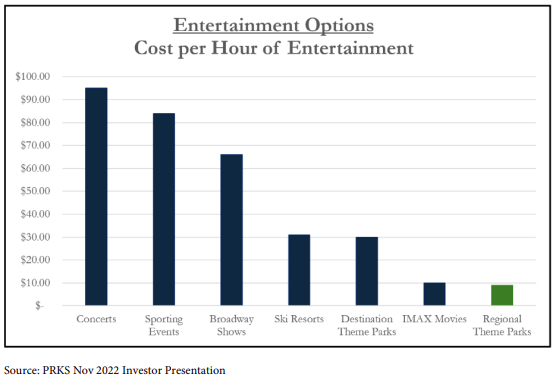

This relative strength in weak economic periods is in large part because PRKS provides a compelling value proposition in lean times compared to many alternative family entertainment options (see chart below). In addition, as a regional theme park, PRKS’ attendance is much more driven by local residents than Disney or Universal, which can make it more economically resilient as its visitors don’t have to pony up for airline tickets and hotels on top of park passes. Both Disney and Universal have hiked ticket prices more aggressively than PRKS post Covid, making PRKS even more of a relative bargain now versus five years ago.

We think PRKS offers a differentiated theme park experience from the fantasy, media content driven experiences of either Disney or Universal Studios, as PRKS is oriented around animal content and educational shows. Busch Gardens Williamsburg has been named America’s most beautiful park 33 years in a row by the National Amusement Park Historical Association, and SeaWorld Orlando is routinely voted as Best Theme Park in America by various reader’s choice awards (including USA Today and Theme Park Magazine). This distinct experience also means PRKS can be a compliment to a Disney/Universal vacation from out of state or international visitors. Historically, Universal or Disney’s promotional activities had much more impact on each other than on PRKS attendance numbers.

One of the most overt fears and competitive threats is due to a massive expansion forthcoming at Universal Orlando called Epic Universe that is opening in early 2025. New parks and expansions are nothing new over PRKS’s multi-decade history. One pertinent case study is the 2013-2014 timeframe when Universal opened a new Harry Potter Diagon Alley to much fanfare. Bears point to the decline in Universal Orlando attendance as evidence of competitive pressure – but we would contend that this was more related to idiosyncratic issues surrounding the damaging Black Fish documentary release. SeaWorld Orlando attendance declines were much less severe than SeaWorld San Diego, showing that the issues at that time were more tied to the negative publicity as opposed to Universal’s expansion. PRKS has long since reduced the importance of orcas to the guest experience by investing heavily in new attractions and roller coasters.

Orlando is an important market for PRKS to be sure, as it accounts for ~35% of EBITDA. Nonetheless, assuming a 10% decrease from the Epic Universe opening would only amount to a 3.5% headwind to overall EBITDA. The remaining parks would have to grow at ~5.5% to keep overall EBITDA flat. For what it’s worth, PRKS management has the clear expectation to grow overall EBITDA in 2025 even in the face of Epic Universe’s opening.

It’s worth pointing out a couple of other underappreciated dynamics at the company. PRKS owns all the real estate underlying their parks (apart from the San Diego SeaWorld location), which totals about 2,000 acres. This includes 400 acres of unutilized excess land adjacent to the parks that are currently under review on how to best to drive value. To wit, from their Q4 2023 earnings call:

“First, let me be clear that we believe there is a great opportunity for hotels in our parks. We own approximately 400 acres of developable land adjacent to our parks. We know there is significant vacation hotel demand from guests in our markets and we see an obvious opportunity to generate significant incremental EBITDA and value from hotels in our parks. Second, we have not decided to spend any capital actually constructing hotels and, in any event, we will not spend any capital to construct a hotel without high confidence in achieving 20%-plus ROI unlevered cash-on-cash returns.”

An additional possible future growth avenue is their highly attractive licensing model. The sole licensed SeaWorld location in Abu Dhabi provides the company with around $10M of high margin revenue with no capital outlay and this model could certainly be replicated in the future.

Perhaps the cornerstone of our thesis is that the company has a bold board led by Hill Path’s Scott Ross & James Chambers who are likely to execute some form of significant strategic corporate action over the coming years. Ross has made his investment career as a private equity executive with a focus on location-based entertainment and theme park investments. Theme parks can require major capex investments, so a bold board is only a positive if it is married with sound capital allocation – which we believe PRKS has proven it has. The company is not shy in expressing its opinion on the current valuation of the business:

“The Board and company believe our shares are materially undervalued. We have significant confidence in our business and our prospects. And as we shared with you last quarter, any reasonable way you look at it, we feel we are materially undervalued and that there is significant upside opportunity in our current share price.”

Such corporate jawboning is cheap, but this team puts their money where their mouth is as PRKS has been an insatiable share cannibal in recent years, while keeping leverage stable.

So, what do we think the likely paths forward could be? With the large and growing Hill Path ownership stake, which will be nearing 60% (including positions controlled through swaps) when the company soon exhausts the current $500 million share repurchase authorization, we think there is an elevated chance of one of the following events happening in the coming years:

Take private by private equity

Take private by Hill Path

Transformative acquisition

It’s no secret that private equity has long had an affinity for buying cash generative theme park operators and Ross is certainly well connected within the industry. With net debt/EBITDA at a conservate 2.7x, a potential PRKS buyer has plenty of room to juice leverage judging from Blackstone’s comfort taking leverage on stable theme park assets above 5.0x in the past. Alternatively, Hill Path has the wherewithal to take the company private itself, and fortunately a deal would have to be approved by a majority of the minority shareholders. Behind door number three is a potential acquisition. Hill Path has shown they have an appetite to do a large M&A deal, such as when PRKS made an (unsuccessful) offer for Cedar Fair in 2022. In such an undertaking there would likely be significant operating synergies, and with Hill Path at the helm, we believe any acquired business would likely exhibit improved baseline margins separate from the operating synergies.

We think previous owner Blackstone buying PRKS and combining it with their current portfolio company Merlin Entertainment would make the most strategic sense due to their geographic overlap in key markets and a like-minded operating playbook. Aside from cost synergies, the two could implement attendance driving co-marketing agreements with initiatives such as multi-park passes. Merlin’s recent press release highlighting the acquisition of the “Orlando Eye” Ferris wheel cited the company’s “strategic focus in building major attraction clusters in key cities, including Orlando.” Merlin was purchased (for the second time) by Blackstone in 2019 and is held in its long dated “Core Private Equity Strategy” fund with a stated life of “10-15 or more years,” so they are more apt to plan their next phase of growth than seek exit liquidity. Heraclitus said no man ever steps in the same river twice, but he didn’t say anything about wave pools. To Jon Gray we say, come on in, the water is warm.

Valuation

Despite tremendous operational improvements over the recent years, the shares remain stuck at the loading platform. At ~6.8x ’25 EBITDA, current valuation is a far cry from theme park stocks’ 5-year pre-Covid average multiple of double-digit EBITDA multiples. Furthermore, when we look at transaction comps, the median theme park transaction multiple over the last couple of decades is ~11.0x EBITDA. Aside from the sole acquisition of Busch Entertainment by Blackstone done at 8.0x in the depths of the 2009 financial crisis, no other significant acquisition that we could find data on was completed below 9.9x EBITDA.

With shares currently trading at a 2025 P/E ratio of ~10x, we feel like valuation would likely re-rate eventually in the public markets even if none of the strategic paths noted above come to fruition. Shares traded at an average of ~21x forward earnings between 2014-2019.

We think PRKS valuation is compelling almost any way you slice it. Our base case price target of $88/share gives the stock +80% upside over the next two years, using a conservative EBITDA multiple of 8.7x (15.0x P/E). This would still represent a discount to its own trading history and to precedent transaction comps.

It’s a timeless Vossism to look down before looking up, so we must consult our inner Eeyore here. First, there seems to be a tidal wave of supply coming to market, with Disney, Universal, and the newly formed Cedar Fair all committing to significant multiyear expansions recently. We’ve articulated why we think PRKS is outside of the capex splash zone, but from a simple supply/demand perspective this is a headwind. Somewhat related, overall attendance has not grown over the decades and PRKS still has a way to go before reclaiming the 2008 attendance record. EBITDA has grown tremendously over the years, but without attendance tailwinds. The parks are by no means operating at capacity, so that is not a governor for attendance growth going forward. If we assume ’26 attendance reaches the lowest level in the last 20 years (excluding COVID depressed ‘20/’21), at 20.8 million and margins revert to ’19 levels, we get about $540m of EBITDA. Capitalizing this at 6.8x EBITDA, about the lowest it has traded at in its public history, the equity would be valued in the mid $30’s per share. In other words, trough multiple on trough earnings, which seems unlikely to us and if it occurs, is a manageable downside. (We are capitalizing on ’26 numbers and assume some free cash flow generation through ’25 in these scenarios).

In a bull case we see a potential return to historical attendance records along with further margin improvement that could turn this into a multi-bagger. For instance, PRKS lays out a scenario in which the parks return to 2019 attendance levels (international visitors is the only lagging cohort remaining), increase per caps from ~$80 to ~$87, and achieve their cost reduction goals. In this case EBITDA would reach ~$960M in ’26 with margins increasing to an impressive ~49%. Capitalizing this at ~10x EBITDA would work out to about a 3x return for the stock. Undoubtedly this is the rosy-cheeked case, but by no means is it pure fantasy.

Conclusion

There is a large scope for creative subjectivity to be applied to the combinatorial explosion of data available in markets, and just like a gestalt picture, what at first appears to be one image or conviction emerging from the data can be something entirely different in a flash. You are not affecting the picture when you shift from one perception to the other, both possibilities were already there, you are just making a choice between them by actively toggling your perspective. We must strive to be as objective and as open-minded as possible while we are collecting information, viewing the data from as many perspectives as possible and hopefully settling fastidiously on one that corroborates a thesis from various vantage points.

Even then, there are so many contingencies for the market’s path forward that no a priori knowledge can be entirely relied upon, however with an embedded margin of uncertainty in our bottom up company assumptions and a double digit FCF yield, we can tolerate some ambiguity and simultaneously remain confident that either the broader crowd or deep-pocketed buyers (e.g., PE funds or strategics) will eventually sniff out the compelling value embedded within our portfolio.

We have 9 more new ideas for our paid subscribers below.