Welcome, subscribers!

We’re back with more unique stock pitches taken from the letters of investment managers.

If you enjoy what we do, please consider forwarding to a friend or colleague who might also appreciate our work.

This week, we’re excited to highlight 4 new ideas, including:

A networking hardware company with an excellent capital allocator at the helm

A small cap bank with a unique value proposition

A collection of hard asset regional monopolies

Keep reading to learn more.

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

Bonsai Partners delivered a deep dive on Ubiquiti (UI), the $12 billion hardware company that competes with Cisco. Bonsai is attracted to Ubiquiti’s capital light business model (rare for a hardware company) and their outsider founder/CEO, Robert Pera.

New Investment: Ubiquiti (UI)

You’ve likely noticed by now that we’re fascinated by things that don’t behave as expected. Following our curiosity has been an excellent filter for where we spend our time because we either learn something new or get lucky and stumble upon a new investment idea.

As far as businesses go, Ubiquiti presented itself as a complex web of contradictions. However, as we peeled back the onion, we learned that its contradictions were the source of its competitive advantage. Allow me to share a few of these puzzle pieces:

Ubiquiti is a provider of networking technology hardware. In 2012, Robert Pera, the company’s founder and current CEO, wrote a blog post describing some of Ubiquiti's unusual traits. He wrote (emphasis my own):

Robert Pera: “Perhaps something of an oddity amongst publicly traded tech companies, Ubiquiti Networks was bootstrapped with no operational funding from inception to the IPO. For a software company, this path is challenging enough. But, Ubiquiti makes hardware. And with making hardware comes the additional financial burden of funding larger and larger manufacturing expenses as the business grows.” 1

How could a fast-growing hardware company self-fund its growth without raising outside capital?

Here is another riddle:

Although Ubiquiti’s products are ~70% as functional as enterprise-grade networking equipment (e.g., Meraki (Cisco), Aruba Networks (HPE), or Ruckus Networks (CommScope), etc.), the company sells its products for roughly one-third of the price and without charging lucrative recurring maintenance fees. But that’s not the strange part. Ubiquiti is also considerably more profitable than its competitors.

Next, if you consider that Ubiquiti appears from the outside to be a “boring” networking hardware business, this contradicts the company’s remarkable long-term financial performance. Over Ubiquiti’s publicly available financial record (from 2008 to 2023), the business grew its revenue from $22m to $1.9 billion, a 15-year compounded annual growth rate of 34%. Over the same period, Ubiquiti maintained a median operating profit margin of 32% and a median return on invested capital of 60%. These are figures that most software companies dream of, but Ubiquiti sells hardware!

To make matters even more confusing, although Ubiquiti is a longstanding publicly listed company, it operates like a lifestyle business for its founder. Today, Robert Pera, Ubiquiti's 46-year-old founder and CEO, owns ~93% of all outstanding shares, which is virtually peerless for a >$10 billion company listed on the New York Stock Exchange. Similarly, Ubiquiti’s board of directors and executive team resemble a skeleton crew of just a few people each.

Finally, beginning in 2018, the company discontinued all earnings calls and investor relations activities for interested investors who made it this far into their story. If you want to solve this puzzle, you are on your own. As far as barriers to investment are concerned, Ubiquiti sets a very high bar.

With the facts presented, our job was to determine whether the company's unusual results were a mirage or built upon solid foundations.

Ubiquiti’s Unique Model

I'll share what I believe is the critical insight behind Ubiquiti’s business model, which explains many of the questions above, but before I do, it is essential to offer some background on the company.

Ubiquiti is a product-focused company. Before founding Ubiquiti, Robert Pera worked a brief stint as a networking hardware engineer at Apple, where he gained muscle memory on how to build great products. Like Apple, Ubiquiti believes in the tight integration between hardware and software, emphasizing beautiful design. Ultimately, Ubiquiti operates like a playground for engineers who want to build great I.T. products since this is how Robert wants to spend his time. Of the ~1,500 employees at Ubiquiti, over 1,000 are in research and development, which is a highly unusual employee mix for an I.T. company.

Robert realized that if they delivered products far ahead on the price-to-quality spectrum, its customers and partners would cover many of Ubiquiti’s operating expenses. This dynamic is "operational float," as described above. Ubiquiti’s model self-perpetuates because its operational cost savings are often passed back to the customer through R&D and lower product prices, further driving its price-to-quality advantage.

Ultimately, operational float explains how Ubiquiti can simultaneously sell high-quality products at disruptively low prices while enjoying industry-leading profitability. Although the average networking equipment competitor spends 30-60% of its revenue on selling, general, and administrative expenses, Ubiquiti spends only 10% of its revenue this way. The magic of operational float helps Ubiquiti charge significantly lower prices while earning higher margins on average.

For example, Ubiquiti only relies on a small sales and marketing function and instead believes that great products sell themselves—another idea borrowed from Apple. Similarly, because customers are willing to go out of their way to buy Ubiquiti’s products, the company does not incentivize distribution partners with fat margins, which keeps customer prices low and direct-to-consumer penetration high. Further, Ubiquiti does not maintain an extensive customer support team. Instead, Ubiquiti maintains a design ethos that its products should be so easy to use that customers don’t need phone-based support in the first place. Only recently did Ubiquiti begin to offer a paid tier of phone support, and still today, most support requests go through their online forums, where its users help one another, and a small Ubiquiti team steps in on the most challenging questions. Due to these dynamics, Ubiquiti saves a considerable amount on operating expenses.

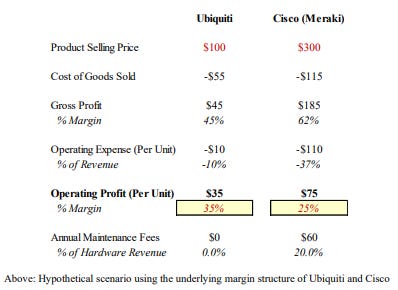

See below a hypothetical example of Ubiquiti’s unit economics compared to a competitor's.

Ubiquiti is difficult to compete against because in the hypothetical example above (assuming Ubiquiti’s products sell for 1/3 of the price, on average), the competitor’s cost of goods ($115) and operating costs per unit ($110) are both higher than Ubiquiti’s selling price. A competitor would need to completely overhaul its business model to compete with Ubiquiti in terms of price, which makes little sense considering that Ubiquiti earns ~50% less profit per unit sold. Operating like Ubiquiti is neither rewarding nor part of the DNA of the competition, which is a powerful form of counter-positioning.

It's also important to recognize that, unlike its enterprise competitors, Ubiquiti does not charge recurring annual fees for maintenance and support, which typically cost ~20% of the initial hardware cost each year. These high-margin service fees are where Ubiquiti's competitors earn outsized profits, and it's likely why they aren't interested in going head-to-head with Ubiquiti in the first place. In this example, two years of recurring service fees ($120) exceed the selling price of new Ubiquiti hardware ($100). It's no wonder why customers flock to Ubiquiti products despite their drawbacks.

In the example above, while Cisco isn't the perfect comparison to Ubiquiti, we selected it because it is the most profitable networking company in Ubiquiti’s peer group. In contrast, most others in the SMB space are either unprofitable or marginally profitable. Of all the enterprise competitors, Cisco is, therefore, the most able to lower its prices and compete. Indeed, when we look at Cisco's lower-priced Meraki line, which more closely competes with Ubiquiti, its prices are still multiples higher than comparable Ubiquiti products.

While gross margins are typically the first-place investors look to see if a company is doing something special, the real magic of Ubiquiti’s model lies in its extremely low operating expenses. Although Ubiquiti typically has lower gross margins, many of Ubiquiti’s costs are either covered outright, or shortcomings are overlooked due to operational float. Such a dynamic allows Ubiquiti to spend significantly less in the areas that aren’t their core focus while passing excess savings back to customers through lower prices. As a result, Ubiquiti’s extremely lean operation allows the company to offer excellent products at disruptively low prices and earn higher profit margins than its competitors.

Due to these product-level dynamics, Ubiquiti's customer sweet spot is not ultra-high performance or enterprise-tier customers but those seeking high-quality products on a limited budget. Therefore, Ubiquiti’s core customer base is in the "prosumer" market, small and mid-sized organizations, and international markets.

I have yet to describe Ubiquiti's product portfolio in depth because no individual product lines are critical or unique. Instead, Ubiquiti's model revolves around creating better-designed and priced versions of industry standards (routing, switching, wireless access points, VoIP phones, access devices, security cameras, etc.) rather than radically new product categories. Ubiquiti's outlier price-to-quality ratio is its greatest innovation and what drives its long-term competitive advantage.

Shrewd Capital Allocation as the Kicker

In addition to being a product-obsessed founder, Robert Pera has demonstrated his skills as a shrewd businessperson and capital allocator. These skills are uncommon together.

Although Ubiquiti typically generates hundreds of millions of dollars of net income each year, it takes an asset-light approach by outsourcing production to others and mainly invests its capital through inventory. Therefore, the company’s net income converts into free cash flow at attractive rates.

While Robert has never acquired another company, he has aggressively used free cash flow to repurchase Ubiquiti stock and pay dividends. From 2016 to 2023, the company repurchased $2.8 billion of its shares, or roughly $300m annually. As a result, Ubiquiti’s outstanding share count shrunk by ~32% over these seven years, nearly -4.6% each year.

To better understand Robert’s capital allocation mindset, see the below quote from the company’s 2017 analyst day (before they discontinued all investor relations efforts):

Robert Pera: “…this one is one of my favorites. It's from a company called Teledyne and a CEO named Singleton, and he did something really incredible. So when the market wasn't really high on his business and he had a really low multiple, he bought back and he retired 90% of the stock. And in the future, that essentially helped boost his earnings per share 40x….This actually helped me a lot even this past week whenever I got frustrated with people knocking down the multiple, I just stared at this and I said, hey, maybe they're working for us.”2

Like Robert, Henry Singleton was an engineer turned CEO with a keen eye for capital allocation in moments of opportunity. Since Robert currently owns 93% of all Ubiquiti shares outstanding, the remaining 7% of floated shares are worth approximately $600m. Considering that Ubiquiti repurchased $300m annually, on average, from 2016 to 2023 and that free cash flow is likely to continue growing, this creates an interesting situation for those who already own Ubiquiti stock. Share repurchases are currently on hold since the company is now focused on paying down debt after interest rates rose. However, share repurchases remain a future source of optionality.

Risks

Every investment has risks, and Ubiquiti’s risks are mainly concentrated around its operational footprint and governance. As mentioned above, Ubiquiti is structured as a playground for engineers interested in building great I.T. products. While this is a novel idea, this vision naturally opposes operational processes, which Robert views as hindering innovation. From our research, Ubiquiti is often disorganized, with Robert employing an autocratic leadership style.

Robert is notoriously capricious, leading to changing product roadmaps and significant turnover among higher-ranking employees and at the board level. Even today, the executive team and board are incredibly lean despite past problems. Weak internal processes and controls ultimately led to multiple operational gaffes, including the company falling victim to a ~$47 million wire fraud scheme in 2015.

Although past operational missteps forced the company to improve its infrastructure–such as bringing on a new CFO, adding KPMG as its auditor, etc., I don’t consider all their operational concerns resolved. The company’s board governance remains lackluster, and operations teams remain extraordinarily lean. However, I believe the business's operations are much improved from where they used to be, and its strengths outweigh its weaknesses. Ultimately, Ubiquiti probably shouldn’t have gone public, and they’re still dealing with growing pains from that decision.

On one hand, Robert is a visionary founder who takes no salary from the company, treats the stock like gold, and deeply cares about the products he builds. On the other hand, Robert built a lifestyle business based on how he wants it to operate, which means he does not have the same degree of checks and balances you typically find at other founder-led publicly traded companies. Robert's hand remains firmly on the tiller, even in areas he should delegate to others.

Concluding thoughts

Ten years ago, if you asked me how to identify an outlier CEO, I would tell you that I look for managers with deep work experience at top-performing companies, strong communication skills, an MBA, and a compensation package aligned with future share price appreciation. Today, my answer to that question is quite different.

The more I learn about great companies and the people who build them, the more I realize they're often run by people so unassuming and strange that you would never pick them to be the CEO if they had to interview for the position. These people could only become the CEO if they created the business themselves or rose through the ranks over time. These unusual leaders are obsessed with the problems they're solving because it's their life's work–it’s not just a job to them. Unconventionally successful companies are often built by unconventional people. Ubiquiti is, if nothing else, unconventional.

Ultimately, Ubiquiti sells excellent products at disruptive prices, and this valuable combination provides a long runway for compounded growth, coupled with leading profitability and an aligned owner who thoughtfully allocates capital. When we acquired our position, the company was valued at a historically low valuation multiple, which improved our odds of a reasonable outcome. Put together, Ubiquiti has the potential to deliver attractive long-term compounded growth, and we’re excited to see what the company is capable of.

We have 3 more new ideas for paid subscribers below.

Note: If you’re still on the fence about subscribing, consider asking your employer to fund the purchase.

We’ve provided a potential script below!

Hi [manager’s name],

I’d love to expense my subscription to Elevator Pitches! It’s a newsletter full of the best stock pitches curated from the letters of professional investors. Here are two examples (here and here) of the types of posts they deliver each week. The paid subscription will give me access to every stock write-up they surface.

Because the newsletter is an educational resource, I was hoping that it’s something that can be expensed to [insert company name]. It is $90 for the whole year, which is a steal considering all the insights and learnings I will get from it.

Thank you so much for considering!