Welcome, subscribers! Today, we share pitches for an autonomous-driving technology provider, a mid cap bank, and a Japanese consumer products manufacturer.

Read on to learn more. 📕👇

Your support is appreciated. If you enjoy this issue, please forward to a friend or colleague!

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

In their latest investment letter, Arch Capital Fund went into great detail on their new investment in Ally Financial (ALLY). Compare Arch Capital’s thoughts with Silver Beech’s from a pitch we shared back in May 2023.

The one new investment we've made through the first half of the year is Ally Financial (ALLY). This is a company we had been following for several quarters starting back in the middle of 2022. During the short-lived banking crisis this spring, shares of Ally stock dipped along with many other banks, and we decided to make the leap and become shareholders at a cost basis of around $25.

As of this writing, Ally makes up 6% of our portfolio. Below, we outline why this is a high-quality business that can put up strong returns for the limited partnership over the long term.

What is Ally Financial?

Ally Financial has a long history but has only recently been an independent consumer bank. It began as the lending arm of General Motors (GM) during the automotive boom of the 1920s. When General Motors filed for bankruptcy during the Great Recession in 2009, its financial arm was spun out as a separate entity, and what we know today as Ally Financial was born.

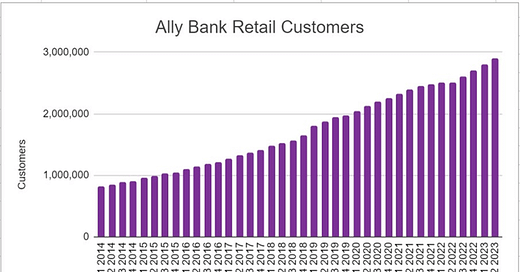

Since 2009, Ally has operated as a consumer bank with a branchless, online-only model that allows it to offer higher interest rates to depositors than competing legacy banks such as Bank of America (due to lower overhead costs). It has grown its depositors for 57 straight quarters (chart below) and had 2.9 million total depositors as of Q2 2023. Insured deposits make up 92% of overall deposits, putting Ally's risk of a bank run extremely low compared to the institutions that failed this spring. Its total retail deposits were $139 billion at the end of Q2 2023.

Ally has remained in the automotive lending business, given its roots as the financing arm of General Motors. It has long-running relationships with thousands of automotive dealers across the United States, who feed Ally with consumer loans that need financing. It also offers financing for the dealers themselves and automotive loans to commercial customers. At the end of Q2, automotive-related loans made up 61% of Ally's earning assets (77% if you exclude cash and investment securities), making it by far the most important group of loans on the balance sheet.

Owning a consumer bank such as Ally requires getting comfortable with a few variables:

How much it costs to retain deposits and the long-term growth trajectory of its deposit base

The returns the bank will achieve loaning out these deposits through a full business cycle (or multiple) and how much it can grow its loan book while achieving these same returns

Trusting management to act conservatively. This is true for all companies but especially true of a bank.

Let's go through each of these variables in more detail.

Attracting and retaining depositors

Ally's strategy for attracting new depositors at its bank is simple: Offer higher interest rates, better customer support, and lower fees than the legacy banks. It is able to do so while remaining profitable because of lower overhead costs and no branch locations. Someone who needs branch access for their bank will not want to use Ally, but there is a large (and growing) % of the population who don't need a bank with physical locations.

There are various concerns investors have had with this strategy. Some get concerned that depositors won't move from the big banks due to switching costs and brand trust. Others get concerned over competition from the dozens of VC-backed online banks that sprang up during the recent financial technology bubble. These include names like Chime or SoFi (SOFI) with large marketing budgets. All compete with Ally for deposits. At the end of the day, consumer banking is a commodity business with hundreds of different options that individuals can choose from. So why would they choose Ally?

While we agree that banking at its core is just a commodity, Ally's consumer banking strategy just…works. The proof is in the 57 straight quarters of customer growth and its growing $139 billion worth of retail deposits. 2022 and early 2023 had strange comparisons due to the government stimulus checks sent out during the pandemic, but the long-term trend is hard to miss: Up and to the right.

This is despite Ally operating for many years with the Federal Reserve setting interest rates at or near zero, which minimizes its interest rate advantage vs. the big banks. Ally wasn't a super compelling offer when it paid depositors 2% and the big banks paid near zero. But when Ally can pay 4% or higher? That is a strong selling point compared to the big banks, which still pay depositors next to nothing. It is no surprise then to see Ally adding a record amount of depositors in recent quarters.

Since spinning out of GM, Ally has never had a problem attracting and retaining deposits, and we see no reason it cannot consistently grow depositors in the years to come, especially if interest rates remain elevated. The potential problems - and why Ally stock is cheap at the moment - are fears around the future performance of its automotive loan portfolio.

Automotive loans: A trifecta of headwinds (that will eventually end)

As we mentioned above, Ally's business model is to take customer deposits and make automotive loans. It earns a spread on the interest it pays to depositors compared to the interest it earns from its loan portfolio, defined as net interest margin (NIM).

A few factors drive the performance of its loan portfolio, such as the interest it pays depositors, the interest it is earning on its loans, the net charge-off rate (i.e., the % of loans Ally expects to not get paid) on the loans, and the change in used car prices.

During 2020 and 2021, Ally's loan book saw a trifecta of tailwinds that helped it "over earn" on its loans compared to 2019. Ultra-low interest rates allowed it to pay depositors very low rates on deposits, thereby increasing the NIM it earned on loans made in prior years when interest rates were higher. Rising used car prices allowed it to recover more value on collateral from delinquent loans, while stimulus checks and increased savings rates reduced net charge-off rates to near zero for its automotive loans for several quarters. In fact, in Q2 2021 Ally had a negative net charge-off rate on its retail auto loan portfolio, which is unheard of in the lending world.

All these tailwinds have turned to headwinds in recent quarters. With the Federal Reserve raising interest rates, Ally has been forced to raise the interest rate it pays to depositors. Ally has countered these rising deposit costs by raising the interest it charges on automotive loans (Q2 2023 retail auto loans had a yield of 8.81% vs. 6.82% a year ago), but it is still facing NIM compression on the loans it made in 2020 and 2021 when the Federal Reserve had interest rates at 0%. Used car prices have started to decline with supply chains normalizing, which will hurt the recovery value Ally can get on delinquent loans. And speaking of delinquency, Ally's net charge-off rate has gotten back to pre-pandemic levels as the credit cycle gets normalized and the U.S. consumer gets further and further away from the stimulus check era.

The following charts will hopefully visualize these bullwhip dynamics for readers and how they impacted Ally's earnings power:

While the next few quarters could be tough, Ally has plenty of liquidity to weather any storm and is already reserving its loan book for a sharp decline in used car prices this year. At the end of Q2, the company had $42.5 billion in total liquidity, or 3.8x its level of uninsured deposits. Management is already expecting used car prices to decline 12% through the rest of 2023. Even if the industry goes through an even sharper downturn, the tens of billions in liquidity will keep Ally in a stable financial position and puts it at minimal risk of running into insolvency issues.

If Ally was "over earning" in 2020 and 2021 it will likely "under earn" during 2023 and perhaps for a few more quarters into 2024. However, with a conservative balance sheet, 92% insured deposits, and a steadily repricing loan book, we have confidence Ally is going to survive this rough patch and will likely come out even stronger on the other side.

Do we trust management?

This is the question we ask about every company, but it is extra important for a bank. Why? Because banking executives have the power - if they act irrationally or aggressively - to put the stock at risk of being worth zero in a short time period. Just ask the old executives of Silicon Valley Bank (OTCPK:SIVBQ), First Republic Bank (OTCPK:FRCB), and Signature Bank.

In our view, the most important thing (and maybe the only important thing?) to look at when evaluating banking executives is whether they are conservative with growing the business. Or, inverting the situation, whether they are not trying to push aggressively to grow the bank's loan book and/or deposit base.

Ally is currently led by Jeff Brown, who got the role back in 2015. He has been at the company since March 2009 when he joined as the corporate treasurer.

While we don't know Brown firsthand, there is plenty of evidence that he runs Ally not to be the fastest-growing bank in the country (which we would consider a red flag), but one that grows slowly and simultaneously generates a profit. This is not a revolutionary concept. Still, there are few financial institutions with the discipline to restrain themselves from trying to grow too quickly, especially in the era of easy money after the Great Recession. Pre-pandemic, Ally's NIM was consistent, meaning it didn't risk the performance of its loan spread by either aggressively attracting depositors with unsustainable deposit rates or making bad automotive loans. After we go through the pandemic bullwhip, the company should be able to earn an even higher NIM since it will be operating with the Federal Reserve keeping rates above 0%.

In recent years, Ally has expanded into mortgages, credit cards, and other consumer lending. The expansion has been a crawl, not a sprint, which we find reassuring to mitigate any rookie mistakes the company may make when getting away from its automotive bread-and-butter. Right now, it looks like the biggest mistake was taking on low-interest-rate mortgages. At the end of Q2, there were $19 billion of mortgage loans yielding just 3.22% on Ally's balance sheet, which is less than the 3.74% rate it paid on deposits. Not great. The mortgages will create a headwind to NIM for a while but are not in a position to kill this business.

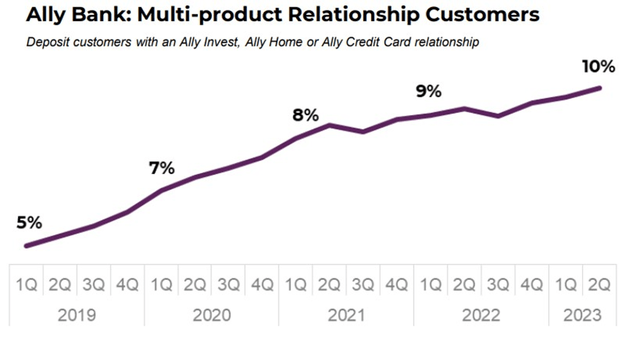

At the end of Q2, 10% of Ally's customers had a multi-product relationship with the bank, meaning they have adopted one of Ally Invest, Ally Home, or Ally Credit Card products. This is only up from 5% at the start of 2019, so progress has been slow, but there is a long runway for Ally to diversify the financial services it offers customers. This should also help increase switching costs and keep customers from leaving the bank.

Ally's strategy may not be the formula for growing your depositors and loan book as fast as possible, but it is the one that minimizes the risk of collapse.

Future earnings vs. current market price

Okay, so we've rambled on to show why we believe Ally can retain/grow deposits, why its loan book is not on the verge of imploding, and why we trust management. The final question we need to ask is: What will the company earn over the next few years? And does it pass our return hurdle rate?

We'll keep it simple. Today, Ally trades at a market cap of $8.3 billion. Outside of the pandemic bullwhip, Ally has earned around $1 billion in net income every trailing twelve-month period since 2014. After it gets through the looming headwinds we discussed above, there is no reason Ally can't return to earning at least $1 billion annually.

In fact, there is reason to believe the company will earn much higher than $1 billion in net income annually due to its growing deposit base, diversifying loan book, and the potential for rising NIMs once interest rates plateau or fall. Wider NIMs on a larger loan book equates to higher earnings, all else equal.

Making precise financial projections is futile - especially for a bank somewhat at the whim of the Federal Reserve - but we think it is reasonable to expect Ally to cumulatively generate its entire current market cap in net income over the next 5-6 years.

It will likely distribute this net income to shareholders through dividends and share buybacks but mostly share buybacks. Since it started its repurchase program around six years ago, shares outstanding have fallen by 37%.

With all the distributable earnings it will generate this decade, there are two scenarios for Ally stock. One, the stock doesn't rise and management takes out 90% of its current shares outstanding (increasing our ownership by 10x). Or two, when the company generates its entire market cap in earnings by the end of the decade and uses that cash to repurchase stock, the share price will start moving higher. We love these setups as it means - as long as we are generally correct about the earnings trajectory - the company either gets absurdly cheap as management takes out huge chunks of its shares outstanding every year or (more likely) the stock starts moving higher.

We think scenario two is likely with Ally. This gives us the confidence to own the stock and expect market-beating returns over the next 3-5 years.

Barons Funds increased their position in Mobileye (MBLY), a leader in autonomous driving technologies. They briefly walk through what they like about the company below.

During the quarter we added to our position in Mobileye Global Inc., a leading provider of advanced driver-assistance systems (ADAS) and autonomous driving technologies. The company partners with a wide range of automotive manufacturers worldwide. As of April 2023, their solutions have been installed in about 800 vehicle models and deployed on over 140 million vehicles globally. Furthermore, Mobileye has maintained a dominant share position in the global ADAS market for years. The company was founded in 1999, effectively pioneered the ADAS market, and introduced its first EyeQ system-on-chip in 2007 – enabling vehicles to efficiently gain ADAS capabilities such as real-time detection of vehicles, pedestrians, and lane markings. Until recently the company’s growth was mostly driven by capturing additional market share, but we believe in the future Mobileye will benefit from automakers’ expanding adoption of its more advanced programs. These programs, such as SuperVision and Chauffeur, leverage Mobileye’s extensive data assets, technology, and strategic relationships with customers to deploy systems with sophisticated capabilities. The advanced programs are expected to generate thousands of dollars in revenue to Mobileye per installed vehicle, well above current levels of approximately $50. Mobileye has secured several contracts for its SuperVision solution, including Chinese brands such as Geely’s Zeekr and Western brands such as Porsche. We have closely followed the company and its technology innovations and interacted with Mobileye’s management team for many years now, having been shareholders of Mobileye prior to its acquisition by Intel in 2017. We remain optimistic about the transformative potential of the autonomous revolution. Leveraging years of investment, a diverse customer base, expertise, and robust cash generation, we believe Mobileye is well positioned to create value for both shareholders and customers during this transformation.

Ennismore Global Equity Fund detailed their thesis on Japanese rubber products company, Okamota Industries (5122.T).

Okamoto Industries Inc – Japanese rubber industrial company (0.9% NAV) Set-up in 1934 as a raincoat and rubber-coated fabric manufacturer, Okamoto Industries (“Okamoto”) has over the years expanded into a wide range of related products, ranging from consumer goods such as condoms, heat pads, boots, gloves and dehumidifiers, to industrial items including vehicle seat covers, construction wallpaper, adhesive tapes, and protective films. With the founding family still deeply involved and owning shares, the business is conservatively run and managed. The crown jewel, however, is the condoms division which was launched in 1969.

Condoms account for just around 10% of revenues but well over a third of profits. Okamoto is the market leader in Japan, twice the size of the next largest competitor in an industry where the top 3 players account for more than 90% of condoms sold. Selling a relatively low cost regulated medical device – with significant downside risks in the event of failure – ensures a good degree of brand loyalty and pricing power with its end-users, as buying the cheapest available contraceptive isn’t going to impress any sexual partner. With ageing demographics in Japan, a reduction in drug store shelf space has kept potential new entrants away and reinforced scale advantages of the incumbents in distribution and marketing. The brand is also globally known for its ultra-thin condoms, which has seen increased foreign awareness thanks partly to the increasing number of international tourists to the country. Okamoto’s reputation for high quality has undoubtedly helped sales grow outside of Japan, especially in places like China where the brand is considered a premium product, enabling it to compete with giants like Durex and offsetting weak growth in a mature domestic market.

Condoms are part of the group’s household consumer goods segment which has steadily increased margins over time, generating a very respectable post-tax return on capital employed of over 20% today. This segment also contains a mix of high-quality branded products such as heat pads and dehumidifiers, as well as less differentiated ones like rubber boots. These categories clearly face more competition than condoms, but also share in the production and R&D capabilities of the group leading to cost efficiencies. The yen depreciation since the start of Abenomics has certainly helped by making Okamoto’s exports more competitive and boosting tourism. However, such improvement in profitability is also driven by innovative product launches like the Zero One condom in 2015 as well as more active efforts to expand outside of Japan in recent years.

Okamoto as a whole generated JPY5bn in after-tax net income during the fiscal year ending March 2023, which we have viewed as a fair estimate of profits going forward. We were pleasantly surprised therefore when management upgraded full year net income guidance to JPY6.1bn for fiscal year 2024 alongside reporting Q1 2024 results a few weeks ago. Against a current market capitalisation of JPY84bn, at first glance the shares seem reasonably valued at around 14x earnings. This however ignores the net cash balance of JPY30bn and long-term deposits plus liquid Japan-listed securities of another JPY30bn on the balance sheet. Adjusting for these we’re paying less than 4x net profits.

It is worth noting that the industrial segment, whilst accounting for almost two-thirds of group revenues totalling JPY64bn in fiscal 2023, is barely profitable right now – mostly due to volatile energy prices which are a key input. This division has historically generated operating margins in the mid-to-high single digit range, providing additional upside should conditions improve.

There’s no broker analyst currently covering the company, which makes it less likely to be well-analysed, and we think this is a big driver of today’s large mispricing. The shares aren’t highly liquid either, although we were still able to build a decent sized position well within our internal liquidity rules. Our downside is well protected – the cash balance, liquid securities, and the mature Japanese condom business alone are enough to justify today’s market capitalisation, plus some more. In effect we are getting the international growth aspect of the condoms unit – still in the early stages – plus around JPY90bn in non-condom revenues – which as a whole consistently generated profits over time – for free.

The shares currently have a dividend yield of around 2.3% which is more than thrice covered by net income. Buybacks are also a regular feature with the company, reducing the share count by more than 40% since the turn of the century. Valuing the existing business on a more reasonable 14x 2024 net profits gives an upside of more than 70% from today’s levels.

Until next time! - EP