Welcome, subscribers!

Would you be interested in pitches for a couple of Canadian microcap tech companies—plus four more financials-adjacent stock ideas?

If so, you’re in the right place.

And if you like what you see, please forward to a friend or colleague!

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter if you’d like to be included in a future issue.

Let’s get to it.

Greystone Capital Management initated a new position in Sylogist Ltd. (SYZLF), a Canadian-listed SaaS that serves the non-profit, government, and education verticals. Can a new CEO improve the company’s trajectory?

Sylogist Ltd. (SYZLF)

During the quarter we purchased shares of Sylogist Ltd. and setting the stage (or table, if you will) for this investment are the many cooking shows in my rotation, where I love watching chefs prepare and talk about food. These shows offer many parallels to investing and portfolio management, one of which is that the greatest chefs understand that the best recipes are all about the ingredients. I believe Sylogist is following the recipe for success, with the ingredients consisting of a high-quality business, strong growth prospects, a net cash balance sheet, good management, and free cash flow generation at a bargain price. Sylogist is a public sector softwareas-a-service (SaaS) business whose stock has been orphaned due to its history of poor corporate governance along with a recently implemented strategy shift and dividend cut that caught investors off guard but was executed with the sole focus of driving shareholder value. This, along with the massive selloff in small companies and software related businesses during 2022 has caused the stock to be left for dead, despite possessing some characteristics that point to an intrinsic value much higher than where the shares trade today. Over time, and with proper execution, I believe our shares could be worth multiples of what we paid.

Sylogist is a Canadian listed SaaS business that provides mission-critical software solutions to nearly 2,000 customers worldwide in three public sector verticals of Non-profits/NGOs through their SylogistMission segment, Government through their SylogistGov segment, and Education through their SylogistEd segment. Within these verticals, software solutions consist of ERP, CRM, fundraising, education administration, and payments products. These products carry high value propositions and sticky customer relationships as they serve a critical need for organizations of all sizes. The areas within the niche that Sylogist occupies have less competition than enterprise level software businesses, who typically avoid these end markets and are not well adapted to offer the customized solutions that Sylogist can. One example would be a growing non-profit that requires more advanced fund accounting and donor management software that integrates with the rest of the organizations applications, thereby eliminating sometimes manual processes for data input and storage. The organization could use Sylogist’s ERP product to address those needs. Historically, despite underinvestment in customer relationships under the previous management team, customer retention has been in the high 90% range as there is reluctancy to switch providers given the integration into their workflows and systems.

Sylogist has three primary revenue segments made up of Cloud Subscriptions (40% of revenues), Maintenance and Support (25%) and Professional Services (29%). Approximately 65-70% of revenues are recurring between Cloud Subscriptions and Maintenance and Support, providing both visibility and resiliency into future revenues, with software gross margins in excess of 75% and cash flow conversion in the 70-80% range. Several of Sylogist’s products are built using the Microsoft Dynamics platform, where Sylogist can not only customize products for specific verticals but can also benefit from the reputation and track record of Microsoft during customer acquisition and when cross-selling adjacent products and services. Moving forward, management’s strategy is to grow both organically and via M&A, while focusing on the organic growth of software subscription revenues.

Software businesses, and among those, Sylogist’s peers, can be great businesses, especially when tied to critical parts of an organization’s operations. They share characteristics such as strong organic growth, high revenue retention, high margins, and strong cash flow conversion, while providing remarkable durability through all economic cycles. Publicly traded peers Tyler Technologies, Blackbaud and Sage have long histories of growth and profitability, while each grew revenues through the financial crisis with no decline in operating margins. Strong fundamentals and durability means that most of Sylogist’s peers trade at valuations of 20x EBITDA or more, compared to <9.0x NTM EBITDA for Sylogist.

For the reasons behind the valuation disparity, I’d point you toward the company’s history. The early version of Sylogist consisted of a low margin, no growth, reseller of software until prior management made some acquisitions in the early 2000’s to capture more of the customer relationship and to focus on building a public market software business. Unfortunately, prior management made it a point to focus on tuck-in M&A, manage acquisitions for cash flow, neglect organic growth, and milk the company for compensation. Poor corporate governance, a company with no business being public, and a management team with no desire to drive shareholder value was going nowhere and would never garner a proper public company multiple. Prior to the former CEO’s retirement in late 2020, Sylogist ran a strategic review (an attempt to sell the business) and emerged with the Board determining that the best path forward would be to pursue the near-term market opportunities for growth in order to drive shareholder value. They also went on a search for a new CEO who would be given an organic growth mandate.

Enter current CEO Bill Wood, an industry veteran who was a founding member of Blackbaud, one of Sylogist’s direct competitors, also previously serving as President and CEO of two software businesses during a 17-year span that culminated in both businesses being acquired, one by Constellation Software and the other by a private equity firm. Shortly into his tenure, Bill cut the dividend (a 9% yield), freeing up nearly $12mm in annual cash flow, and formally announced the company’s strategic shift toward growing organically and via M&A. As part of the strategy shift, EBITDA margins would be taken down from the low-mid 50% range to 30%, while maintaining a Rule of 40 posture, with the excess cash flow being reinvested into product development, sales and marketing, and M&A. The company’s credit facility was also increased by 65% to $125mm, providing additional firepower for acquisitions, while a share buyback program was put in place that would allow the company to repurchase up to 10% of shares outstanding. The market, along with yield focused investors, did not like this news. I, however, am thrilled with these decisions, as I tend to seek out management teams willing to endure short-term discomfort in exchange for potential long-term value.

The strategy is working, and investors have been slow to recognize the shift, despite what I believe to be an important inflection point. In just three short years, Sylogist has made tremendous progress toward building a software platform by strengthening the management team, launching and acquiring in-demand products, repairing customer relationships, improving the NPS score, and returning the business to organic revenue growth. To date, effortsto accelerate sales, marketing and product development have been and should continue to prove successful as the sticky products that Sylogist offers, and the collegial nature of their end markets means that a continued organic growth profile shouldn’t be too difficult a hurdle to overcome. In fact, Sylogist is firing on all cylinders, growing bookings, revenues and cash flows effectively, and as of the most recent quarter, reported positive sequential growth in organic software subscription revenue. During the most recent earnings call, management highlighted an attractive sales pipeline and new bookings matriculating at a higher rate than at any point since the current management team was brought on. This, along with the hiring of an experienced Chief Revenue Officer and the continued flexing of marketing muscle bodes well for future organic growth. A recent upgrade to the CFO position should also come with improved communication and disclosures, helping investors better understand the story and strong fundamentals.

Sylogist’s strategy shift will be bolstered by significant tailwinds including the large addressable market among their customer base, low digital penetration among the same customer base, the acceleration of software tools post-COVID, and a fragmented market for products and services that Sylogist can tap into for M&A. Since their hiring, management has completed four acquisitions, all largely accretive and providing both the opportunity for continued organic revenue growth and the opportunity to add valuable products and services to their platform. According to management, the deal pipeline remains incredibly full, with hundreds of potential targets on their list. As private market valuations continue to come down, we should see additional transactions take place that help grow the top and bottom lines over time. Sylogist could also find themselves on the receiving end of an acquisition offer, as the government software space is incredibly acquisitive due to the fragmented nature of these businesses, value to both strategic and financial acquirers, and durability of the business models. In a macro environment where two of the biggest worries are inflation and a recession, the combination of nondiscretionary recurring revenue and pricing power makes for an attractive setup. Even share-losing Blackbaud, who has consistently underinvested in the business to the point of declining revenues and margins, finds itself in the midst of a take-private offer from a PE firm.

Sylogist remains a ‘show me’ story but I believe the right ingredients are in place. The company is small. Publicly traded float is minimal. Shares trade over the counter in the US and have zero US analyst coverage. Management is non-promotional and IR efforts could improve. The potential for mispricing here is significant and I believe shares could be worth multiples of what we paid looking out a few years. I like the setup and look forward to discussing Sylogist in future letters.

Silver Beech initiated positions in 4 new companies in the first quarter of 2023. We include their pitches for ECN Capital (ECN), U-Haul (UHAL), Ally Financial (ALLY), and First Citizens Bancshares (FCNCA) below. Note: we shared pitches for both FCNCA and UHAL recently, so it’s interesting to get a different (but similarly bullish) perspective on each company.

ECN Capital Corp. (TSX: "ECN")

ECN Capital Corp. ("ECN") is a small-capitalization specialty finance holding company that originates, manages, and advises credit portfolios within three distinct platforms: (1) Triad, a scaled consumer lender in the manufactured housing ("MH") market; (2) SourceOne & Intercoastal, consumer lenders in the recreational vehicle ("RV") and marine markets; and (3), RedOak, an inventory finance lender, primarily for dealers that offer consumer access to Triad, SourceOne, and Intercoastal's credit products. All three platforms are asset-light businesses with significant long-term growth potential. Despite being listed on the Toronto stock exchange, ECN operates exclusively in the United States. We believe ECN's intrinsic value is more than 70% greater than its March 31 share price.

ECN sits at the nexus of credit relationships between funding partners (banks, insurance companies, etc., who fund the credit on their balance sheets), dealers (who sell products like MHs, RVs, or boats in physical or online stores), and consumers (who purchase the MH, RV, or boat, financed by credit originated by an ECN platform). ECN and its counterparties are regulated by many different entities. We believe this operating complexity and regulatory compliance require specialized knowledge that creates an important economic moat.

In this letter, we focus on ECN's crown jewel, Triad, which accounted for over 90% of adjusted EBITDA in the final quarter of 2022. We estimate that Triad will account for ~75% of adjusted EBITDA in 2023. We wouldn't usually analyze companies using adjusted EBITDA but do so here considering ECN's de minimis economic depreciation, and to compare cash flows through time unburdened by interest expense (each platform utilizes different amounts of leverage depending on platform maturity and product), tax treatment, and corporate G&A expense.

ECN acquired Triad in December 2017. Triad grew originations from $525 million of MH loans in 2018 to $1.4 billion in 2022; 2.6x origination growth in four years, or a 27% compound annual growth rate ("CAGR"). We estimate the manufactured housing market grew sales volume at a 21% CAGR over the same period, meaning Triad took market share. Over the same period, Triad expanded its EBITDA from $22 million (a 44% margin) in 2018 to $91 million (a 54% margin) in 2022. This EBITDA expansion of 4.2x in four years indicates Triad's market share gains were highly profitable.

Triad's credit products are also profitable for funding partners. Our industry knowledge of leveraged loans and real estate informs our view that MH consumer credit ranks as one of the most attractive credit products for investors today. MH loans typically price ~250 basis points above traditional 30-year mortgage rates despite shorter duration. We believe the continued attractiveness of MH credit pricing is driven by (i) difficulty for entrants to deploy substantial capital into a smaller market versus traditional 30-year mortgages; and (ii), less competition due to manufactured housing's oligopolistic market structure (Berkshire Hathaway's (BRK.B) (BRK.A) wholly-owned MH lenders 21st Mortgage and Vanderbilt have about 50% market share).

In addition to economic moats, strong continued growth, and attractive credit products that have driven the company's strong returns on capital, we believe ECN is an attractive investment because:

Management Track Record: We have confidence in management because they have a strong track record of performing for shareholders. Since ECN's inception in September 2016, ECN shareholders have earned a ~23% total return CAGR (versus ~12% total return CAGR for the S&P 500). ECN's CEO, Steve Hudson, owns ~6% of the company's outstanding shares.

Attractive Valuation: What valuation is appropriate for a high-growth, asset-light business with 50%+ adjusted EBITDA margins operating in an oligopolistic market with a strong management team? Taking ECN's lowest EPS guidance estimate for 2023, as of March 31, ECN trades at 12x estimated earnings, whereas the S&P 500 trades at 20x estimated earnings. We believe ECN's intrinsic value is at least 70% greater than its share price.

Near-Term Strategic Review Process: On March 7, ECN announced a "review of strategic alternatives to maximize shareholder value" due "to interest that has been received." We would be thrilled if ECN was able to maximize value in this near-term process, however, we are also happy to own ECN for the long term based on our articulated view of the company's profitable growth and strong management.

U-Haul Holding Company (NYSE: "UHAL"; "UHAL-B")

U-Haul Holding Company ("U-Haul") is North America's largest do-it-yourself moving company, one of the largest owners of self-storage real estate in the United States, and a high-quality business that has grown its market-leading position for decades by putting customers first. U-Haul is one of North America's most recognizable brands and can be thought of as a royalty on consumer moving. All else equal, we prefer to invest with owner-operators as their economic incentives are aligned with shareholders. The Shoen family controls U-Haul with about 50% of the voting common stock. Joe Shoen is U-Haul's CEO. Joe's father, Leonard Shoen, founded U-Haul in 1945. We believe U-Haul's intrinsic value is more than 40% greater than its March 31 share price.

U-Haul's consumer moving products include truck, van, cargo trailer, moving box, self-storage real estate rentals, moving insurance, packing supplies, trailer accessories, and an online marketplace for moving labor. U-Haul also sells WebSelfStorage, a web-based platform for self-storage facility management that connects users to U-Haul's network of 5,000+ owned, operated, or affiliated self-storage facilities. Our channel checks and scuttlebutt research inform our view that U-Haul's moving products and services are second to none in customer experience and value proposition.

U-Haul holds an unassailable market position in a mature but growing industry, where the company's vast distribution network and preference to pass lower costs to customers act as strong economic moats. U-Haul's products can be accessed at over 23,000 locations (2,000 U-Haul owned / 21,000 independent dealer locations). Recognizing the power of its distribution network, U-Haul began offering propane tank refills at its stores in 1984. In just three years, by 1987, U-Haul was the largest propane retailer in the United States! Further, U-Haul's customer-focused approach drives loyalty and market share gains, sustaining a virtuous circle of lower prices and increased market share. It would be expensive, difficult, and require decades of commercial discipline for any competitor to challenge U-Haul's market position.

In April 2022, U-Haul's Board of Directors formed a special committee to enhance "the marketability and liquidity of the Company's stock." The committee acted quickly. In October 2022, the company changed the name of its parent company from "Amerco" to "U-Haul Holding Company", did a 10-for1 stock split with nine shares of non-voting common stock and one share of voting stock distributed to existing stockholders, and announced a dividend on the new non-voting stock. U-Haul's decisive actions piqued our interest and helped convince us that U-Haul was committed to creating shareholder value by helping public markets recognize the company's intrinsic value.

We believe U-Haul's shares are undervalued. Our variant view is driven by:

Undervalued Asset (Self-Storage Real Estate Portfolio): U-Haul owns a 55 million square feet self-storage real estate portfolio. We conservatively value this real estate at $10 billion[1], roughly equal to U-Haul's current market capitalization. Valuing the real estate at $10 billion implies investors get the rest of U-Haul's impressive business (trucks, equipment, brand/customer goodwill) for less than 5x after-tax operating earnings.

Understated Earnings Power: GAAP accounting understates U-Haul's earnings power. GAAP depreciates U-Haul's self-storage real estate too aggressively, resulting in GAAP earnings that are 10%+ lower than true earnings power. GAAP approximates maintenance capital expense to depreciate U-Haul's trucks and equipment, but it is not an appropriate estimate for real estate.

Strong Returns on Capital: U-Haul generates sustainable 11%+ after-tax returns on capital despite the capital-intensive and commodity nature of its business. This is important because the company is currently investing all operating cash flow into growing its self-storage real estate portfolio, and its truck and equipment fleet.

Attractive Valuation: As of March 31, U-Haul traded at 11x trailing GAAP earnings and 6x trailing EBITDA, a low valuation for a business of this quality and durability, and a substantial discount to the sum of its parts. We believe U-Haul's intrinsic value is at least 40% greater than its share price and is compounding at 10% annually driven by profitable growth.

Ally Financial (NYSE: "ALLY")

Ally Financial ("Ally") is the largest all-digital bank in the United States, the 22nd largest bank by total assets ($192 billion), the nation's leading prime auto lender (with 6.5 million consumer customers), and leading auto floorplan lender (with over 23,000 dealer relationships). Most of Ally's assets are auto loans and finance receivables, but Ally also offers consumer protection insurance through its dealer channels and operates small corporate and mortgage lending businesses. Notably, Ally also offers some of the industry's most competitive deposit products: Ally was awarded "Best Checking Account", "Best Saving Account", and overall "Best Online Bank" by third-party reviews and was the first large bank to eliminate overdraft fees. We believe Ally's intrinsic value is more than 40% greater than its March 31 share price.

Ally evolved from the auto finance unit of GMAC, emerged from GMAC's restructuring as a bank holding company, and rebranded, before going public in 2014. Since then, Ally has transformed itself from a wholesale-funded, captive finance company into a full-service retail-funded automotive finance and insurance provider by steadily gaining retail deposit market share. Today, Ally's balance sheet is 85% funded (versus 43% funded in 2014) by $152 billion of deposits (versus $58 billion in 2014) across 4.4 million depositors (versus 900k depositors in 2014). Over 90% of Ally's deposits are FDIC-insured, more than any other $100+ billion-asset bank in the United States. Ally's massive insured deposit base is stickier and more resilient to depositor fear of a bank run than other regional banks.

Ally's funding transformation has driven structural improvement in net interest margins ("NIMs") from the mid-2%s to mid-3%s. Although recent interest rate increases will pressure Ally's NIMs in the short term as deposit rates rise faster than can be passed through to loans, Ally's moderate-duration assets will capture recent rate rises and should drive strong NIMs of 3.5-4.0% by 2024, and ultimately returns on equity of 12%+.

Recently, market participants have become concerned by broadly rising auto loan charge-offs and delinquencies. There are also concerns that used car prices (used cars are collateral for many of Ally's loans) have declined from COVID's supply-constrained highs. However, despite this negative macro sentiment, our analysis of Ally's balance sheet position is favorable, where 90% of Ally's auto loan book is "prime credit" (FICO score over 620). And although Ally "over-earned" in 2021 and 2022 when credit losses did not materialize, Ally has earnings power to offset credit losses in 2023 and 2024 should they exceed existing loss reserves.

Moreover, Ally's balance sheet already reflects a 30% decline in used car prices between 2021 and 2023 as its base case underwriting assumption. Ally has reserved ~3.6% of its auto loans for losses. We do not believe Ally's credit losses will exceed those already underwritten. To help contextualize the conservatism of Ally's ~3.6% auto credit loss reserve, we note that during the Global Financial Crisis ("GFC") of 2007 and 2008, GMAC auto finance credit losses peaked in 2009 at ~2.3%.

We believe Ally is an attractive investment today because:

Resilient Deposit Base & Assets: Ally's deposits are large, diverse, and insured. Ally has moderate duration assets and no hold-to-maturity book. Ally's balance sheet is resilient against banking sector concerns over asset-liability duration matching.

Auto Credit Losses Already Provisioned: Ally has appropriately reserved its balance sheet for potential losses. Moreover, Ally's earnings power can offset excess credit losses (which we don't believe will significantly materialize).

Attractive Valuation: At $25.49 per share as of March 31, Ally trades at ~85% tangible book value and a mid-single digit price-to-earnings ratio on trough 2023 earnings. We believe returns on equity of 12%+ remain achievable for Ally, implying intrinsic value above $36 per share and offering 40% upside from March 31 price levels.

First Citizens Bancshares, Inc. (NASDAQ: "FCNCA")

First Citizens Bancshares, Inc. ("First Citizens") is a 130-year-old, Raleigh, NC-based, large regional bank operated by the aptly named Holding family. Robert Powell Holding, who joined the bank as an assistant cashier in 1918, became president in 1935. Frank Holding Jr., Robert's grandson, has been Chairman and CEO since 2008 (preceded by his father, who held the role for over 50 years). Frank and his family own over 20% of First Citizens stock and have nearly 50% of the voting power.

We have tracked First Citizens for several years. Frank is a world-class banker who deeply understands the rewards of operating within limits during periods of excess, or in his own words, "taking the road less traveled." First Citizens reaped the fruits of Frank's discipline after the GFC. First Citizens entered the GFC with a strong capital position and high-quality book of assets and took no Troubled Asset Relief Program funds. Frank then led First Citizens to acquire 20 banks in the aftermath of the crisis (six failed banks almost immediately after the GFC and several failed banks thereafter). Frank has consistently expanded the First Citizens franchise in a cost-effective manner by acquiring failed banks.

We purchased shares of First Citizens after First Citizens acquired certain assets and liabilities of the failed Silicon Valley Bank ("SVB"), including 17 SVB branches and the SVB franchise, from the FDIC. Although public markets immediately recognized the acquisition's accretion to First Citizens' underlying value (shares rose over 50% on the day of the deal's announcement), we think First Citizens is in an even superior capital position than the public market has recognized.

First Citizens acquired $110 billion of SVB's assets ($35 billion cash, $72 billion loans, and $3 billion of other assets). The acquired assets were funded by $94 billion of liabilities ($56 billion of deposits, $3 billion in other liabilities, and a 5-year $35 billion loan from the FDIC with a 3.5% interest rate). The $16 billion plug between SVB's assets and liabilities equals the discount that First Citizens received from the FDIC. We would argue this is one of the most profitable and asymmetric bank deals of the modern era.

First Citizens ended 2022 with $8.8 billion of common equity. Clearly, the $16 billion discount for SVB created substantial accretion to First Citizens' common equity. The acquired SVB loans are primarily short-duration capital call lines with near-zero loss history, not riskier venture loans that SVB was infamous for when it was solvent. After acquiring SVB, First Citizens has substantial cash reserves, an FDIC back-stop, and credit loss-sharing on SVB assets. Based on our valuation analysis, which includes First Citizens incurring a "bargain gain" tax and burdening SVB loans with conservative loss estimates, we believe the SVB acquisition accreted over $8 billion to First Citizen's common equity. First Citizens also benefits from downside protection and loss-sharing provided by the FDIC.

If our valuation analysis is correct, and First Citizen's common equity rose by more than $8 billion, or nearly 100% of First Citizens' pre-transaction common equity, then the shares are materially undervalued. We look forward to investing alongside CEO Frank Holding and we have confidence he will continue to create value for shareholders.

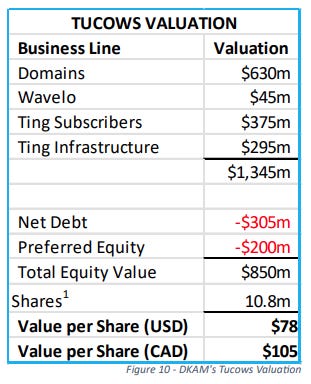

Donville Kent Asset Management started a “new” position in Tucows (TC), a company the manager has owned before. We include an excerpt of their lengthy thesis below, which details the imminent catalysts they see that make now an opportune time to own the shares again. Click through to read their entire pitch.

Tucows (TC) Similar to the last newsletter, we are attaching an in-depth report on a new investment (sort-of). We have re-entered our investment into Tucows and believe the upside from here is significant, plus there are imminent catalysts for the stock that we discuss in more detail.

TUCOWS – A PIVOT POINT

Tucows is a Toronto-based company that has been providing internet-related services since 1993. They started as a simple shareware site and now have grown into a 3-business-line technology utility company. The services they offer are crucial to operating a business and living in the 21st century, which leads to recession-resistant revenues and a long runway for growth.

Tucows is a company we have a lot of history with. We were investors in the business for years and the stock did well. In 2020, they sold one of their business lines and began a complicated investment cycle. They began investing in two separate growth businesses and the debt on the balance sheet began to mount. We sold our position from September to December 2021 at around $100/share. The stock has now dropped to below $30/share. We have now begun to invest in the business once again because we believe all the major issues causing the decline have recently been or are about to be resolved. We now believe the business is as strong as ever and some upcoming catalysts will prove this point. We have met with Elliot Noss, the CEO, many times over the years. He is a capital allocator, a genuine straight-shooter, and someone we have referenced as an “Outsider CEO” in the past. We have full faith in Elliot’s long-term strategy.

Last year they restructured their business into three separate business units and now Tucows operates as the holding company. They have separated their company into 3 separate units. Think of it as a 21st century utlity company. They provide the backbone and services necessary for internet, websites, and mobile.

We believe the business is the strongest it has ever been. The recent stock price performance suggests otherwise. What’s the disconnect?

1. For the last couple years, the company was investing in two growth companies that required a lot of capital. This stressed the balance sheet.

2. Without a strong view on how Ting fiber gets funded going forward, the business is fairly uninvestable.

3. The recent reported quarters have been messy because they sold a business line making year over year comparisons difficult.

4. Their reported earnings are understated because their upfront investment being put into fiber masks the long-term value being created.

We believe all four of these concerns have been answered in 2023.

1. Wavelo goes from investment phase to cashflow phase in 2023.

2. A funding deal with an infrastructure fund is imminent which solves the balance sheet issue by shifting from using internal capital to using external funds.

3. All three business lines should grow in 2023.

4. The infrastructure funding details should clear the air and establish a baseline for how much the fiber business is really worth.

CONCLUSION

The operations and financials of Tucows are at the “Pivot Point” across all three business lines. The “transition phase” is now coming to a close. We believe the company is set to go back to being valued like the compounder it is.

Until next time! - EP