Welcome, subscribers!

Would you be interested in pitches for two energy companies and the “Latin American Amazon”—plus three ideas from a well-respected hedge fund investor?

If you answered yes, then you’re in the right place.

And if you like what you see, please forward to a friend or colleague!

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter if you’d like to be included in a future issue.

Let’s get to it.

Deep Sail Capital outlined their thesis on Mercado Libre (MELI), described as 1/3 Alipay, 1/3 eBay, and 1/3 Amazon, in their latest quarterly letter. We include their thoughts below.

Current Position: Mercado Libre

Mercado Libre is an internet, technology, and payments company that services Latin America. Mercado Libre went public in 2007. Since the IPO, the company has grown from an eBay-like clone geared towards Latin America to a full suite of e-commerce, shops, payments, and logistics. Mercado Libre is a unique company that might be best described as 1/3 Alipay, 1/3 eBay, and 1/3 Amazon of Latin America (Latam). Aside from that, Mercado Libre is essentially Latin America's sole e-commerce and internet behemoth.

Latam has lagged the rest of the world, especially compared to North America, in terms of adoption of the internet, e-commerce, and investment in internet startup companies for the last 15 years. But that adoption has accelerated in the last 5 years. Specifically, in the last 3 years, the Latam VC landscape has exploded, with a multitude of new Latam startups emerging to service the growing internet users of the region. Many of these startups were founded by former Mercado Libre employees. I mention this to highlight the key position that Mercado Libre holds within the Latam market; it provides the payments, logistics, and credit that allow these startups to scale.

Mercado Libre’s business is broken into six verticals: Mercado Libre (marketplace), Mercado Envios (logistics), Mercado Shops, Mercado Pago (payments), Mercado Credito (credits), and Mercado Ads. While the overall business is still running at extremely high growth rates (+40% yoy) even after some deceleration post-COVID, the most exciting part of the business for me is Mercado Pago, the payments segment. Mercago Pago is a payment system modeled after the successful Chinese payment system Alipay. Mercado Pago recently focused on expanding payments off the Mercado Libre exchange. It has seen its off-exchange payment volumes grow by 122% in the 3Q to $21 billion. This off-exchange payment growth is just beginning. Coupling the payments business with Mercado Libre’s high-moat businesses in Marketplace and Logistics sets Mercado Libre up to be the backbone of commerce in Brazil, Mexico, and other Latam countries for many years to come.

High Quality Business Model:

Mercado Libre’s product segments all have adjacent network effects. If a user uses one of their products, then using a second product within Mercado Libre is more valuable for that user. For example, Mercado Logistics drives logistics revenues but also provides its Mercado Shops or Marketplaces with an easy way to ship and deliver products to customers. Mercado Pago's payments system is the interconnecting tissue that binds merchants and customers both on and off of their platform. Mercado Pago is used for not only payments but has extended into investments, savings, credit, and other financial services. Engagement in one vertical can quickly extend to other verticals, as you can see by the progression of revenues in each of their major markets and verticals over the last three years.

Mercado Libre has built its business in a similar fashion to how Amazon has built its business, but a key distinction is that Mercado Libre has been able to grow into broader verticals than Amazon. This was largely due to the lack of competition in Latam eCommerce over the last 20 years.

Outstanding Management:

Marcos Galperin is the founder, chairman, and current CEO of Mercado Libre. Galperin founded the company in 1999 while attending Stanford University to get his MBA. Galperin is exactly what I look for in an outstanding manager. He has some skin in the game, as he still owns about 10% of the company through the Galperin Trust and his own equity. Dis brother is highly involved in the oversight of the company as a board member while at the same time taking no board compensation. Galperin has built a culture at Mercado Libre that is entrepreneurially driven and technology-first. Historically, Galperin has shown great skill in managing through difficult times, including through the tech bubble burst in 2000, the GFC in 2008, and extensive geopolitical stress in Latam countries over the last 20 years. He has been able to take on eBay and Amazon in Latam and remain the market leader in eCommerce. Mercado Libre has built its own logistics network in response to entrants like Amazon and Sea, which are pushing heavily into Brazil and Mexico. Outside of Galperin, the CFO, Pedro Arnt, has a long tenure with Mercado Libre. He has been with the company since 2000 and the CFO since 2011. Galperin and Arnt have a long track record of successfully executing on their stated strategy.

Substantial long term growth prospects:

Mercado Libre generates two types of revenue: commerce and fintech. Commerce is your traditional e-commerce revenues from marketplaces and product sales, while fintech revenues are from newer segments like payments, point of sale systems, financial services, and other financial products. Commerce revenues have been growing consistently in the mid-20s to mid30s since COVID started, similar to other e-commerce companies. Fintech revenue has been growing at a high rate for the last few years, around 80–100%, driven by their expansion in their payments offering. Mercado Pago’s off exchange growth aligns well with the rise of the PIX system in Brazil. PIX is an electronic payments system in Brazil that allows consumers to pay directly from a bank account for all sorts of goods. For those not familiar with the Brazilian PIX system, here is a quick primer (Pix: Brazil).

While competition has been entering their markets, specifically Amazon and Sea, Mercado Libre still sits as the sole eCommerce giant in Latam. They are in the driver’s seat to shape the face of eCommerce in Latam in the near term, and I expect them to continue to expand into adjacent verticals over time and leverage their central role in e-commerce to provide additional services to the next generation of Latam startups.

Reasonable Valuation:

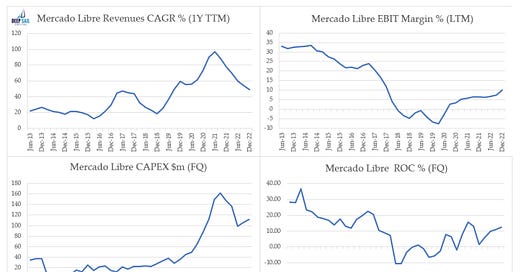

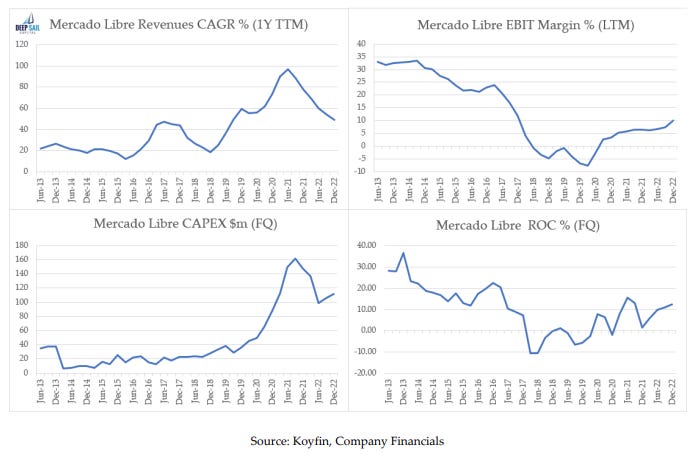

Mercado Libre has seen improving financial metrics alongside fast growth and moderating capital expenditures since the middle of 2021. 2021 was a key turning point for them, as their capex peaked after they ramped up capex to help build out their logistics network in 2018–2019. While continued investment is needed to further build out their logistics networks in other countries outside of Brazil and Mexico, I expect more cash to flow to the bottom line in the years to come as a percentage of revenue than in the last 5 years.

Mercado Libre is currently growing revenues on a FX neutral basis at 58% y-o-y, or 40% y-o-y adjusting for FX. Margins and cashflow have materially improved since they started to reduce the amount of quarterly capex spend in late 2021 (logistics-driven). Consensus estimates are currently forecasting $3.4B of EBITDA and $2.8B of EBIT in 2025. I believe those are likely conservative forecasts, but even on that basis, Mercado Libre is trading at an 18x 2025 EBITDA multiple and a 22x 2025 EBIT multiple. Considering where Mercado Libre sits in the ecommerce ecosystem, I view their valuation as high but justified.

Mercado Libre – Historical Financials

Maran Capital Management detailed a couple of holdings in the energy sector, including the special situation refiner, Delek (DK), and oil field services provider, Ranger (RNGR). They walk through their thoughts below.

I have provided updated thoughts on our top positions in recent letters; let’s examine a few smaller positions to which we have added recently.

Delek US Holdings (DK) – Special Situation

Delek is a holding company that owns four refineries, about 250 gas stations, and 34.3 million shares of publicly traded Delek Logistics Partners, LP (NYSE: DKL), its captive master limited partnership, which owns a series of oil pipelines and infrastructure assets.

Delek has 67 million shares outstanding and recently traded at $21.50 per share, putting its market cap at just over $1.4 billion. I estimate it has around $300 million in net debt (thought the balance sheet is opaque because DK consolidates DKL’s financials), so its enterprise value is $1.75 billion. What are investors getting for $1.75 billion? Well, for starters, DK’s position in DKL, which recently traded at $48/sh, is worth $1.65 billion. So, the adjusted enterprise value (or “stub value” in special situation parlance), taking into account net debt as well Delek’s DKL position, is approximately $100 million.

The gas stations are likely worth $300-$400 million, based on recent comparable transactions. And I think the refineries could be worth another $1.5 to 2 billion or more ($22- 30/sh), triangulating from a number of valuation approaches. All in, DK appears to be a fifty-cent dollar, with essentially all of its market cap covered by its ownership position in DKL, little debt at the parent company, and significant free cash flow.

We have all seen “sum of the parts” stories trade at large discounts to intrinsic value for long periods of time. Importantly, there is a catalyst to unlock the value in this case, and it doesn’t rely on activists or other outside factors. The company has made it clear through its actions and messaging that it is focused on unlocking this sum-of-the-parts value on its own.

Consider some of the recent messaging by the company:

• “Evaluating opportunities across Delek US business segments to unlock value for shareholders” – April 2023 investor presentation

• “CEO transition completed - Shareholder friendly actions taken immediately…Near term focus on centered around unlocking ‘Sum of the Parts’ disconnect” – December 2022 investor presentation

While working to unlock this value (likely through a transaction to take their ownership of DKL below 50% so they can cease to consolidate it and an outright sale of the gas station portfolio), the company is utilizing a further lever to increase shareholder value, which is to repurchase shares with cash flow.

There are some risks and red flags, including recent management turnover, fears about capital allocation outside of the SOTP-unlocking strategy (the company has indicated it might purchase another refinery to bulk up the core once they divest some of the ancillary parts), and lower-than-hoped-for share repurchase guidance for 2023. I believe we are being well-compensated for these risks in the form of DK’s current valuation.

My friend Andrew Walker of Rangely Capital recently wrote up Delek, and he closed his write-up with the following, which I think is a clever and illuminating way to put this situation into context.

At DKL's current dividend level, DK is getting [just over] $2/share annually in dividends from their DKL shares. That's.... just kind of crazy? Again, DK has almost no net debt at this point and is gushing cash flow, and at current prices we're buying them at a low double digit multiple to their dividends from DKL. Obviously "price to dividends from your controlled subsidiary" is not a valuation metric, but it is pretty crazy!

Ranger Energy Services (RNGR)

I have previously described Ranger as a company that provides proverbial “picks and shovels” to the energy industry. It is an onshore domestic oil services company that helps E&Ps service their wells, once drilled. While energy is a volatile, commodity-driven business, Ranger is a small, well-run, now unlevered company that should stay pretty busy as long as oil stays above, say, $50-60/barrel, which is a reasonable long-term assumption. Last year, Ranger generated $100 million of EBITDA on $700 million of sales, and it should do better this year. The business requires some capex, so the free cash flow of the business is around $70 million. Ranger has paid down its debt from over $75 million a year ago to almost zero today.

Ranger’s market cap is $300 million, so the business is trading at 3x EBITDA and just over 4x Free Cash Flow. Now that its balance sheet is clean, it will start to buy back shares. At the current pace of FCF generation, it could buy back approximately 2% of its shares every month. With a low float and high insider ownership, it may not take much for the stock to re-rate.

Greenlight Capital started three new positions this quarter in Black Knight (BKI), New York Community Bancorp (NYCB), and First Citizens BancShares (FCNCA). They briefly detailed their theses in their latest letter.

The new small long positions are Black Knight (BKI), New York Community Bancorp (NYCB), and First Citizens BancShares (FCNCA).

BKI is a software provider to the mortgage servicing and origination industries. Shareholders agreed to sell the company to Intercontinental Exchange (ICE) for a package of cash and shares worth just about $75 per BKI share. In order to cure the only meaningful overlap between the two businesses, ICE has also offered to divest BKI’s mortgage origination unit. Despite the pending sale of this business to Constellation Software, the FTC sued to block the deal. It is now up to a federal judge to determine the merits of the case. We estimate a conservative value for BKI in a deal break scenario to be $51 per share. We acquired our stake for an average price of $60.59 per share. BKI shares ended the quarter at $57.56, implying just greater than a 25% chance of the deal succeeding. We handicap the odds at closer to 75%.

NYCB and FCNCA are similar investments, as they were the FDIC auction buyers of Signature Bank and Silicon Valley Bank, respectively. Both acquisitions occurred at deep discounts and should lead to impressive improvements in earnings. Though we invested after the purchases, both stocks had been depressed by the banking crisis. We see them emerging as stronger than they were entering the crisis, and believe both merit higher values going forward. We take further confidence by virtue of the FDIC deeming them capable of these acquisitions.

Until next time! - EP