Welcome, subscribers!

Today we share pitches for a recent spinoff, a resort owner, and a European telco—plus two quick hitters.

If you like what you see, please forward to a friend or colleague!

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter if you’d like to be included in a future issue.

Let’s get to it.

McIntyre Partnerships initiated a position in Star Holdings (STHO), a recent spinoff that plans to liquidate over the next 4 years. The story is complicated, and McIntrye detailed their thesis in their most recent letter, which we include below.

Star Holdings (STHO)

STHO is a recent spinoff of a liquidating portfolio from the STAR/SAFE merger. As a quick back story, STAR was a financial business and REIT that made some poorly timed investments prior to the Great Financial Crisis. The business and stock eventually recovered, and the company spent the bulk of the 2010s cleaning up the prior mess and searching for new business ideas. During this time, the company started a business focused on ground leases, which eventually was IPOed under ticker SAFE with STAR retaining a majority ownership in SAFE and operating as its third-party manager. As SAFE successfully executed and grew, the value of SAFE eclipsed that of all STAR’s other assets and the decision was made to merge the entities and internalize the manager. However, a small portfolio of workout assets from STAR’s prior businesses remained, and STAR spun these assets out prior to the merger to clean up SAFE’s balance sheet. That portfolio of workout assets is STHO. However, complicating matters, the workout assets may have some capital needs, and STHO has agreed to effectively cover the cost of SAFE’s internalized manager for the first three years, which means STHO has modest cash needs initially. As STAR had minimal assets beyond its significant holdings in SAFE, management decided to capitalize STHO with a small cash buffer and a significant number of SAFE shares.

I believe STHO’s odd structure has a resulted in an opportunity to buy an orphaned security at an attractive price. While STHO’s history is convoluted, its current assets are straight forward. For every one share of STHO, we own one share of SAFE, $360MM in book value real estate, and $250MM in “effective” net debt. At current prices for STHO and SAFE, that implies STHO’s NAV is ~$35/sh. compared to STHO’s current price of $16. We have hedged some of our position by shorting SAFE shares, partially locking in this spread.

Going forward, STHO plans to liquidate over the next four years, which at current prices implies an ~22% annualized yield. I believe there are a few ways in which our return could be better, and a few which could hurt us. First, STHO could return cash and/or SAFE shares earlier than expected. Second, the marks on STHO’s liquidating real estate are old and could prove conservative. Almost half of STHO’s liquidating real estate is its investment in 30 acres of waterfront Asbury Park real estate, a growing “hipster” area of the Jersey Shore I am familiar with and think has potential. Third, SAFE is a portfolio of low-risk leases with exceptionally long duration, which makes SAFE extremely sensitive to interest rates. If inflation comes under control and/or if the Fed must pivot as the economy weakens, I believe SAFE shares could rally significantly. However, STHO is modestly levered, and the liquidation could take longer than expected. Balancing these risks, the fund has built a modest position, but I could see increasing it going forward.

Voss Capital shared their thesis on their newest position in Playa Hotels and Resorts (PLYA), the all-inclusive resort owner with key properties in Central America. Additionally, Voss updated their thoughts on Academy Sports and Outdoors (ASO) and ECN Capital (ECN), which is a company we also shared last week.

New Core Long: PLYA - Playa Hotels and Resorts

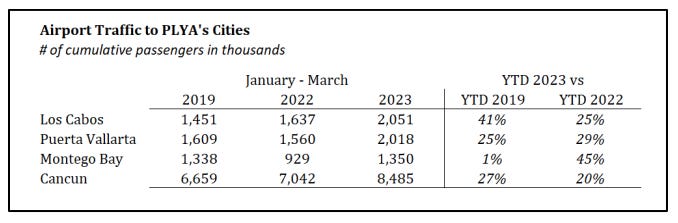

PLYA is the only publicly traded, all-inclusive resort owner-operator and has a portfolio of 25 all-inclusive resorts across Mexico, Jamaica, and the Dominican Republic. PLYA built its collection of resorts by acquiring properties from local family owner-operators. These acquisitions were then accompanied by strategic re-branding collaborations with renowned international chains such as Hyatt, Wyndham, and Hilton. Hotels brought under the umbrella of a large global brand benefit from increased consumer awareness, access to the brand's loyalty member network, and increased negotiating power with the online travel agencies (OTAs), driving higher margins. In 2018, the company presented what appeared to be a credible path to $300 million in EBITDA by 2021, which included multiple highROI projects that were set to be delivered at the end of 2019 and start generating significant cash flow in 2020. However, the COVID restrictions beginning in March 2020 forced the shutdown of all PLYA's resorts, reducing occupancy to 0% and delaying their path to $300 million. Earlier this year, we bought PLYA at the same enterprise value that it had in 2018 (~$2 billion). This was a bargain price considering the investments made back in 2018 and 2019 have begun to bear fruit and the additional tailwind of a boom in consumer travel to start 2023, which has particularly skewed toward Mexico and PLYA’s budget friendly, all-inclusive resorts. Airport traffic numbers for some of PLYA's most important locations (Los Cabos, Puerta Vallarta, Montego Bay, and Cancun - together accounting for 68% of total rooms) show strong passenger traffic growth compared to the same period in 2019 and 2022.

Management is being proactive in creating value for shareholders by exploring sale opportunities for the lower to mid-tier assets (presumably at valuations above the stock's current valuation in the public market) with the goal of buying back stock. We also love that they added scales to all the bathrooms to cut down on food costs. Our base case assumes an 11x 2023 EBITDA multiple on $288 million EBITDA (adjusted for the $13 million drag from two resorts being sold) for a $3.1 billion EV. With $783 million in net debt, our price target is $15.20/share, 70% upside from the current price of ~$8.90 per share as of the date of this letter.

Update on Long: ASO - Academy Sports and Outdoors

ASO is a sports and outdoor retailer based in Houston, TX, with 268 locations across 18 states. ASO is concentrated in the south and southeast, which contain many of the fastest growing markets in the country in terms of both population and labor force. Of ASO’s current footprint, 40% of stores are in Texas with another 40% spread across Florida, Georgia, Alabama, North Carolina, South Carolina, Arkansas, Oklahoma, and Tennessee – all states in the top 20 for net migration since 2020. ASO recently hosted an investor day where they presented their plan to reach $10 billion in revenue, 13.5% operating margins, and 10% net margins by 2027, with a 30% ROIC. This plan includes 120 - 140 new store openings and 3% average same-store sales for existing stores. The company emphasized that these targets were calculated with the assumption that there may be a recession in 2023 or 2024. While there are typically a lot of risks associated with a retailer or restaurant expanding into new markets that aren't familiar with the brand, we believe ASO has a good track record of doing this successfully and profitably. 7 All ASO's stores are profitable6, including stores that are the only Academy location in the state such as in West Virginia, Virginia, or Illinois. In fact, ASO's stores are so profitable that even its worst quartile of stores generates the same amount of operating income ($2 million EBIT per location) as its largest competitor's average store.

Two of ASO’s three distribution centers are currently operating at only 50% of capacity, giving them plenty of space to grow into with lower incremental capital needs. If the company executes on its guidance, it will generate $3.5 billion in free cash flow cumulatively from 2023 - 2027. Given this FCF build (assuming no buybacks or dividends), ASO's enterprise value in 2027 (at the current stock price) would be $1.8 billion or 1.1x 2027 EBIT. The 75th percentile of ASO's retail peer group trades at 14.5x FY2 EBIT. Achieving these targets over the next four years would cement ASO among the best-in-class public retailers, coming in above the 90th percentile in value-driving metrics including revenue growth, margins, and ROIC. However, even if ASO is valued at just the current median EV/EBIT multiple of the peer group (8.5x) in 2026, it would result in an enterprise value of $11.5 billion. If one adds on the estimated $3.2 billion in net cash in 2027, this will equate to an equity value of $14.7 billion or $184/share, 207% upside from today's price of ~$60/share or a 45% 3-year CAGR. This assumes the management team can more or less hit the targets they laid out at their 2023 investor day in April--but should they whiff, there could be a downside buffer (or further upside) if there is any value-additive capital allocation along the way.

Significantly Upsized Core Long: ECN Capital (ECN CN)

ECN is a financial services company that primarily originates loans on behalf of its customers. ECN's customers include banks, credit unions, insurance companies, and other institutional investors. ECN generates revenue from loan origination fees as well as recurring loan servicing fees on most loans originated, with the underlying credit performance being non-recourse to ECN. ECN operates through two segments. The first, Triad, originates and services loans in the manufactured housing (MH) industry. Triad is the second largest manufactured home loan originator in the US and will likely generate over $1.5B of manufactured home loans in 2023 per their estimates8 (Berkshire Hathaway's 21st Mortgage is #1 in terms of market share). Although there may be some uncertainty on manufactured housing volumes in 2023, we believe Triad is positioned to maintain strong long-term growth. Manufactured housing provides the most affordable housing option for many people amidst a broad and growing housing affordability crisis across the country. By way of comparison, the average rent for a 2-bedroom apartment is $1,332/month versus Triad’s average customer’s mortgage payment of $829/month9. We feel MH’s strong value proposition will increase demand for manufactured homes in the years to come. In addition to benefiting from industry tailwinds, Triad has been successful in broadening the menu of loans they are able to originate. Triad’s historical core loan product has been super prime (high FICO score) chattel, or property only loans. Over the last few years, Triad has been able to grow related loan originations for Land+Home loans, manufactured home rental loans, and lower FICO score loans (their “Bronze” and “Silver” programs). Triad was able to originate about 27% of its total loans from these related products in 2022, up from only 4% in 2019. We believe the potent mix of industry shipment tailwinds, Triad’s ability to take market share in core chattel loans, and their growth through a broadening of loan products offered to lending partners will continue to drive a high revenue growth rate while enjoying strong operating margins in the high 30s range. The second business unit operates under the IFG & Source One banners and originates and services loans in the RV & Marine industry. The businesses in this unit were acquired by ECN in 2021 and 2022 when management saw an opportunity to develop and scale another niche origination platform in the RV & Marine industry, using the expertise they gained from Triad and previously owned Service Finance (home improvement loans) operations. We expect the RV & Marine business to originate about $1.3B in loans for its customers in 2023. IFG & Source One were each regional lenders that are currently in the process of rolling out operations nationally under ECN's ownership. For instance, three years ago Source One was not operating any meaningful business in California, Florida, or New York, despite these three states accounting for about 22% of the total RV & Boat sales in the US. Source One has since worked to secure licenses to expand their operations across the country which we believe will lead to an exceptional CAGR over the coming years as the business continues to expand geographically. ECN has recently developed a related product for its funding partners in the form of inventory financing loans ("IF"). These loans help manufactured home dealers, boat dealers, and RV dealers fund the inventory they keep on site as part of their ongoing operations. ECN’s “IF” loans have historically had extremely low losses and currently generate a very attractive earnings yield compared to their risk profile. As such, we believe these are attractive loans for ECN's lending partners to own. ECN is projected to start to meaningfully originate and “flow” these loans to their lending partners in the coming quarters and years. In conjunction with this new product, ECN has kept a fair amount of these loans on their balance sheet, given the attractive economics. ECN borrows against the inventory loans it owns and thus earns a spread between the interest received and the interest paid (both assets and liabilities have variable interest rates). This practice has caused some consternation amongst the investment community (especially given the recent focus on credit amidst rising interest rates and ongoing panic over recession). Our view is that these inventory financing loans will continue to be low risk loans as they have been for many years (<5 bps of cumulative net charge offs over the last three years)—the fact that ECN holds some amount on their balance sheet does not pose an existential risk to the business.

We may have buried the lede here, but the kicker is that the Company has received unsolicited inbound interests and therefore hired Goldman Sachs and initiated a formal Strategic Review process. While our team is unsure what exactly will come of this review as many similar processes are failing to land buyers lately, we do believe that ECN would be a phenomenal business to own for an institutional investor with long duration liabilities that could retain the loans that ECN originates on their own balance sheet. ECN’s broad and long-standing relationships with manufactured home, RV, and marine dealers across the country is an asset that would be difficult and costly to replicate. ECN's management has been involved in many specialty finance transactions over the years and we believe they understand the significant strategic value of the underwriting platform. If there is a deal to be done, we are confident they will ensure an appropriate value is received.

If there is a full buyout of ECN, we think it could be around CAD$4.50/share. The components of this value are CAD$4.30/share for Triad at 14.0x 2023 operating income and CAD$1.60/share for Marine and RV at 12.0x 2023 operating income. These values are netted against capitalized corporate expense and net debt & preferred stock of CAD$1.40/share. If there is no buyout, we think ECN will enjoy strong earnings growth in the years ahead, and at current prices we don't believe the market appreciates this potential growth. Voss has acquired ~13% of the company and it is currently a ~9% position in the Voss Value Master Fund as of today.

We finish this week’s issue by heading abroad. Palm Harbour Capital details why they own Telekom Austria (TKA-VIE), a leading Austrian telecommunications provider. Will the spin-off of their tower business unlock value for shareholders?

Telekom Austria (TKA AV)

The combination of a defensive business model, growing free cashflow and low leverage creates a particularly attractive investment thesis around Austria’s largest telecommunications provider. Additionally, the spin-off of its tower assets is expected to unlock value and potentially allow them to re-lever with a special dividend or M&A.

Telekom Austria (TKA) is a leading Austrian telecommunication provider with growing business in Central and Eastern Europe. The company splits operations geographically with Austria representing 55% of sales, followed by Bulgaria (13%), Croatia (9%), Belarus (9%), Serbia (7%), Slovenia (4%) and North Macedonia (3%). TKA operates in oligopolistic markets being the incumbent in Austria and number two or three in all other jurisdictions. While telcos are perceived as mature businesses, TKA has managed to grow top line at 2.7% pa over the last five years mainly due to the growth of its international activities, which benefit from price increases, a post-covid recovery, convergence, and rising penetration rates. Moreover, the group is not suffering from changes in consumer behavior or increased churn, and it continues to benefit from strong demand for highbandwidth products and successful upselling.

TKA has more pricing power than most European peers, with inflation-linked tariffs in the two key jurisdictions, Austria and Bulgaria, and price increases in most other markets, protecting profitability in a particularly challenging macro environment. Simultaneously, the ongoing restructuring program combined with the main shareholder’s focus on financial performance has already borne fruit with the EBITDA margin increasing from 32.5% in 2016 to 36.7% in 2022 to grow EBITDA at 5.0% per annum over the last five years. Finally, the lowly-levered balance sheet (<1.0x excluding leases) offers ample space for management to execute a 5G and fiber investment program without adding debt risk. It is worth noting that the United Group, the main competitor in Bulgaria, Croatia, Slovenia and Serbia has a similar investment program but it is 5.0x levered.

The most interesting part of the story is the announced spin-off of the tower business and its listing on the Vienna stock exchange. While public markets are unlikely to pay recent private market multiples for this business, publicly traded peers are still highly appreciated by the market. Apart from the value recognition of the tower company asset, currently ignored by the market, the spin-off is expected to benefit the thesis in multiple ways. As an independent entity, the tower company could expand its strategy by signing agreements with other telecom operators and tower companies, hence increasing the tenancy ratio, which is the main driver of profitability. Moreover, TKA will transfer approximately 50% of their leases and we estimate 200-250 million of financial debt to the tower company, reducing lease (IFRS 16) and financial debt and their linked lease and interest expense cash outflows.

Exposure to Belarus, roughly 10% of the business, weighs negatively on investor sentiment. Thus far they have been able to extract dividends and the currency has been remarkably stable, however this could change at any time. Even in the most pessimistic scenario, the thesis remains attractive. Low liquidity of the share and the required investment in 5G and fiber are probably two other reasons for the discount. We don’t see them as a concern since the first has nothing to do with the value of the company and the second is a market-wide trend which probably affects the levered peers more. The major shareholders have already agreed to a capital expenditure plan so the risk that the government forces uneconomic 5G/fiber rollout is limited.

Excluding any value realization from the tower business divestment, we estimate that Telekom Austria trades at a 12% free cash flow yield, which for a stable and growing business with improving margins should be considered a bargain. Although the details of the spin-off haven’t been released yet, the tower company should add an extra €2.5- 3.0 per share value to our thesis. The spin-off is also expected to further reduce leverage, which could give room for a special dividend. Overall, we see this as a classic value play with an interesting upside potential without taking significant risk.

Until next time! - EP