EP112: Compounders on Sale in Life Sciences, Semis, and More

Stock Ideas From Investment Professionals

Welcome, subscribers!

It’s the start of a new quarter, and we’re digging into the latest investor letters to surface the best stock ideas from top allocators.

This week, we explore misunderstood compounders, regulatory shakeups, and consumer brands trading at pessimism-fueled lows. With themes like M&A optionality, tariff clarity, and industry leadership throughout, the common thread is clear: high-quality assets mispriced by short-term noise.

If you enjoy surfacing high-quality businesses during moments of dislocation, forward this to a fellow investor. 📬

We’re excited to share 6 new stock ideas, including:

• A leading life sciences tools platform trading at a trough multiple, with strong free cash flow and strategic takeout appeal once academic budgets stabilize.

• A dominant Chinese chip equipment maker gaining rapid domestic share while its U.S. listing trades at a steep discount to its own Shanghai stock.

• An essential drug delivery partner to top pharma companies, mispriced after temporary headwinds and ready to benefit from biologics and GLP-1 growth.

• A high-performance footwear brand with cult followings in both fashion and fitness, trading near cycle lows despite long-term brand momentum.

• A global mobility platform leveraging data scale, dynamic pricing, and a sticky ecosystem—mispriced due to exaggerated fears over autonomy.

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

Headwaters Capital started a new position in Bio-Techne (TECH), a high-quality life sciences platform trading at its lowest valuation since 2017. With growth set to reaccelerate in FY’27 and strategic interest likely, this looks like a rare chance to own a coveted asset at a trough multiple.

Bio-Techne: Coveted Life Sciences Asset On Sale Due to Academic Pressures

Summary Thesis:

1) Market leading life sciences reagents and instrument company. Recurring consumable revenue, strong profit margins, healthy free cash flow and a net cash position.

2) Concern around US academic funding is weighing on shares of TECH, pressuring the stock to its lowest valuation since 2017.

3) Revenue growth rate inflecting higher in FY ’27 (6/30 FYE) as Company laps one-time NIH budget reset and growth assets propel consolidated revenue.

4) Coveted asset as evidenced by recent M&A transactions, which supports a significantly higher valuation than implied by current share price.

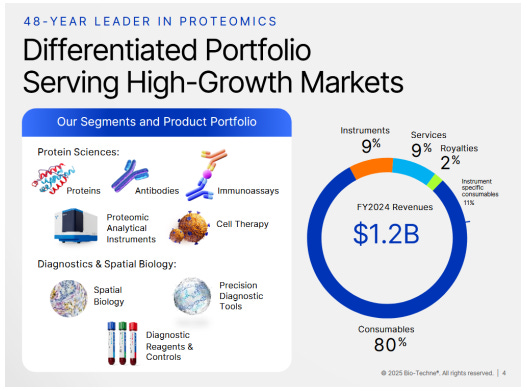

Bio-Techne (“TECH”) develops, manufactures and sells life science reagents, instruments and services for the research, pharmaceutical, diagnostics and bioprocessing markets worldwide. Founded in 1976 as Research and Diagnostic Systems, the company IPO’d in 1985 when it merged with Techne Corporation. TECH has been a leader in manufacturing high-quality antibodies and proteins used in life sciences research. The Company also manufactures instruments that utilize these reagents, creating a razor/razor blade model. In 2013, the Company embarked on a strategy to accelerate revenue growth by utilizing cash flow from its Protein Sciences business to acquire higher growth products leveraged to its existing customer base. Today, 80% of the company’s revenues are consummables, driving highly recurring revenue for the company. Customer concentration is minimal given TECH’s broad product and customer base. Today, the Company operates in two segments: Protein Sciences and Diagnostics & Genomics.

Protein Sciences – TECH’s Crown Jewel

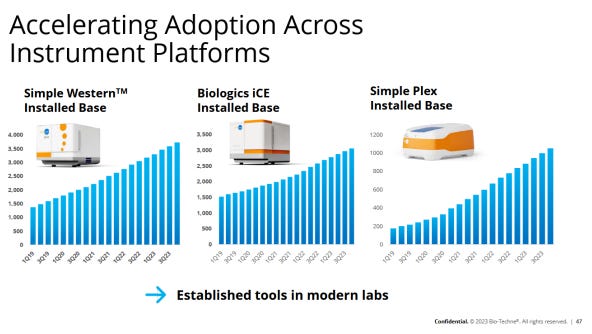

Protein Sciences represents the original TECH business that sells reagents and instruments into research and diagnostics markets. Key customers in this segment include research institutions, biopharma, pharma and diagnostics companies. TECH’s proteins and antibodies are widely used in academic research, which in addition to patent and trademark protection, provides important validation for the quality of the products. Academic citations also serve as a strong marketing tool for TECH’s products and help to drive future sales. On the equipment side, TECH’s growing installed base of instruments provides visibility into ongoing utilization of TECH’s products.

More recently, TECH has broadened its customer base and now sells GMP grade proteins that are utilized in the production of cell and gene therapies (“C>”), both in clinical trials and FDA approved commercial products. The C> business represents a growth opportunity for the segment as clinical trial customers (85 today) ultimately convert to commercial customers (4 today). The core reagents and instruments business has historically grown at mid to high single digit rate as ongoing innovation in drug discovery and development has fueled strong demand for TECH’s products. While comprising only ~11% of Protein Sciences revenue today, TECH’s emerging C> business is projected to sustain its +20% growth rate over the next few years, supporting ongoing growth for this segment. Gross margins for the Protein Sciences segment are ~75% and the business generates an impressive 45% operating margin. The Protein Sciences segment accounts for ~70% of TECH’s revenue and 95% of consolidated operating income. This is the crown jewel of Bio-Techne.

Diagnostics and Genomics – TECH’s Venture Capital Portfolio

TECH’s Diagnostics and Genomics business represents a collection of assets that have been acquired since the 2013 strategy shift. Many of these businesses are small and each one specializes in niche diagnostic and research markets. Key areas of focus include spatial biology, liquid biopsy, molecular diagnostics and diagnostic reagents. Understanding each of these businesses in detail is very difficult as the science is beyond my comprehension. Instead, I think of this segment as the venture capital portfolio of TECH. Each of these businesses represents a call option for a potentially significant business. Given the small size of each company in this segment, it is difficult to underwrite significant value from any individual asset today. Given that many of the businesses in this segment are emerging and require significant marketing and R&D, operating margins for this segment are depressed at ~7%. While not a meaningful source of earnings today, there is significant potential from this portfolio via operating leverage and a focus by management on margin improvement. I trust that TECH is appropriately sizing its bets in these markets and that the portfolio will ultimately deliver shareholder value.

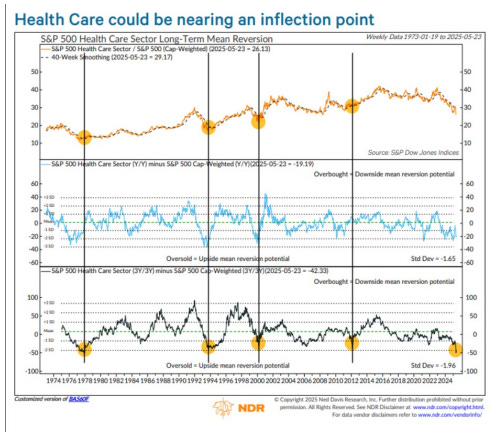

Investment Opportunity – Customer Budget Concerns

TECH’s stock has been hit hard by concerns around cuts to NIH/NSF funding, which will have a direct impact on the 12% of TECH’s revs that are generated from US academic customers. As proposed today, the 2026 fiscal budget would cut the NIH budget by 40%. TECH’s revenues should be less exposed to the full 40% cut for a myriad of reasons (less indirect cost exposure, consummables focus, priority funding areas, etc), but this figure is a good baseline to run sensitivity analysis around NIH exposure. TECH also has risks related to China revenue (8% of revs) and general uncertainty around pharma and biopharma spending. No matter how you slice it, it’s hard to envision TECH generating significant revenue growth in FY ’26 (6/30/26 YE). This uncertainty has weighed on not only TECH’s stock, but also the broader healthcare sector and life sciences tools industry. While the chart below illustrates Healthcare’s underperformance for large caps, the same dynamic is occurring in small caps.

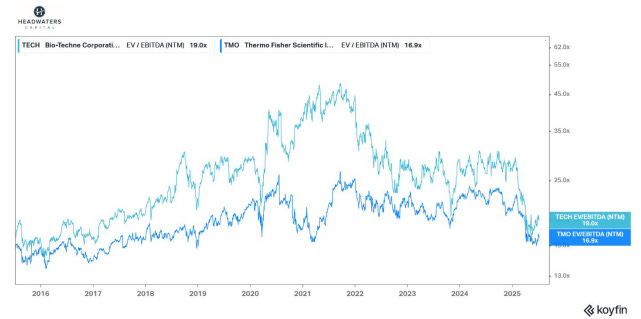

As a result of the pressure on the healthcare sector broadly as well as specific risks to TECH’s revenues, the Company’s shares traded down to a multiple not seen since 2017. While the absolute multiple by itself is likely at or near a floor, it was interesting that TECH’s multiple also approached that of Thermo Fisher (“TMO”). TMO has always been considered a natural acquirer given that TECH already has a commercial distribution agreement with Thermo in its Protein Sciences segment. Additionally, TECH’s CEO, CFO and President of Protein Sciences all held previous roles at TMO. As can be seen below, TECH’s shares have historically traded at a premium to TMO given faster revenue growth rates and an embedded take-out premium (from TMO or any other larger cap player). This provides some comfort that shares of TECH are likely at or near a trough valuation.

Financial Outlook and Valuation

It's reasonable to assume that TECH’s revenue in FY ’26 will probably be flat with FY’25 as pressure on US academic revenue is offset by growth in C> and other smaller growth assets. Margins can likely be maintained in ’26 as margin compression in Protein Sciences is offset by improvement in Diagnostics. More importantly, FY ‘26 is likely to represent trough earnings for TECH. Once the Company digests the one-time reset of the NIH budget cuts, growth assets should support consolidated revenue growth in 2027. Additionally, TECH will continue to generate strong free cash flow during FY ’26 and, absent M&A, will operate in a net cash position within the next year. TECH is unquestionably one of the highest quality assets in the life sciences space and it appears that we are buying this A+ asset at a trough multiple on trough earnings. Investors may need to wait 12 months for the market to recognize that earnings are inflecting in 2027, but this is exactly the type of market inefficiency that the Headwaters Capital portfolio seeks to exploit via a patient and elongated investment time horizon. Management believes the business will return to long-term double-digit revenue growth after next year and margin expansion should support mid-teens earnings growth. Given the scarcity of this asset and strong growth and margin profile, TECH will likely trade at a 20-25x EBITDA multiple once growth resumes. Using a 20x multiple on my 2027 EBITDA forecast yields a price target of $64, or +27% upside from the $50 average purchase price. 25x yields a $78 price target or +57% upside.

M&A Value

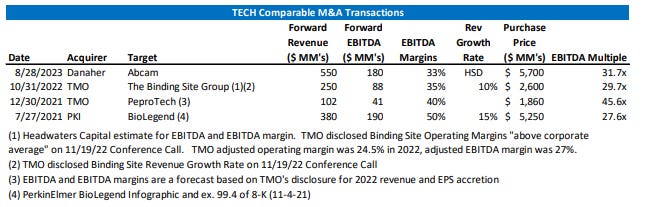

Readers may notice that TECH’s Protein Sciences segment is similar to a previous Headwaters Capital investment, Abcam, which was ultimately acquired by Danaher. I was initially attracted to Abcam through research I had done on TECH years ago. I always admired TECH’s protein sciences business, but I could never get comfortable with BioTechne’s valuation which seemed to assign excessive value for its portfolio of smaller growth businesses. At today’s multiple, investors don’t need to ascribe any value to these growth businesses as the Protein Sciences segment itself is trading at a discount to recent transactions. Using comparable transactions in the antibody and protein space, we can see that there has been substantial M&A interest in peers over the last few years. A 30x EBITDA multiple on trough 2026 earnings would yield a price target of $82, or +64% upside. I sincerely hope that TECH would not sell the Company based on 2026 earnings, but it’s a useful sanity check on the true value of the Company.

We have 5 more stock ideas waiting for our paid subscribers, each one pulled straight from the portfolios of professional investors.

If you're still on the fence, ask yourself: How much is missing out on high-conviction ideas really costing you?

Still hesitant? Try getting your employer to cover it. Many of our subscribers do. Here’s a simple script you can use.

Hi [Manager’s Name],

I’d love to expense a subscription to Elevator Pitches, a newsletter that curates the best stock ideas from professional investor letters. It provides high-quality insights that help identify overlooked opportunities and special situations.

Here are two examples (here and here) of the types of posts they deliver each week. With a paid subscription, I’d gain access to every stock write-up they uncover.

Since Elevator Pitches serves as an educational and research resource, I was hoping it could be expensed through [Company Name]. The cost is just $90 for the entire year, which is a great value given the depth of insights provided.

Let me know if this is possible—thanks for your time and consideration!

Best,

[Your Name]