Welcome, subscribers!

This week’s issue highlights several asymmetric setups across real estate, payments, consumer, and aerospace, plus a candid letter from a long-time investor pushing for change at a misunderstood platform business.

We’re happy to share 6 new ideas in this issue, including:

A durable logistics REIT with irreplaceable assets in coastal markets trading below replacement cost

A cross-border payments platform treated like a declining niche player, despite strong execution, expanding verticals, and signs of a narrative reset

A viral consumer products company defying tariff headlines with pricing power, international growth, and a steady stream of social media–fueled launches

A pharmaceutical leader in a generational healthcare trend

An aerospace aftermarket specialist shedding its legacy lessor label, with a capital-light growth engine and strong network effects hiding beneath a short-term overreaction

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

Silver Beech sees a rare opportunity emerging in logistics real estate, a sector typically too efficient for their return thresholds. But a unique mix of constrained supply, mispriced tariff fears, and undervalued assets has opened the door to an investment in First Industrial Realty Trust (FR), offering compelling upside with resilient downside protection.

First Industrial Realty Trust (NYSE: “FR”)

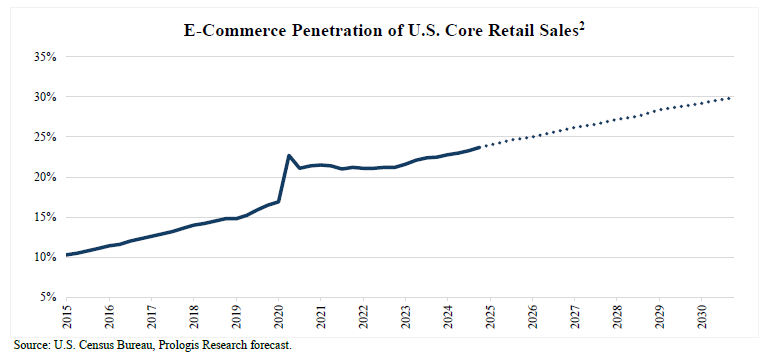

For over a decade, the logistics real estate sector has been a top-performing asset class, powered by profound and durable shifts in the American economy. Logistics properties, which are essential for storing, sorting, and delivering goods, form a mission-critical component of the modern supply chain. This importance has fueled strong, long-term demand driven by the structural rise of e-commerce and, to a lesser extent, the reindustrialization of certain U.S. manufacturing sectors.

This sustained demand has given property owners significant pricing power, with logistics rents growing at a ~7% compound annual growth rate (CAGR), approximately doubling since 2015. Because rent typically accounts for only 3%-6% of a tenant's total supply chain costs, landlords have an outsized ability to increase rents, capturing a large share of the productivity gains from automation and other efficiencies. The continued consumer demand for faster delivery, evidenced by a 65% year-over-year increase in Amazon Prime's same-day and overnight deliveries in 2024, ensures that demand for well-located logistics space remains robust.

Real estate investment trusts (REITs) typically fail to clear Silver Beech's high return thresholds, due to their investor’s lower cost of capital, however, we believe a unique convergence of factors has created a compelling, downside-oriented exception in the logistics sector. The opportunity is rooted in a prohibitive construction environment; a combination of high interest rates and elevated materials and labor costs has pushed “replacement rent”—the rent required to earn economic returns on new projects—approximately 15% above current market rents.

This challenging cost environment has led to a sharp drop in new construction. As a result, the pipeline of new supply projected to be delivered in 2025 and 2026 is muted at over 60% below peak deliveries in 2022, levels not seen since 2018. This supply-side limitation provides strong support for continued rent growth, as market rents must inevitably converge with the higher replacement cost rents.

Compounding this opportunity are recent tariff-driven fears that have temporarily depressed the valuations of public industrial REITs. We believe these tariff-driven fears are misguided because any incremental reindustrialization or reshoring of American manufacturing caused by tariffs will generate demand for space, not just for the manufacturing space itself, but the “3-5x multiplier effect2” new manufacturing facilities have on incremental demand for space from upstream and downstream suppliers and distributors required to service new manufacturing facilities. An acceleration of American reindustrialization portends well for industrial real estate demand. This backdrop, where structural demand collides with a period of limited new supply, is an ideal entry point for an opportunistic investment in the sector.

The interior of a state-of-the-art logistics facility.

To capitalize on these market dynamics, we invested in First Industrial Realty Trust (NYSE: “FR”), a U.S.-only, internally-managed, mid-capitalization REIT. First Industrial owns 424 logistics properties totaling approximately 70 million square feet in 15 markets, concentrated in supply-constrained coastal markets such as Southern California, South Florida, and New York. The company is durable: (i) its properties are the youngest among its publicly traded peers, with an average vintage of 2005; (ii) its properties feature a high average clear height of 31 feet, which is important for modern tenants who require higher clear heights to optimally stack goods for vertical efficiency; and (iii), beyond its existing assets, First Industrial possesses an enviable in-the-money land bank of approximately 1,000 acres in attractive markets that can be used develop an additional 16 million square feet.

We expect the large spread between First Industrial’s in-place and market rents will continue to drive strong growth in same-store net operating income (SSNOI), a real estate metric akin to EBITDA, even as re-leasing spreads tighten from highs in 2023 and 2024. Over the next five years, we project a ~7% CAGR in First Industrial’s SSNOI, which will drive an even stronger ~9% CAGR in free cash flow per unit over the same period.

At its current price, we believe First Industrial trades below replacement cost and at an attractive valuation of a 6.5% cap rate (2025E) / 8%+ mark-to-market cap rate. This represents a large spread, over 20%, to where other high-quality public industrial REITs and comparable private market transactions are valued. Should the construction environment improve, management can also invest in its land bank to benefit from near-term supply constraints. First Industrial’s management team has a strong track record as a profitable developer.

We believe an investment in First Industrial today can defensively generate a 15% IRR over the next five years. We anticipate the majority of our projected return could be realized over the next two years, as the market looks past near-term tariff noise and focuses on the compelling supply/demand environment in 2026 and beyond. As core institutional capital returns to the market after years of redemption queues, we would not be surprised to see private markets and take-private activity that highlights the value embedded in First Industrial’s shares.

In an upside scenario, where First Industrial’s valuation normalizes against private and public peers within two years, and market rent growth accelerates due to the continued supply/demand imbalance, we project our investment can generate a 20%+ IRR. In a downside scenario, where valuations compress due to higher for longer interest rates, coupled with a cyclical softening in leasing demand, we project an ~8% IRR. Ultimately, we believe the pronounced upside/downside convexity of this investment in essential, class A logistics real estate is attractive in this market environment.

We have 5 more ideas for paid subscribers below.

If you're in the business of identifying underfollowed compounders before the crowd, access like this isn’t a perk. It’s your edge.

Most of our professional subscribers expense their subscription through their firm as part of research or education. You can too. Just copy and paste the email below to your manager:

Hi [Manager’s Name],

I’d love to expense a subscription to Elevator Pitches, a newsletter that curates the best stock ideas from professional investor letters. It provides high-quality insights that help identify overlooked opportunities and special situations.

Here are two examples (here and here) of the types of posts they deliver each week. With a paid subscription, I’d gain access to every stock write-up they uncover.

Since Elevator Pitches serves as an educational and research resource, I was hoping it could be expensed through [Company Name]. The cost is just $90 for the entire year, which is a great value given the depth of insights provided.

Let me know if this is possible—thanks for your time and consideration!

Best,

[Your Name]