Welcome, subscribers!

This week’s batch of investor letters uncovers eight compelling ideas — including an AI infrastructure play quietly taking share from a tech incumbent, a cash-rich e-commerce disruptor, and two biotech bargains trading below net cash. You'll also find hidden value in pawn lending, commercial real estate software, security hardware, and global facilities management. If you enjoy finding high-upside ideas before the crowd, share this with a fellow investor — or consider upgrading to unlock every pitch. 🔎📬

This week, we’re excited to share 8 unique stock ideas, including:

A networking infrastructure company quietly powering the AI boom — and taking serious market share from the industry's legacy giant.

A pair of beaten-down biotech names with massive cash cushions and hidden optionality, picked up during a sector-wide capitulation.

A founder-led e-commerce disruptor upending a mature industry with vertically integrated manufacturing and repeat purchase economics.

A commercial real estate tech platform under activist pressure to refocus and unlock years of pent-up EBITDA growth.

A defensive lender with high-margin, needs-based loans and a long runway for consolidation in the U.S. and Mexico.

A security hardware provider entrenched in non-residential markets, trading well below intrinsic value despite dominant market share.

A global facilities management leader recovering from self-inflicted wounds, with procurement advantages and deep family ownership.

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

Deep Sail Capital laid out a detailed long thesis on Arista Networks (ANET), a high-performance networking company steadily taking share from legacy giant Cisco. With tailwinds from AI infrastructure and cloud data growth, Deep Sail projects a 25%+ IRR over the next 3 years.

Arista Networks is a prominent player in the cloud networking sector, specializing in highperformance switching and routing solutions tailored for data centers, campus environments, and AI-driven infrastructures. At the core of Arista Networks is Ethernet, which, as you all probably know, is the standard networking architecture for the internet. But for data centers and AI networking, there are two competing network architectures: Ethernet and InfiniBand (which is Nvidia’s proprietary offering that they acquired through the Mellanox acquisition). Understanding the network architecture landscape is important to understanding where Arista fits into the broader AI landscape.

The company's growth is fueled by the increasing demand for scalable, low-latency networking solutions, particularly as enterprises and cloud providers expand their AI and machine learning capabilities. Arista's emphasis on software-driven networking, automation, and security positions it advantageously. While the CEO of Arista is not created as a founder but rather a founding executive, two of the original founders, Andy Bechtolsheim and Kenneth Duda, are still involved as the chairman/chief architect and CTO, respectively. Due to this, I consider the company founder led.

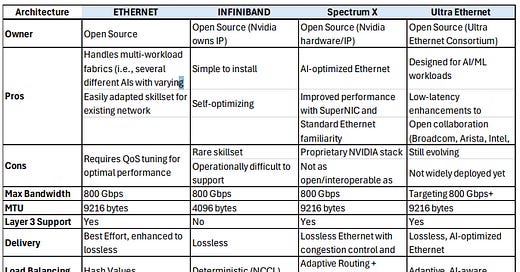

Ethernet vs InfiniBand vs Spectrum X vs Ultra Ethernet

Arista Networks' Ethernet and NVIDIA's InfiniBand represent two distinct approaches to AI data center networking, each with unique advantages, but the networking landscape is continually evolving. NVIDIA's InfiniBand offers ultra-low latency and high throughput, making it ideal for tightly coupled AI training workloads, but it is not necessary for general datacenter needs or running AI workloads post training. InfiniBand’s architecture ensures synchronized data flow across GPUs, minimizing idle times during complex computations. This has led to InfiniBand's dominance in large-scale AI training clusters, with approximately 90% of such deployments utilizing this technology. Jenson Huang summarized this important point: “AI only cares about the last student to turn in their partial product.” This means that high utilization and high accuracy are of utmost importance during AI training, which is where InfiniBand excels.

While InfiniBand is more useful in AI training, Arista Ethernet focuses on scalability and costeffectiveness. With advancements like RDMA over Converged Ethernet (RoCE), Arista's Ethernet solutions have significantly improved in performance over the years. Arista’s Etherlink AI platform incorporates dynamic load balancing and congestion control, catering to the demands of AI workloads. While Ethernet may have slightly higher latency compared to InfiniBand, its widespread adoption and flexibility make it a compelling choice for many data centers.

On top of these two current architectures, two more ethernet architectures are being developed in the near term, Nvidia’s Spectrum X and Ultra Ethernet.

Arista is a major backer of the Ultra Ethernet Consortium, a group of companies including Broadcom, Cisco, Meta, and others. Ultra Ethernet is the next generation of Ethernet architecture, including new hardware and a full protocol stack, with the focus to “deliver an Ethernet-based open, interoperable, high-performance, full-communications stack architecture to meet the growing network demands of AI & HPC at scale.” Ultra Ethernet is slated to be fully available and deployable in late 2025 and early 2026, which Arista is anticipating adopting.

Spectrum-X, already available in the market, competes directly with Ultra Ethernet as both target the growing demand for AI data center networking. Built on technology acquired through NVIDIA’s Mellanox acquisition, Spectrum-X is tightly integrated with NVIDIA’s AI stack, offering performance tuned specifically for its ecosystem. However, this integration comes with trade-offs: it locks customers into NVIDIA’s proprietary environment and tends to be more expensive. Despite the competitive pressure from NVIDIA, Arista continues to offer a more cost-effective solution that delivers comparable performance for most data center workloads, making it an attractive alternative for organizations seeking flexibility and lower total cost of ownership.

Now that we laid out the competitive landscape in networking, let’s talk about Arista’s business model.

High quality business model

On top of the open-source Ethernet architecture, Arista Networks employs its proprietary software, including their Extensible Operating System (EOS) and CloudVision platform, to deliver high-performance, scalable, and programmable networking solutions tailored for modern data centers and AI-driven infrastructures. EOS is a highly programmable modular networking operating system at the core of running a data center network. EOS is the software layer of the network architecture that is the sticky part of the stack. CloudVision sits on top of the EOS software layer as a multi-domain management platform that delivers a zero-touch network operations product to clients. This allows corporations, universities, and government agencies to run large, complex data centers easily and manage across multiple locations to deliver consistent experiences for their users.

EOS and CloudVision are the core software components that differentiate the business, but the company also sells the hardware, including switches, routers, cabling, and other networking devices.

Arista's services revenue is their higher-margin business, with gross margins around 80% versus around 60% for their product revenues. The services business has been growing at a +30% revenue growth rate, driven in part by AI enterprise data center growth but also due to new offerings like network automation, security, and analytics.

From a competitive perspective, Arista is the relatively new company in the networking space. They compete with Cisco, HPE (via Aruba Networks), Juniper Networks, and Broadcom (via VMware), and most notably now Nvidia (via Mellanox). Nvidia competes with Arista mainly on the hyperscaler and AI networking front, while the others compete largely in traditional enterprise and campus sectors. Arista stands out from its competition due to its superior software architecture (EOS), its strategic focus on AI and hyperscale data centers, and its bestin-class hardware performance. Enterprises love Arista for their easy-to-deploy software and their deep technical engineering support. Overall, Arista has a very high net promoter score relative to their peers in almost every review website we checked online, including a 1st rank in every category on comparability.com (shown below).

Outstanding management

Arista Networks is run by CEO Jayshree Ullal, a founding executive, who continues to serve as president and CEO. Andy Bechtolsheim, Arista’s co-founder and Chief Development Officer, remains heavily engaged in product innovation and technology strategy, helping the company stay at the forefront of networking advances. The management team has been very successful at staying at the forefront of networking while maintaining a conservative balance sheet and prudent capital allocation strategy. The company has made a few small acquisitions over the last 8 years but generally focused internally for growth, spending 15% of revenues on R&D over the last 12 months. In software and technology, I prefer this strategy, as large acquisitions can take years to digest at this size and scale. The company has no long-term debt, and it has an ongoing share repurchase program that bought back $480 million in shares in the last year. Management has stated that they plan to continue to buy back shares as the main form of capital allocation, as the business is now in a place where it will generate significant free cash flow going forward.

Substantial long term growth prospects

Arista sits in a prominent position in the networking sector with many large tailwinds, including AI data center investment and the adoption of Ultra Ethernet. Their growth will be driven by the rapid expansion of AI-driven data centers and the increasing demand for highperformance networking solutions over the next 10 years.

The global AI data center market is projected to reach $100 billion by 2030, growing at a compound annual growth rate (CAGR) of 30% over the next five years. In the United States alone, the AI data center market is expected to grow at a CAGR of 25.3% from 2025 to 2030, with services being the fastest-growing segment.

Arista will not only benefit from the growing AI data center market but also by offering new and additional products to manage more complex data center environments.

Reasonable valuation

Arista's valuation has always been on the higher end of the companies that we follow. This is largely due to the growth and financial profile of the company (high gross margins, little need for reinvestment). Arista is currently trading at 24x NTM EBITDA and 31.4x NTM earnings. That seems expensive for even the best businesses, but with an 18% growth rate CAGR and a mid-20s ROIC, I believe over the next three years Arista will generate slightly above the rule of 40. Based on the current valuation, we project that over the next 3 years, Arista can generate an IRR of above 25% per annum.

7 more stock ideas are waiting, including what might be the most asymmetric small-cap setup I’ve read all year

Access to differentiated, overlooked opportunities isn’t just a nice-to-have. It’s an investment in better decision-making and better outcomes.

Many subscribers even get reimbursed through their employer as part of professional development.

Here's a ready-to-send script to make it easy:

Hi [Manager’s Name],

I’d love to expense a subscription to Elevator Pitches, a newsletter that curates the best stock ideas from professional investor letters. It provides high-quality insights that help identify overlooked opportunities and special situations.

Here are two examples (here and here) of the types of posts they deliver each week. With a paid subscription, I’d gain access to every stock write-up they uncover.

Since Elevator Pitches serves as an educational and research resource, I was hoping it could be expensed through [Company Name]. The cost is just $90 for the entire year, which is a great value given the depth of insights provided.

Let me know if this is possible—thanks for your time and consideration!

Best,

[Your Name]