EP106: 8 Fresh Stock Ideas from Industries You Can’t Ignore

Stock Ideas From Investment Professionals

Welcome, subscribers!

The latest wave of investor letters is packed with overlooked opportunities, from dominant suppliers in aerospace to stealth turnarounds in minerals and insurance. This week’s ideas cover essential industries like energy, travel, childcare, and semiconductors, all trading at compelling valuations with catalysts on deck. If you like finding quality before it gets priced in, forward this to a fellow investor. 📈

This week, we're happy to share 8 new stock ideas, including:

A turnaround story in essential minerals, where new leadership, debt paydown, and operational focus could unlock significant hidden value.

A dominant aerospace parts supplier quietly eating market share from larger OEMs, with a hyper-decentralized culture and a stellar regulatory track record.

A childcare solutions provider poised for a rebound as corporate return-to-office mandates drive increased demand across its network.

An insurer with a rare ten-year underwriting incentive structure, leading to superior returns and a fortress balance sheet that’s flying under the radar.

A global semiconductor equipment leader, monopolizing a critical technology node and benefiting from a massive fab construction boom.

A memory-focused semiconductor equipment specialist still trading near cyclical trough earnings, but positioned to surge as the cycle turns.

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

O’Keefe Stevens Advisory delivered a lengthy write-up on one of their newest positions, Compass Minerals (CMP). Compass’s primary business (83% of revenue) is salt (everything from table salt to highway deicing salt), but they also sell plant nutrition fertilizers, such as potash. We include an excerpt of their pitch below, but encourage you to read the whole thing.

Summary

Back to Basics will drive shareholder value. Distractions, operational challenges, missed filing deadlines, and misallocated capital resulted in substantial shareholder value destruction over the past several years. In January 2024, Edward Dowling was appointed as the new CEO, succeeding Kevin Crutchfield, who has held the position since May 2019. Under Kevin’s leadership, CMP’s stock declined by 57% (excluding dividends, which was cut in February 2024) due to poor capital allocation decisions, which are now being addressed by the new management team. With these distractions removed and focus restored to its core Salt operations, free cash flow generation will enable the company to reduce and refinance its debt. As leverage concerns ease, earnings inflect higher after a mild FY2024 winter and little precipitation in FQ1; the high-quality assets Compass owns will be drive higher earnings power.

Thesis

- Market is missing the $50m contract signed with Buffalo. In addition, investors are completely offside and are mismodeling normalized earnings power.

- Cost-cutting initiatives will improve margins as they exit their loss-making retardant business. Should the sulfate of potash (SOP) market remain soft, management may choose to exit this business, eliminating another loss-making business (simplifying the story even further).

- Historically poor free cash flow conversion improves due to lower capex.

- Working capital release will enable them to generate significant FCF, which can be used to pay down upcoming maturities.

Risks

- A weak pricing environment from mild winters has depressed salt pricing and volumes.

- Several misguided business initiatives resulted in significant capital destruction.

- A new, lower-cost salt mine is expected to come online in 2030, which could pressure pricing.

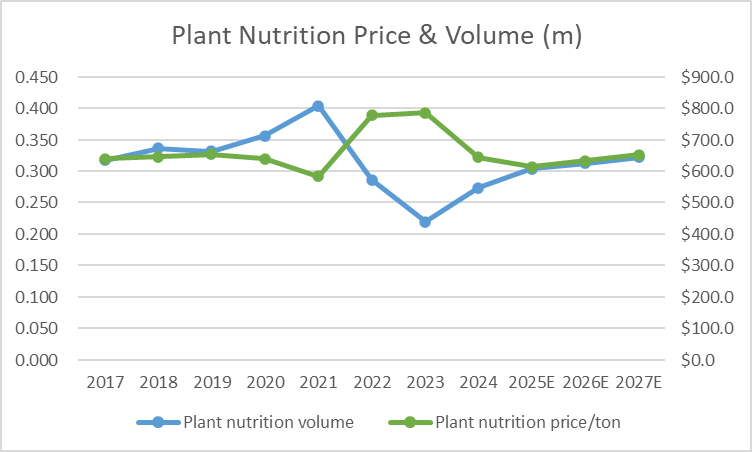

- The plant nutrition (SOP) market is experiencing weak prices, resulting in operating losses.

Business Overview

Compass Minerals is a leading producer of essential minerals, primarily focusing on salt and specialty plant nutrients. The company operates through two key business segments: Salt and Plant Nutrition (sulfate of potash). Compass Minerals has built a broad geographic footprint within these segments, with major production assets in North America and a presence in the United Kingdom and Brazil. This diversified asset base and product mix position the company as a critical supplier in its markets, serving customers ranging from municipal road agencies to agricultural growers.

Salt Segment: Accounting for 83% of the 2024 revenue. Producer of highway deicing salt, industrial salts, and consumer salts (such as table salt, water-softening pellets, and ice melt products). Their Goderich salt mine in Ontario, Canada, is the largest underground salt mine in the world. Goderich has an annual production capacity of up to 9m tons and is located on the shores of Lake Huron, enabling low-cost shipping via the Great Lakes to key markets in the U.S. and Canada. Their Cote Blanche mine in Louisiana has an annual production capacity of 3.4m tons. Cote Blanche serves the U.S. Gulf Coast and Midwest markets, with access to barge transportation on the Mississippi River system. Buffalo, Chicago, Cincinnati, Cleveland, Detroit, Milwaukee, Minneapolis, Pittsburgh, St. Louis, Montreal, and Toronto are the 11 primary markets Compass serves. Additionally, they operate a rock salt mine in Winsford, United Kingdom (Cheshire), to supply deicing salt to the U.K. market. Beyond these rock salt mines, Compass Minerals produces refined evaporated salt at Kansas, Saskatchewan, and Nova Scotia facilities. The company also manages an extensive network of storage depots and distribution points to ensure timely customer delivery. Customers include state and provincial transportation departments, municipalities, contractors, as well as industrial and consumer buyers, solidifying its market positioning as one of North America’s top salt suppliers.

Plant Nutrition Segment: The Plant Nutrition business focuses on high-value specialty fertilizers, primarily sulfate of potash (SOP). SOP is a potassium-rich fertilizer prized for its low-chloride content, which makes it ideal for sensitive crops such as fruits, vegetables, and nuts. Compass Minerals is the largest SOP producer in the Western Hemisphere. Its flagship operation is the solar evaporation facility at the Great Salt Lake in Utah, where the company harvests minerals from naturally occurring brine. At this site, Compass produces SOP under the Protassium+® brand with an annual capacity of approximately 350,000 tons. The Great Salt Lake facility also yields significant volumes of salt (around 1.5m tons capacity) and magnesium chloride as co-products. The Plant Nutrition segment once included a broader portfolio of micronutrients and specialty plant supplements, including operations in Brazil; however, in recent years, Compass Minerals has narrowed its focus. The company divested its micronutrient businesses by 2021 to streamline operations, and today, the segment is centered on SOP production and distribution. Compass markets its fertilizer products globally, selling SOP across North America (with an emphasis on the Western and Southeastern U.S. agricultural markets) and exporting to Latin America, Asia, and Oceania. Plant Nutrition represented 17% of 2024 revenue.

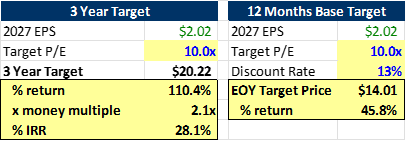

Due to the previously mentioned initiatives and events, I am currently well above consensus estimates. In Q3 2026, I expect them to repay $120m of debt and refinance the remaining term loans and debt facilities. Furthermore, declining energy and freight rates throughout Q1 are a tailwind for gross margins. Finally, in November 2024, Reuters reported that Compass was potentially in discussions with private equity to take the company private. Although nothing has materialized, this remains an additional source of upside, particularly in the context of a much cleaner story and reduced capex moving forward. Revenue & Earnings will see a rate of change acceleration in 3 of the next 4 quarters.

7 more stock ideas are waiting, carefully selected from the investor letters of top-performing funds.

Access to differentiated, overlooked opportunities isn’t just a nice-to-have. It’s an investment in better decision-making and better outcomes.

Many subscribers even get reimbursed through their employer as part of professional development.

Here's a ready-to-send script to make it easy:

Hi [Manager’s Name],

I’d love to expense a subscription to Elevator Pitches, a newsletter that curates the best stock ideas from professional investor letters. It provides high-quality insights that help identify overlooked opportunities and special situations.

Here are two examples (here and here) of the types of posts they deliver each week. With a paid subscription, I’d gain access to every stock write-up they uncover.

Since Elevator Pitches serves as an educational and research resource, I was hoping it could be expensed through [Company Name]. The cost is just $90 for the entire year, which is a great value given the depth of insights provided.

Let me know if this is possible—thanks for your time and consideration!

Best,

[Your Name]