EP105: Crisis Buys, Cruise Bets & a Data Center Sleeper

Stock Ideas From Investment Professionals

Welcome, subscribers!

Investor letters are rolling in with fresh ideas, some bold, some contrarian, and a few hiding in plain sight. This week’s lineup includes turnaround plays in healthcare, discounted compounders in HVAC and advertising, and industry leaders in travel, beer, and energy trading well below their potential. If you enjoy spotting inflection points early, forward this to a fellow investor. 📈

This week, we share 8 new stock ideas, including:

A U.S. healthcare provider rising from near-insolvency to profitability, thanks to a regulatory pivot and a string of high-stakes arbitration wins.

A misunderstood cruise operator with resilient demand and contrarian value appeal amid macro headwinds.

The world’s largest oilfield services firm, trading at a discount amid commodity cycle fears—just as national oil giants gear up for long-term projects.

A high-margin HVAC manufacturer gaining ground after a regulatory tailwind narrows the pricing gap with bigger competitors.

A niche player in data center cooling solutions, benefiting from chip-intensive infrastructure demand and a deep backlog.

A leading premium beer importer with iconic brands, now trading below peers despite long-term demographic tailwinds.

A recent European spinoff in the advertising space—oversold post-separation and now deeply undervalued relative to its stable cash flow and acquisition runway.

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

Forager Funds discussed Nutex Health (NUTX), an owner/operator of micro-hospitals that operate in areas underserved by traditional healthcare providers. The stock is up significantly YTD but Forager stills sees considerable upside with the shares trading at just ~14x 2025 earnings.

Despite a five-fold share price increase, this US micro cap is still a bargain. Sifting though the market's most unpopular stocks is fraught with danger. Explaining why you bought something everyone else thought was a dog isn't easy. And we have on the odd occasion purchased some dogs that we thought only had fleas but actually had terminal cancer. But among the beaten up is also where we have found some of our best Forager investments. Sometimes you get it right. Sometimes you get lucky. If you happen to get both, the upside can be enormous. We think we have that combination with Nutex Health (Nasdaq:NUTX).

This micro-cap US healthcare provider was first purchased in August 2024 and now sits among the portfolio’s largest positions. The Forager International Shares Fund acquired it during a period of turmoil, when the stock was priced for insolvency after falling some 99% from its 2022 peak. Today, it stands as one of the portfolio’s largest contributors, both for the quarter and over the past year.

Since listing via a backdoor merger in 2022, Nutex has faced significant challenges: falling insurance reimbursements, inconsistent shareholder communication, and two reverse stock splits just to maintain its NASDAQ listing. Despite that, a viable and increasingly valuable business has begun to emerge.

The model is straightforward in theory, though complex in execution. Nutex operates 24 micro-hospitals in suburban areas underserved by traditional healthcare infrastructure. It aims to offer faster service and more patient-friendly experiences, while focusing on the less complex (read more profitable) segments of emergency care. A major inflection point came with a structural shift in its reimbursement model. A Federal piece of legislation, the No Surprises Act (NSA), upended the reimbursement model, initially hitting Nutex hard.

The Act’s objective was to protect patients from large surprise medical bills where they had been treated outside their insurance company’s approved list of providers (“out-of-network”). While it achieved that objective, it also gave insurance companies cover to pay the hospitals substantially less than they were previously paid. Nutex’s revenue per patient dropped more than 30% and, in a relatively fixed-cost business, wiped out all of its profits.

By closing underperforming hospitals, renegotiating supplier contracts and performing an increasing proportion of high-value treatment in its own hospitals, Nutex had already taken steps towards a sustainable future. We had it pencilled to generate US$20 million of free cashflow in 2024, an attractive proposition relative to the US$70 million market capitalisation at the time of our first purchase. But there was an enormous amount of upside if Nutex could somehow return to prior levels of profitability. That “if” is becoming a reality.

Nutex and other healthcare providers have been in a battle with insurance companies to get what is argued to be their rightful payments ever since the legislation came into effect. Having exhausted the commercial options available to it, in July 2024 Nutex began pursuing claims through a binding federal arbitration process, a last resort included in the Act to protect providers.

Nutex has been submitting 60-70% of its patient visits to arbitration and disclosed a fourth-quarter success rate exceeding 80% on these claims. The payment awarded to it has ranged from 150% to 250% of the amount it initially received—an outcome with material financial implications. Importantly, these outcomes are consistent with the experience of other providers (the number of claims processed and awarded is in the hundred of thousands and publicly disclosed every six months).

Transformational outcomes

Following market close on 31 March, Nutex released an outstanding fourth-quarter result, far exceeding even optimistic expectations. The company booked $170 million in arbitration-related revenue—taking its total revenue to more than $3,000 per patient.

Most of the arbitration revenue remains uncollected (receivables rose to $232 million), but the cash should start flowing in the first quarter of this year. Margins remained strong despite substantial arbitration-related legal and processing costs, and full-year pre-tax profit attributable to shareholders reached $71 million.

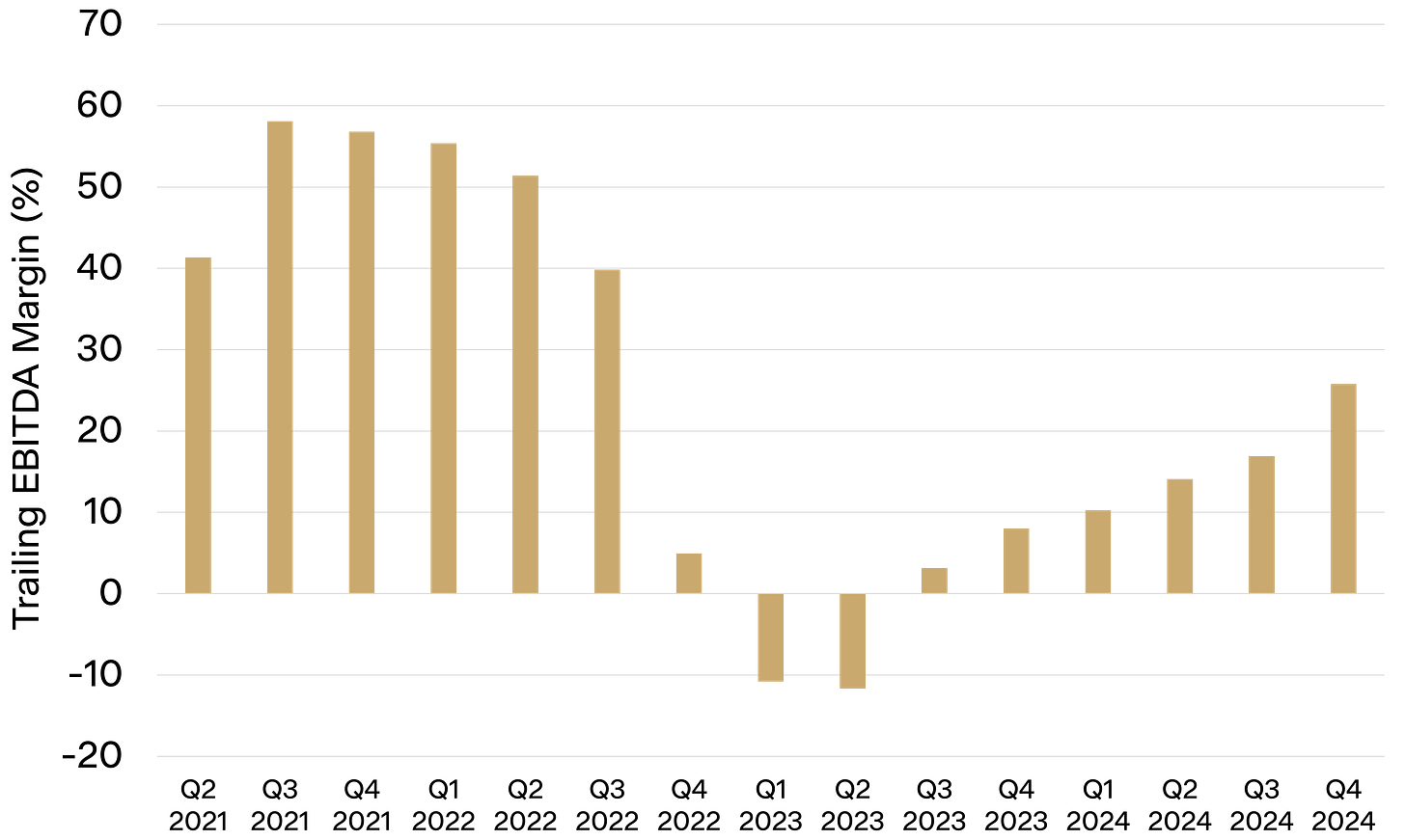

Source: Bloomberg, Nutex Health

*EBITDA is an abbreviation for Earnings before interest, taxes, depreciation and amortisation

Even after a fivefold share price increase since the Fund’s initial purchase—including a 50% rise post-result (after month-end)—the business continues to trade at a very attractive valuation. A market capitalisation of $388 million represents roughly four times the pre-tax earnings we expect it to make in 2025. Assuming a bit of catch up from last year, we expect it to have something like $100 million of net cash by this time next year.

It remains a high-risk investment. Arbitration rules could change. A single tweet from the White House could move the share price violently. New competition will emerge if margins persist.

But each passing quarter reveals a more profitable, scalable, business trading at what remains an attractive valuation. This is a business that has gone from loss-making to generating significant cash and has a nice organic growth plan, including four new hospitals in 2025. The market has yet to fully adjust.

We have 7 more stock ideas waiting for our paid subscribers. These picks come from straight from the portfolios of professional investors.

If you're still on the fence, ask yourself: How much is missing out on great ideas really costing me?

Still hesitant? Try getting your employer to cover it—here’s a simple script you can use.

Hi [Manager’s Name],

I’d love to expense a subscription to Elevator Pitches, a newsletter that curates the best stock ideas from professional investor letters. It provides high-quality insights that help identify overlooked opportunities and special situations.

Here are two examples (here and here) of the types of posts they deliver each week. With a paid subscription, I’d gain access to every stock write-up they uncover.

Since Elevator Pitches serves as an educational and research resource, I was hoping it could be expensed through [Company Name]. The cost is just $90 for the entire year, which is a great value given the depth of insights provided.

Let me know if this is possible—thanks for your time and consideration!

Best,

[Your Name]