EP102: Uncovering Value—Six Stocks with Game-Changing Potential

Stock Ideas From Investment Professionals

Welcome, subscribers!

We’re back with another set of compelling stock ideas—featuring market leaders in transition, high-growth disruptors, and deep-value plays with hidden upside. This week’s lineup spans fintech, industrials, defense, and software, offering something for every type of investor.

If you’re enjoying these insights, don’t keep them to yourself! Forward this email to a friend or colleague who appreciates high-quality stock ideas. The more, the merrier! 🚀

This week, we're happy to share 6 new stock ideas, including:

A company benefiting from the resurgence of ATM fees and digital payment growth

A high-growth business capitalizing on the shift from brick-and-mortar to online food and grocery delivery

A software firm driving the adoption of DevOps automation and cloud-native infrastructure

An industrial technology company with strong pricing power and expanding margins

A government contractor well-positioned for increased defense and infrastructure spending

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

Gemway discussed its position in Zomato (543320-IN), the leading food delivery company in India. Gemway walks through Zomato’s growth trajectory, competitive positioning, and future profitability potential. They highlight the company's strong market leadership, expanding customer base, and improving unit economics as key drivers of sustained growth.

Zomato is India’s leading restaurant aggregator and food delivery company.

It pioneered a restaurant search and discovery website and later developed a platform that connects customers, restaurants, and delivery partners. The company has launched Food Delivery business in 2015 and has since enjoyed the accelerated growth of Indian online food delivery market. It also operates a one-stop procurement solution Hyperpure, which supplies high quality ingredients and kitchen products to restaurant partners. Post its acquisition of Blinkit in 2022, the company has developed a major presence in quick commerce services (fast delivery for small orders of food and daily essentials) which competes with Kirana stores (unorganized mom and pop stores), as modern retail accounts for only 6-7% of the total retail spend. As of today, Zomato has built a vast network with 238,000 restaurants and 410,000 delivery partners in the Food Delivery business and a presence in 24 cities for Blinkit.

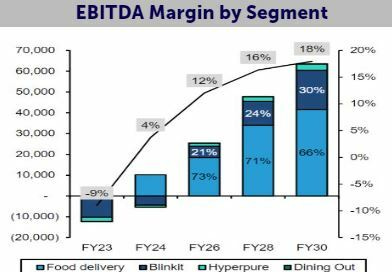

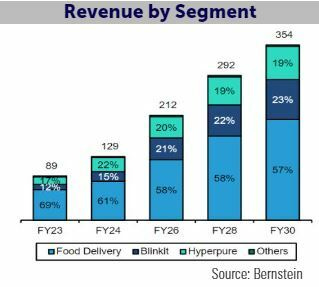

As the two largest food delivery platforms with more than 55% of market share, Zomato and Swiggy (its key competitor) are well positioned to enjoy a large addressable market and the ample growth potential of the industry. Zomato’s Monthly Transacting User base has grown from 1M in 2018 to 18.5M in 2023, with take-rate expanded from 9.8% to 20.3%. We expect such strong growth to be sustainable in the years to come. Because of ongoing urbanization (to add 416M people to its cities by 2050), steady per-capita income growth, and more women participation in workforce, the new generation of Indian consumers embraces a change in habit from home cooked food to restaurant food. Meanwhile, the industry has also attractive potential to further increase penetration rate, which is still in the early stages (14%) compared to that of more developed markets such as China (25%), as well as a benign competition environment. As such, the Online food and grocery delivery industry monthly transacting user base is expected to grow from current base of 30M to 80M by 2030. Such growth prospect is highly positive for Zomato. As a dominant leader, the company starts to benefit from economies of scale which leads to reduced delivery costs. After achieving adjusted-EBITDA breakeven for its consolidated business in 2023, Zomato management remains confident in further profit expansion. The company aims at 100% E-Bikes in its delivery fleet by 2030 to further enhance its cost structure. The breakeven of Blinkit, its quick commerce business, within the next 2 quarters would also contribute positively to the consolidated results. Since the acquisition, Zomato has scaled Blinkit impressively. The latter has sustained >100% of growth with improved margins. As its Monthly transacting user base increased from 1.5M to 4.7M in last 2 years, its take-rate expanded from 7% to 18%. Blinkit is today the leader in a 3-player market.

At 8x FY03/25 EV/Sales, Zomato trades at a premium compared to its global peer group. It is supported by better growth prospects (Gross Order Value +30% pa in FY24-26e) and improved profit outlook. It is uniquely positioned to offer the opportunity to invest in the structural growth in affluent Indian consumers/ digitization. We expect the valuation premium to be sustainable, as long as it continues with successful execution. Both GemEquity (1.6%) and GemAsia (1.6%) have invested in the company.

We’ve got 5 more high-conviction stock ideas waiting for our paid subscribers. These picks come from straight from the portfolios of professional investors.

If you're still on the fence, ask yourself: How much is missing out on great ideas really costing me?

Still hesitant? Try getting your employer to cover it—here’s a simple script you can use.

Hi [Manager’s Name],

I’d love to expense a subscription to Elevator Pitches, a newsletter that curates the best stock ideas from professional investor letters. It provides high-quality insights that help identify overlooked opportunities and special situations.

Here are two examples (here and here) of the types of posts they deliver each week. With a paid subscription, I’d gain access to every stock write-up they uncover.

Since Elevator Pitches serves as an educational and research resource, I was hoping it could be expensed through [Company Name]. The cost is just $90 for the entire year, which is a great value given the depth of insights provided.

Let me know if this is possible—thanks for your time and consideration!

Best,

[Your Name]