EP101: Live Events, Energy Infrastructure, and Hidden Gems—6 New Stock Ideas

Stock Ideas From Investment Professionals

Welcome, subscribers!

We’re back with another exciting batch of ideas—featuring special situations, overlooked growth plays, and deep-value opportunities. This week’s lineup is as eclectic as ever, and we hope you find something that sparks your interest.

If you’re enjoying these insights, why keep them to yourself? Forward this email to a friend or colleague who would appreciate high-quality stock ideas. The more, the merrier! 🚀

This week, we present 6 new stock ideas, including:

An online marketplace specializing in ticket resale for live sports, concerts, and theater events.

An integrated downstream energy company specializing in refining, lubricants, and renewable fuels.

A pharmaceutical company focused on ophthalmic medicines and drug compounding.

A natural resources firm with a long history of managing timber, mineral, and energy assets.

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

Emeth Value provided a lengthy pitch for Vivid Seats (SEAT), the online marketplace specializing in ticket resale for live sports, concerts, and theater events. The company went public in April 2021 via SPAC. The performance since going public leaves a lot to be desired, and it would be easy to lump Vivid Seats in with other failed SPACs. Instead, Emeth sees SEAT as a much-better-than-average business with an extremely attractive valuation.

Below I highlight one of our portfolio companies, Vivid Seats Inc., where I believe investor expectations are too low, and the company likewise benefits from dangerous competitive optionality.

Vivid Seats Inc.

Overview

Vivid Seats (SEAT) is a leading online ticket marketplace focused on secondary ticketing for concerts, sports, and theater events in the United States. In its earliest form, the company was founded as a ticket broker, launched in 2001 by Jerry Bednyak and Eric Vassilatos during their undergraduate years at the University of Iowa. What began as a side-hustle to pay off student loans proved to be immensely profitable and scalable, so much so that Vivid Seats bootstrapped its own torrid growth for fifteen years before raising its first outside capital from Vista Equity Partners at a $850 million valuation. Today, Vivid Seats holds an approximate twenty percent market share in the U.S. secondary market with $4 billion in annual transaction volume, trailing only StubHub and Ticketmaster, who each generate $5 billion in annual volume. While the company’s valuation today is nearly unchanged from its initial funding round with Vista Equity Partners a decade ago, its gross transaction volume, revenue, and cash flow have all increased by approximately 2.5x over the same timeframe.

The U.S. Live Events Industry

The U.S. live event ticketing market is large with a long history of structural growth. More than two hundred million fans attend over three hundred thousand live events in the U.S. annually, figures which have grown consistently. Indeed, according to the Bureau of Economic Analysis, expenditure on live entertainment has increased faster than GDP for thirty-four of the last forty years, and on average has grown at 1.4x the rate of GDP over that period. Moreover, spending on live entertainment has proven to be resilient, with only two years of negative growth over the last four decades. Broadly, the ticketing market can be assessed along two dimensions: (i) primary vs. secondary, and (ii) event category. Primary ticketing companies provide the technology and services that venues need to manage and market shows, sell tickets, and validate tickets for entry. Typically, one primary ticketing company provides these services for all events at a given venue. The chosen primary ticketing company then interfaces with fans during an onsale or presale to market tickets that are the direct inventory of the initial rightsholder, i.e., the venue or the artist. Thus, the actual client of a primary ticketing company is the venue, and primary tickets are both the inventory of and are priced by the initial rightsholder. The largest primary ticketing company by far is Ticketmaster, which has more than a seventy percent market share of primary ticket sales in concerts. In addition, more recently, Seatgeek has made inroads into the primary market, and has had some success in the sports industry. Today, primary tickets account for approximately $45 billion of annual ticket volume in the U.S., and primary ticketing companies earn approximately five to seven percent commissions on each sale. Secondary ticketing companies offer a marketplace to buy and sell event tickets that have already been purchased in the primary market. This ticket inventory is sourced from both individuals and professional sellers, and is priced based on real-time market demand. Primary tickets generally go onsale far in advance of the event date and, as is the case in the sports industry, are often bundled as season ticket packages. Secondary markets give consumers increased flexibility and the ability to attend their desired events without needing to plan months in advance. Tickets can be purchased right up until the time of the event, no package commitments are required, and in many instances tickets are available on the secondary market for below face value, which help teams and artists fill venues. Today, secondary tickets account for approximately $17 billion of annual ticket volume in the U.S., and secondary ticket companies earn approximately twenty percent commissions on each sale.

Shifting to event category, live music and sporting events are the two dominant segments in the event ticketing market, and each have their own unique dynamics. Within live music, over the past two decades, the financial importance of live events has increased significantly for musicians.

In 1997, about half of an artist’s income came from album sales. Today, it is common for ninety percent or more of an artist’s income to come from touring. There are several reasons for this paradigm shift, but the two most notable catalysts were the digitization of music and the proliferation of subscription music streaming. In the first decade of the twenty-first century, recorded album sales were cut in half with the popularization of the MP3 file, iTunes as an internet-native distribution platform, and ultimately the ability to unbundle an album into individual song purchases. In near immediate succession, Spotify (SPOT) made its debut in the U.S., and unbeknownst to many at the time, was able to secure licensing deals with the big four music labels by offering equity in its business as incentive. This created a fundamental misalignment between the artists and labels that only worsened with Spotify’s increasing popularity. In short, artists had entered into recording contracts on the assumption that the record labels shared a common interest in obtaining the highest royalty rate for their music. However, by accepting equity in Spotify - none of which was shared with the artists - the labels now had an incentive to see Spotify survive, even if at the cost of lower royalty rates. Consider that today, artists on average only make a third of a cent per stream. In other words, to reach revenue parity with the $75 cost of an average concert ticket, a fan would need to stream an artist’s song 25,000 times. Framed another way, assuming each song is roughly three minutes long, this fan would need to listen to the artist’s music for fifty straight days for twenty-four hours a day to generate the equivalent amount of revenue as a concert ticket. All of this to say, live events are where the real money is made, and as a result, this is necessarily the focus of artists and their managing teams. Today, there are more than ten thousand artists touring in North America, which is an increase of nearly forty percent from a decade ago. On one vector, supply grows predictably each year as seasoned acts tour longer, and as new cohorts of musicians are added into the rotation. On a second vector, supply grows as an increasing number of artists opt for larger venues, such as stadiums and amphitheaters, to meet the growing consumer demand for experiences. This has resulted in a highly favorable growth environment for the live music industry. For example, according to Pollstar, the top 100 North American tours grossed over $6.5 billion in 2023, a nearly $4 billion increase from 2014. Within the sports segment, the market has a barbell structure. The anchor leagues like the NFL, MLB, NBA, and NHL account for a lion share of the attendance and spend in the sports industry. Supply growth in the anchor leagues has been modest, but positive, with the majority of the addressable market growth coming in the form of ticket price inflation. On the other end of the market, you have verticals such as MLS, UFC, women’s sports, and college sports growing significantly. Deloitte estimates that women’s professional sports in aggregate will generate more than $1 billion in revenue for the first time this year, marking a more than three hundred percent increase over the last five years. Within college sports, there is an ongoing facilities arms race underway as top schools compete to land the best recruits, which has only been amplified by the recent change in NIL rules. Indeed, today there are twenty-six college football stadiums under renovation, which both increases stadium capacity and ticket price. Finally, both the MLS and UFC have witnessed strong double digit growth as both soccer and mixed martial arts have gained traction in the U.S. as mainstream sports. In aggregate, we can estimate that live music accounts for approximately forty percent of the addressable event ticketing market, sporting events fifty percent, and theatre events the remaining ten percent.

The Role of Ticket Brokers

While both individual sellers and professional sellers contribute to the ticket inventory of the secondary market, professional sellers make up an estimated eighty percent of total inventory. This is because, in addition to the obvious differences in scale, ticket brokers play a crucial operational role in the entertainment industry. For example, consider the case of live music. Once an artist decides to perform a concert or go on tour, the first major decision they make is to contract with a promoter. Promoters are responsible for securing the right venues, negotiating deals with venues and other service providers, advising on ticket pricing, marketing the shows, and managing the other countless details involved in hosting a concert.

However, in addition, promoters shoulder the financial risk of the tour by guaranteeing the artist a certain amount of money in exchange for a percentage of the profits. In other words, promoters are risk takers; they bankroll the tour in the hope that it turns out to be profitable, but the risks they take make their compensation uncertain. For this reason, risk management is top of mind, which is where ticket brokers enter the scene.

Ticket brokers enable promoters and artists’ management teams to derisk a concert tour by selling a block of tickets upfront for a fixed price. Indeed, for high profile artists, these block sales can even be structured at a significant premium to stated face value, which allows artists to meet their revenue objectives while also offering a fan friendly price at the general onsale. In the case of the ordinary artist, which is the vast majority of concert supply, block sales with ticket brokers not only provide needed financial visibility, but even more crucially, they increase the surety of a sold out event. Recall that primary markets are generally fixed price markets. It would be untenable for an artist to sell tickets to its most loyal fans at one price, only to then lower the price for others when demand is low. On the other hand, secondary markets are dynamic and are structured to find a market clearing price. By allocating a block of tickets to a broker, artists can ensure that the venue will be filled, while simultaneously distancing themselves from a process that could be construed as double-crossing fans. In the world of live sports, brokers play a similar role. NFL insiders will tell you that their season ticket holder base accounts for almost eighty percent of stadium capacity. NBA insiders peg that number around seventy percent. However, what is less broadcasted is that in many instances, a majority of a team’s season ticket buyers are in fact ticket brokers. Front offices partner with ticket brokers to offload risk – specifically the risk that the team will have a poor season, and that they will get stuck with loads of unsold seats and an empty stadium. Again, because the primary market is a fixed price market, operating with a significant percentage of gameday tickets and thus running the risk of being left with unsold low- demand inventory is an untenable situation for a sports franchise. What’s more, broker relationships have matured into strategic multi use channels for many front offices. With hundreds of thousands of tickets per season, sometimes due to circumstances beyond a team’s control, the front office will end up with high quality unused seats which they cannot sell the traditional way. For example, if a season ticket holder defaults on their payment, those season tickets will be reclaimed. Usually, a benefit of existing season ticket holders is that you have first dibs on new seats that come available based on your tenure. However, orchestrating this process intra-season every time a season ticket holder cancels or stops paying would be chaotic. At the same time, putting these tickets onsale to the general public would be perceived as unfair to the most loyal fans who bought in advance. In instances like this, front offices will use the cover of a professional ticket broker to quietly offload the inventory. There are many other instances where a front office might elect to leverage a broker relationship, but at bottom the realities of why ticket brokers have a right to exist in both the world of sports and music are structural: (i) consumers are continuously demanding more flexibility to purchase the tickets they want, when they want, driving a lower percentage of fan held season ticket packages, and (ii) while they might claim otherwise for publicity reasons, artists’ management teams and font offices of sports franchises are not in the business of turning away viable avenues for large scale ticket sales. These factors have led to a durable and growing supply environment for the secondary market.

Skybox ERP

Attracting and retaining professional sellers is crucial to driving marketplace gross order volume, and in this regard, Vivid Seats has a distinct competitive advantage. In 2014, Vivid Seats launched Skybox ERP, a cloud-based software platform that provides brokers with a single-source tool to manage inventory, automate listings, streamline fulfillment, adjust pricing, and generate customized reports. Skybox integrates with all major ticketing marketplaces, including Ticketmaster, StubHub, and Seatgeek, which enables sellers to reach the broadest possible audience without listing manually across multiple sites. Over the past decade, despite efforts from competing platforms such as Ticketmaster’s TradeDesk and StubHub’s Ticket Utils, Skybox has established itself as the dominant broker-side platform. By count, more than seventy percent of the 3,500 professional ticket brokers use Skybox exclusively as their point of sale. This compares to the next closest broker platform at around ten percent. By gross order volume, approximately forty percent of all professional ticket broker sales flow through the Skybox platform, with the delta versus broker count arising from a few large scale brokers like Eventellect who have developed their own inhouse tools. The Skybox platform is also free to use (more on this later), which makes the competitive position a difficult one to unseat. Even still, while owning Skybox ensures that Vivid Seats has unparalleled inventory depth, it also provides another critical feature - data. While competitors can only see how tickets are selling on their own platform, Vivid Seats can, in real time, see how it is selling against every major competitor for seventy percent of the broker universe. For a performance marketing intensive business, this is a tremendous advantage as it allows the group to target and adjust customer acquisition spend down to event level granularity. Finally, in 2023, Vivid Seats began developing Skybox Drive, an automated pricing tool that will be offered through the Skybox platform. This product recently exited beta phase, and is already in process onboarding several hundred existing Skybox users. There are other autopricer tools available in the marketplace today, such as Uptick by Automatiq. However, none of these tools have access to first-party marketplace data like Skybox Drive, and all are monetized products. As a result, Vivid Seats has announced that it is likely to also charge for its autopricer tool. Comparable tools charge anywhere from fifty to twenty- five basis points of gross sales, which means Skybox Drive could generate an additional $5 million to $15 million of annual cash flow for Vivid Seats. Notably, this cash flow would have several avenues for growth as Skybox Drive (i) will naturally grow in line with the overall secondary market, (ii) can be leveraged as a way to recruit more brokers to Skybox ERP, and (iii) could eventually be offered selectively as a standalone product outside of Skybox.

In 2019, Vivid Seats Rewards was launched, which remains the industry’s only loyalty program. The structure of the program is simple, when a customer buys ten tickets on Vivid Seats, they earn a reward credit equal to the average value of the purchased tickets. Or, for marketing purposes, buy ten tickets and get the eleventh free. This launch was part of a broader effort to increase brand awareness for Vivid Seats, as the marketplace’s early years of success were built almost solely upon a highly proficient paid marketing strategy. In fact, while it had reached a similar scale as its largest competitors in the secondary market by the time of IPO, Vivid Seats still had only a fifth of the aided consumer brand awareness. By layering the rewards program onto it’s already competitive pricing, Vivid Seats established its platform as the undisputed value offering for frequent event goers. Note also, the rewards program is a per ticket offering, not a per order offering, which along with increasing transaction frequency and repeat rates, encourages group purchasing. Since its launch, together with targeted brand advertisements, the proportion of repeat orders on the Vivid Seats platform increased from forty-seven percent in 2018, to over sixty percent in 2024, while the total number of repeat orders doubled to exceed six million. On a related topic, it’s important to consider that Vivid Seats’ relatively low brand awareness is partly due to its decision to actively discourage consumer- listed inventory. While the secondary ticket market is composed of about twenty percent consumer supply, Vivid Seats is entirely professional seller inventory. This approach has been intentional, as consumer listings have historically led to a higher incidence of customer service issues, such as improper ticket listings, delayed transfers, or even outright fraud. By focusing on professional sellers, Vivid Seats has recourse in the form of an ongoing commercial relationship, and as a result, issues occur rarely. Nonetheless, with digital tickets becoming the standard, there’s now an opportunity to introduce more safeguards around the consumer listing process. This gives Vivid Seats flexibility, as it starts from scratch in consumer sales— unlike its larger competitors. At the very least, allowing consumer listings could expand inventory and enhance take rates, since large brokers often benefit from discounted seller fees. However, as an alternative, Vivid Seats could use consumer listings strategically as a form of brand marketing. For example, through its Skybox platform, Vivid Seats could offer to automatically cross-list consumer supplied tickets on every major marketplace, making their platform the only free consumer option to do so. Moreover, for tickets sold on the Vivid Seats marketplace, Vivid Seats could return the seller side fee to consumers as a reward credit. For instance, if a consumer lists and sells a five hundred dollar concert ticket on StubHub, they would be charged a fifty dollar seller fee. Vivid Seats could offer consumers the same cash payout, but in addition, give them a fifty dollar reward credit to be used on future purchases at Vivid Seats. This could be added as yet another layer in the Vivid Seats Rewards program and, again, since they are starting from a baseline of zero consumer listings, it would only be accretive from a dollar margin perspective.

White Label Platform

An offering unique to Vivid Seats among its large competitors is a scaled white label platform. This business enables third-party distribution partners to own the customer relationship, while leveraging Vivid Seats’ technology infrastructure, inventory, and customer service. Vivid Seats launched this platform in 2014, and further reinforced the segment through the $60 million acquisition of Fanxchange in 2019, the company’s first acquisition. In particular, Vivid Seats provides solutions for loyalty programs, financial institutions, travel and hotel providers, and other niche ticketing websites. For example, Vivid Seats powers the Capital One Entertainment platform, a program that allows Capital One cardholders to redeem rewards points for tickets to more than five hundred thousand listed events. While this business carries lower take rates than sales made through the company’s owned properties, it is also captive demand that has zero associated marketing expense burden for Vivid Seats. Today, white label sales account for approximately twenty percent of Vivid Seats’ marketplace revenue, or in excess of $125 million, and has grown organically at ten percent per annum since 2019.

Vegas.com

On November 3, 2023, Vivid Seats acquired Vegas.com for $240 million, the local market authority for all things Las Vegas. The company operates under the Vegas.com and LasVegas.com banners, which combined receive over sixty million user visits per annum. The platform provides a comprehensive event inventory of shows, attractions, and tours, as well as end-to-end travel booking with flights and hotels. As a standalone company, Vegas.com is growing and generated $100 million in revenue and $30 million in cash flow.

However, there are several reasons why Vegas.com is now stronger as part of the Vivid Seats ecosystem and vice versa. First, Vivid Seats can cross-list its own inventory for local concerts, shows, and sporting events on the Vegas.com property. Consider that while Vegas.com already had an extensive ticket inventory, its supply consisted entirely of primary tickets direct from local show producers, venues, and entertainment companies. Vivid Seats can bring unique secondary inventory onto the platform, which allows high intent fans traveling to Las Vegas to browse an even more comprehensive offering. Indeed, while it is still early days, Vivid Seats reported recently that one percent of gross order volume for the entire company now comes from secondary tickets cross-listed on Vegas.com. Second, Vegas.com serves as a profitable customer acquisition engine for the Vivid Seats brand. Las Vegas is the entertainment capital of the world, and every year the city attracts more than forty million visitors from cities all around the United States. As these visitors travel to Las Vegas and interact with Vegas.com, this provides a pipeline of identified consumers that can be introduced to the Vivid Seats brand as they return back to their home markets. In its initial cross-sell campaigns, Vivid Seats has witnesses email and push notification open rates of over fifty percent, which is multiples higher than its existing CRM channels. As more Vegas.com cohorts age into their next live event purchase, this will continue to contribute to incremental orders and new Vivid Seats customers. Finally, as referenced previously, the Vegas.com acquisition gave Vivid Seats new capabilities in primary ticket distribution. With this, in April 2024, Vivid Seats announced its first ever primary ticketing deal, having been selected as the official ticketing provider for the College Basketball Crown. This deal was structured in partnership with AEG, the second largest event promoter and venue manager behind Live Nation, whereby Vivid Seats will function solely as the front-end distribution platform for tickets and AXS would provide the technology needed for ticket validation and entry. While it is too early to tell, proving out this differentiated primary ticketing model could significantly increase the total addressable market for Vivid Seats.

International Expansion

For the first two decades of its existence, Vivid Seats has been a U.S. centric platform. However, in 2023, the group began laying the groundwork to expand into adjacent international markets. The competitive landscape is straightforward, with Viagogo, founded by former StubHub co-founder Eric Baker in 2006 and the parent company of StubHub since 2020, maintaining a dominant market share. Vivid Seats estimates that in aggregate, the total addressable market for ticketing in international markets is approximately $40 billion, with secondary ticketing accounting for more than $5 billion. In other words, the international opportunity on solely a secondary basis represents a thirty percent growth in the addressable market for Vivid Seats.

Moreover, because Viagogo is the only scaled secondary platform in many of the international markets where they operate, their average take rate is several percentage points higher than secondary platforms in the U.S. This is critical, as it provides Vivid Seats a healthy margin to work with as they lean into performance marketing. It is also worth noting that Viagogo is near universally disliked. For instance, Viagogo has an average 2.5 star rating on Trustpilot across almost one hundred thousand customer reviews, versus Vivid Seats at a 4.2 star rating. In addition, Viagogo has been sued and temporarily banned by regulators in several markets for continuing to violate consumer protection laws. All that to say that there is both room and appetite in many of these markets for a competing offering. Vivid Seats officially went live with their international platform at the end of 2024, and their aim is to take as much volume as possible while remaining contribution margin neutral with their U.S. marketplace platform – or at a level of approximately thirty percent contribution margins. Said differently, Vivid Seats believes there is a clear opportunity to take share while remaining healthily above first-click-profitable. During the past two years of preparation, Vivid Seats has invested $10 million annually to operationalize the international platform, which thus far has been offset by zero revenues. In the coming year, incremental volumes will go a long way toward recouping, and hopefully in time far exceeding, this relatively fixed cost base. Finally, Vivid Seats is open to both organic and inorganic opportunities as they expand internationally. On August 7 th 2023, the group announced the acquisition of Wavedash, the largest secondary ticketing platform in Japan, for $61 million. As a standalone business, Wavedash is growing and produces $8 million in cash flow. Moreover, because the Japanese market is solely a consumer to consumer market, the company’s competitive position is highly resilient.

Vivid Resale

Recall that Vivid Seats began its journey in the early 2000s as a professional ticket broker. This highly profitable business, Vivid Resale, still exists within Vivid Seats and is yet another asset unique to the company among scaled secondary platforms. On one hand, Vivid Resale serves as an internal research and development team for Skybox. By walking in the shoes of its professional seller clients, the resale team allows Vivid Seats to anticipate the needs of the professional broker and to test and iterate on new software features and tools. For example, Vivid Resale had been beta testing Skybox Drive for nearly two years before the official market launch. However, what may come as a surprise to many is that Vivid Resale is an extremely attractive business on its own merit. The segment currently generates $120 million in annual ticket sales, which has grown at fifteen percent per annum, and has consistently produced in excess of twenty percent contribution margins. Or, at today’s volumes, $25 million and growing in contribution margin. Now, here’s where things get interesting, because Vivid Resale turns its owned ticket inventory on average four times a year, this yields a pre-tax return on invested capital in excess of one hundred percent per annum. However, this is simply the calculation using the figures reported on the face of the financials. Consider that Vivid Seats reports resale revenue net of marketplace service fees, which on average are twenty percent of the gross sales price. Consequently, when the Vivid Resale team sells a ticket on their owned Vivid Seats marketplace for $100, this is accounted for as $80 in resale revenue and $20 in marketplace revenue. The Vivid Resale team transacts across all marketplace platforms like any professional broker, which is another touchpoint that provides valuable information on how competing platforms are performing. However, given that they are able to retain the services fees by directing volume to their own platform, Vivid Resale transacts disproportionately on their own marketplace. Therefore, when considering the benefits of owning the distribution channel, there is another $15 million or more of contribution margin associated with the ticket brokering segment. Bringing this together, we can see that the all-in returns on invested capital are in excess of one hundred and fifty percent per annum for Vivid Resale. Of note, because Vivid Resale effectively competes with the professional broker clients that list on the Vivid Seats marketplace, the much larger and more profitable segment, the company is intentionally cautious around scaling its owned operations. However, highlighting the embedded value of the resale segment is relevant particularly in the context of company’s current public valuation. Consider that while the business transacts on over $100 million in annual ticket sales already, there is a clear pathway to growing significantly, as many other scaled brokers are multiples the size. For example, Drew’s Tickets, which sold to Automatiq in 2023, transacts on more than $200 million per annum in ticket sales. DTI Management, which was funded by CVC Capital Partners in 2016 and is now owned by Clearlake Capital, is even larger. Eventellect transacts on more than $500 million per annum in ticket sales. Moreover, none of these platforms have an owned consumer distribution platform, and thus have a higher cost of capital. As a result, if Vivid Seats hypothetically wanted to turn its focus to scaling its resale segment, I believe it could achieve $100 million or more in resale margin, which alone could justify the company’s current valuation.

Valuation

In April 2021, Vivid Seats agreed to go public via a merger with Horizon Acquisition Corp (HSPO), a SPAC backed by Eldridge Industries. On a fundamental level, the deal was a match made in heaven for Vivid Seats. Todd Boehly, the co-founder and CEO of Eldridge Industries, is a highly strategic investor, being co-owners in the Los Angeles Dodgers, Los Angeles Lakers, Chelsea Football Club, and Penske Media which includes Rolling Stone, Variety, Billboard, Dick Clark Productions, and South by Southwest. However, this would be overshadowed by technical factors which would create a very challenging life for Vivid Seats as a newly public company. First, the sentiment around SPACs deteriorated meaningfully between the time when the Vivid Seats acquisition was announced in early 2021 and when the deal was voted on by SPAC shareholders in October 2021. As a result, two-thirds of the public SPAC shareholders elected to redeem their shares for cash, which ordinarily would result in the cash held in trust to fall below a minimum threshold and the deal would be called off. However, in this case, as part of the original acquisition agreement Eldridge Industries agreed to backstop all SPAC shareholder redemptions. Moreover, in a show of their confidence in the future prospects of the business GTCR, the controlling private equity firm, rolled all their equity in the deal. This resulted in Vivid Seats going public with only seven percent free float (i.e., shares that were not owned by either GTCR or Eldridge Industries). In other words, Vivid Seats was public in name only. This dynamic became acutely problematic as (i) the hatred for SPAC related companies intensified, (ii) the equity risk taking environment collapsed amid historic interest rate hikes, and (iii) GTCR, which owned Vivid Seats through a 2014 vintage fund, remained motivated to find an exit for its stake. Consequently, even as the company continued to grow steadily and post record high cash flows, the share price did not follow suit. In the three years following the de-SPAC event, Vivid Seats traded down from an 18.7x EV/EBITDA multiple, to a 5.1x multiple – or a nearly seventy-five percent compression. Over that same three year period, the company’s cash flows grew by fifty percent. There are several ways to frame the extremity of this valuation. To start, Viagogo, the owner of StubHub and Vivid Seats’ largest direct competitor, is currently 7x levered on an EBITDA basis. In other words, StubHub has more turns of leverage than Vivid Seats has of enterprise value. Moreover, as a private business Vivid Seats itself operated at 5x levered. While any ascribed level of valuation might seem subjective, it can become objective at the extremes when we consider that linear movements in multiple can have extreme non-linear movements in LBO math. Indeed, this is particularly relevant for a company that is ready-made for private equity like Vivid Seats that is non-cyclical, capital light, has negative working capital dynamics, and converts an extremely high proportion of EBITDA to free cash flow. For example, at $3.25 per share, Vivid Seats had an enterprise value of $850 million, which consisted of 1x of debt and 4x of equity. If the company were to pursue a dividend recapitalization targeting 3x leverage, fifty percent of the market capitalization could be returned to shareholders, and the business would still have forty percent less leverage than it did as a private business. Furthermore, Vivid Seats would be able to delever by half a turn per year, which on a post transaction basis equity of 2x generates twenty- five percent returns without growth or a multiple re-rating. To be sure, this is not a purely hypothetical exercise. While Vivid Seats is only 1x levered at present on a net basis, the group amended its debt facilities in June 2024, and currently has 1.2x of cash on hand and a further 0.6x of cash available via an undrawn revolving credit facility. In other words, within six months Vivid Seats would have enough cash on hand to pursue this exact dividend recapitalization without even having to go to the capital markets.

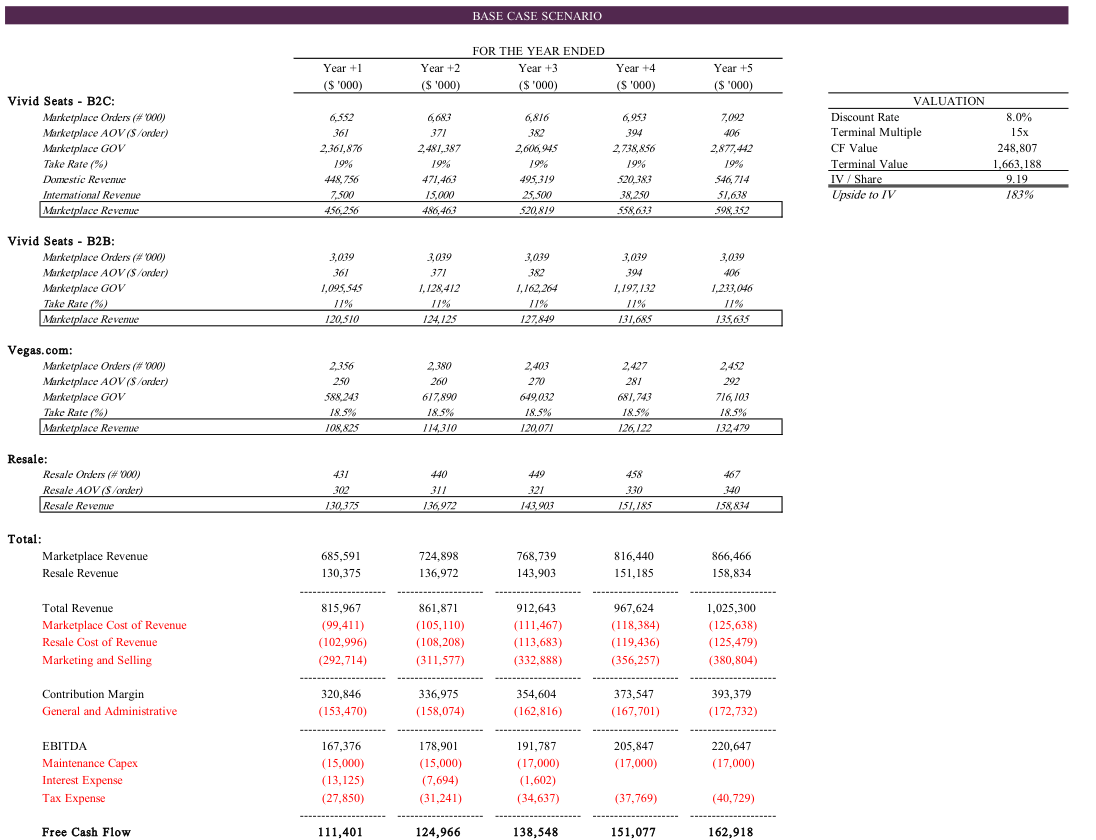

Next, as referenced previously, while Vivid Seats is one company, it is in reality a platform of many assets that gives the business optionality. These assets include: (i) Vivid Seats B2C, (ii) Vivid Seats B2B, (iii) Vegas.com, (iv) Vivid Resale, (v) Wavedash, (vi) Skybox, and (vii) Vivid Picks. The consumer facing marketplace is the largest and most profitable business, with approximately $125 million of annual contribution margin. This is also the business that garners virtually all of the investor debate, as it is the most public and competes head to head with several large and well-known companies. Putting aside the fact that Vivid Seats has been a structural market share gainer over time, while remaining highly profitable, it is evident that even in a scenario where the core consumer marketplace became impaired, the platform itself would still have significant value. For instance, at the extremes, two alternative competitive strategies that Vivid Seats could pursue would be to operate its consumer marketplace at zero contribution margin by either (i) cutting its existing $250 million performance marketing budget significantly, or entirely, but then offering the marketplace free to both sellers and consumers, which would result in average ticket prices that are twenty percent cheaper than other secondary platforms, or (ii) significantly expand the existing performance marketing budget until contribution margin approaches zero, which would drive increased market share and would benefit all brokers listing on the platform, including Vivid Resale. Under both scenarios, Vivid Seats would still generate $40 million of EBITDA with opportunities for growth coming from monetizing Skybox Drive and scaling up Vivid Resale. In other words, at $3.25 per share, the core consumer marketplace could be written down to zero and there would still be pathways to a mid-teens multiple. In fact, this assumes zero cuts to company overhead. If Vivid Seats could reduce its overhead by just twenty percent, likely a conservative reduction if they are operating the core platform as a non-profit, there is a path to a single digit multiple. Finally, we can assess a more realistic outcome for Vivid Seats, such as the one laid out in the base case scenario modeled below. Vivid Seats believes that in aggregate, the secondary market in the United States grows mid to high single digits which breaks down into three components (i) three to four percent increase in the number of live events per year, (ii) three to four percent increase in ticket price, and (iii) increasing secondary transactions per primary ticket. On top of this, Vivid Seats has historically been a market share gainer, which management expects to continue, and international expansion will provide incremental growth. Taken together, this informs the company’s expectation to achieve sustained double digit growth. On the profitability front, pre-covid and prior to launching the loyalty program, Vivid Seats generated as high as twenty-seven percent EBITDA margins. So, in concurrence with the one to two percentage points of margin invested in building the international platform, the company is currently investing one to two percentage points of margin into the loyalty program, which they expect to recoup over the medium term in the form marketing efficiency. When combined with some operating leverage, Vivid Seats management expects there is a path to long-term EBITDA margins of thirty percent. On the other hand, the model below forecasts marketplace revenue growth of approximately five percent, which implies significant market share losses, and an EBITDA margin of just over twenty-one percent, which only gives the company credit for being able to recoup the costs of the international expansion. The output is a share price of $9.19, or 183 percent upside to intrinsic value.

Postscript – In Play?

On December 30 th, 2024, Bloomberg reported that Vivid Seats was exploring a sale of its platform, which sent shares up by twenty percent in a day. The company has refused to comment on the rumors, but it is worth taking some time here to think through the situation. First, both StubHub and Seatgeek want to go public, but can’t with the most relevant comparable company trading at a mid-single digit multiple. It would make strategic sense for one of these large scale competitors to acquire Vivid Seats, because, in addition to removing the roadblock to an IPO, a significant amount of cost synergies could be extracted. Indeed, this is one of the reasons why Viagogo felt it could pay 25x EBITDA for StubHub. Vivid Seats currently has $150 million in corporate overhead. If a competing secondary platform paid 12x for Vivid Seats, or approximately $8.75 per share, the multiple could be reduced to 9x if the buyer can identify $50 million of cost redundancy. Given that there would be near one hundred percent overlap in job functions, this should be easily achievable. If instead a private equity firm wanted to acquire the business, it could pay 10x for Vivid Seats, or $7.5 per share, with a deal structure that has four turns of leverage, and pencil out a high-teens to low- twenties percent return with very little assumed growth. In addition, upside could be achieved from there if the platform continued to execute on accretive bolt-on acquisitions, which the company has a successful track record of doing. There are also several less obvious buyers that could be interested in owning the business. AEG, the second largest primary ticketer, event promoter, and venue owner behind Live Nation (Ticketmaster), would be a natural acquirer. The group’s owned ticketing platform, AXS, is sufficient as a primary ticketing application. However, its technology is very outdated, and as a result, it has limited presence in the secondary market. This is why AEG selected Vivid Seats over its own platform as the official resale partner of the LA Kings (NHL) and the LA Galaxy (MLS), two sports franchises owned by AEG. In fact, as discussed previously, AEG has even started testing Vivid Seats in the role of a primary ticketer with the College Basketball Crown. Given that AEG/AXS is the ticketing partner for 1,300 of the world’s most iconic venues, sports teams, and events, having the ability to translate that embedded presence in primary into actionable volumes in the secondary would provide meaningful revenue synergies. Other acquirers could include Victory Live (Clearlake Capital), Eventellect, Legends (Sixth Street Partners), and CTS Eventim. Finally, Eldrige Industries already owns more than twenty-five percent of Vivid Seats, and as a permanent capital holding company, the group would be an ideal long term owner for the whole business. Acquiring the remaining stake, either on its own, or alongside a partner, would allow Eldridge to significantly reduce its average cost basis. If they liked the deal at 18.7x, they should love it at 10x.

We’ve got 5 more high-conviction stock ideas waiting for our paid subscribers. These aren't just random picks—each comes from the portfolios of top professional investors.

If you're still on the fence, ask yourself: How much is missing out on great ideas really costing me?

Still hesitant? Try getting your employer to cover it—here’s a simple script you can use.

Hi [Manager’s Name],

I’d love to expense a subscription to Elevator Pitches, a newsletter that curates the best stock ideas from professional investor letters. It provides high-quality insights that help identify overlooked opportunities and special situations.

Here are two examples (here and here) of the types of posts they deliver each week. With a paid subscription, I’d gain access to every stock write-up they uncover.

Since Elevator Pitches serves as an educational and research resource, I was hoping it could be expensed through [Company Name]. The cost is just $90 for the entire year, which is a great value given the depth of insights provided.

Let me know if this is possible—thanks for your time and consideration!

Best,

[Your Name]