Welcome, subscribers!

Since our last edition, we’ve combed through more investor letters, and we’re excited to share the best of what we came across.

If you enjoy what we do, please consider forwarding to a friend or colleague who might also appreciate our work.

This week, we have 6 new ideas to distribute, including:

An out-of-favor global exchanges operator with a near-monopoly position

A freight forwarder in the midst of integrating the acquisition of one of its biggest competitors

A recently orphaned spin-off that owns some trophy real estate assets

Keep reading to learn more.

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

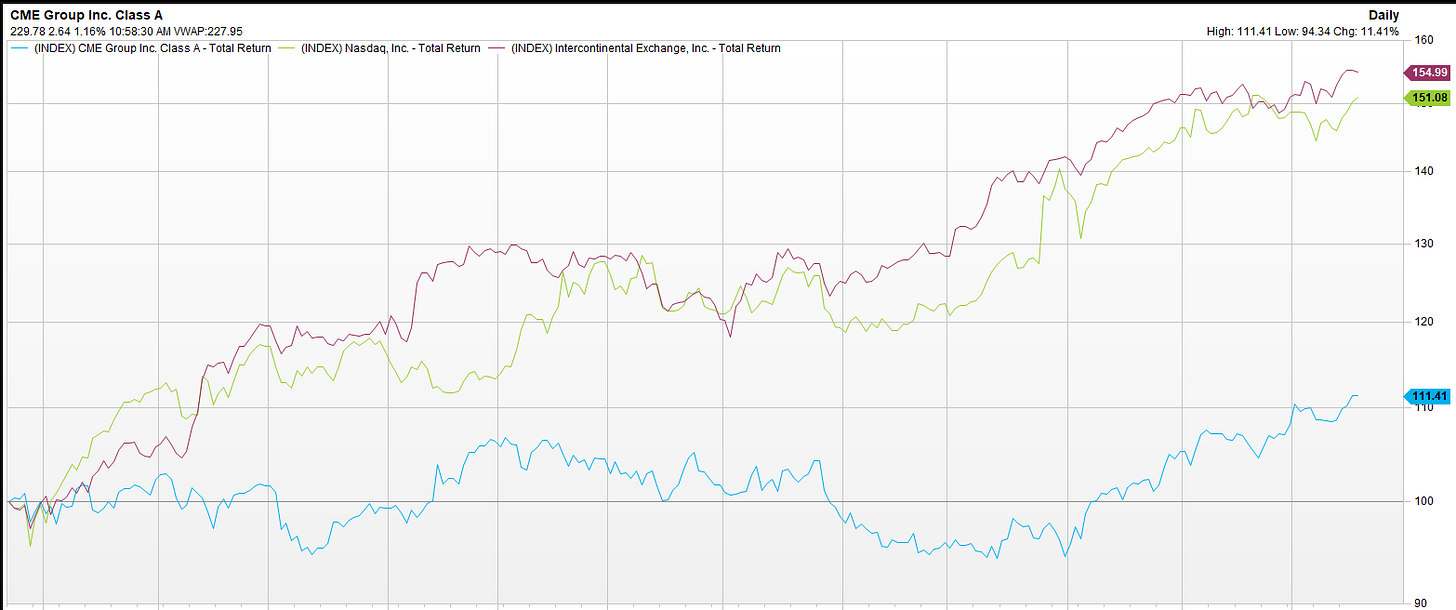

Upslope Capital discussed their new position in exchange operator, CME Group (CME), in their latest client letter. CME has underperformed exchange peers of late (trailing 12 months shown below), and Upslope sees that as an opportunity to own this high quality company.

CME Group (CME) – New Long

CME Group is a leading operator of global derivatives exchanges. Key end markets include interest rates (34% of transaction/clearing fees in 2023), energy + other commodities (31% combined), equities (23%), and FX (4%). Upslope’s thesis is simple: CME is an attractive business that has been relatively out of favor vs. peers due to exaggerated worries about new competition and the end of the interest rate hiking cycle.

The financial exchange sector is comprised of durable, monopoly-like businesses, and has a history of predictable mean-reversion. Exchange stocks come in and out of favor, as investors extrapolate short-term issues and opportunities (not unlike other sectors, but I see this space as more predictable than most). CME is the “out of favor” exchange today: shares have materially lagged peers over the past 1/3/5 years and are reasonably valued today. Over the past 10 years shares have rarely been cheaper on a forward earnings basis. This, despite CME being in a strong position to benefit from continued interest rate volatility and ever-expanding U.S. government debt issuance, as well as general commodity volatility.

What makes CME a high-quality business? Due to the unique nature of derivatives market structure, the company holds a monopoly-like position in many key products. This is reflected in CME’s ~70% EBITDA margins. Additionally, unlike most global exchanges, which have shifted significantly away from being trading volume-driven and towards data/other services, CME still derives most of its revenue (82% in 2023) from trading. While most investors prefer the new exchange model, I hold the opposite view: I prefer to own shares of a company that benefits when volatility surges – even if that makes it harder to predict/model in the short-term.

On the competitive front, investors have worried that CME’s core rates products could be pressured by new competition from BGC Group, who launched the FMX Futures Exchange in late September. With the benefit of very significant network effects (liquidity begets liquidity), legacy exchanges have historically been able to easily fend off competition from new entrants. This situation appears no different. And while it’s early days, FMX volumes and open interest have not impressed to date. BGC’s CEO also appears to have other priorities: he is co-chair of the Republican presidential candidate’s transition team.

Key risks include: heightened volatility and trading volumes may not be sustained, potential for FMX volumes to improve significantly, large scale M&A, and potential trade matching/execution errors.

We have 5 more ideas for our paid subscribers below.