Welcome, subscribers!

We dove into another batch of second quarter investor letters this week, and we’re excited to share our findings.

If you enjoy what we do, please consider forwarding to a friend or colleague who might also appreciate our work.

This week, we highlight 7 new ideas, including:

Two niche distributors each trading for under $10 billion

A special situation holding company for well-known fashion brands

A $1 billion market cap oil field services company with a focus on oil patch water handling & recycling

Keep reading to learn more.

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

Silver Ring Partners went into great detail on their newest position in International Game Technology (IGT). Silver Ring believes the imminent sale of IGT’s non-lottery business will unlock value for shareholders. Read their full thesis below.

New Investment: International Game Technology (IGT)

IGT is a new small investment in the “Undervalued with a Catalyst” category. The company is comprised of two businesses: a lottery operator and a designer of new slot machine games plus related products. The former is a good, stable business with low cyclicality, high barriers to entry and switching costs but modest growth. The latter can be a good business, but is highly cyclical, very competitive and susceptible to product cycle hits and misses.

IGT was already in the process of spinning off its non-lottery businesses and merging them with Everi Holdings (EVRI), when the private equity firm Apollo announced that it will be buying the combined post-spin entity. This new deal results in a much higher all-cash payment to IGT than was contemplated under the spin-off. The deal is expected to close in about a year.

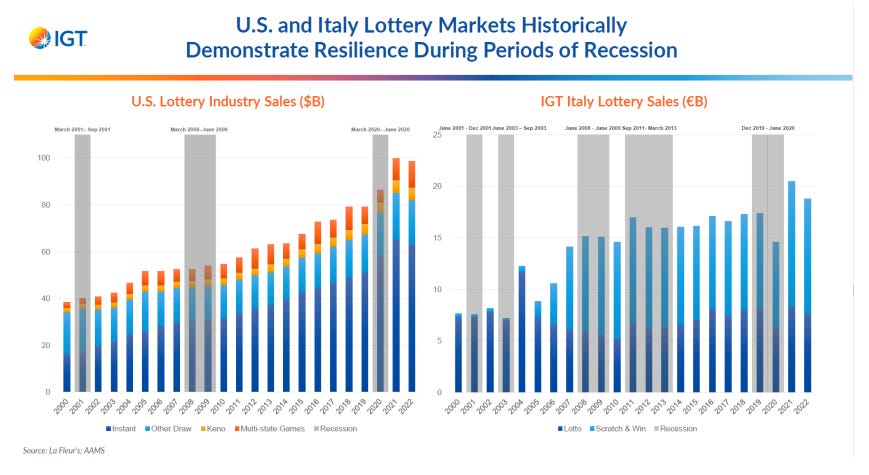

Following the transaction, the remaining IGT will be a pure play lottery operator with a lot of extra cash that it can use, in part, to buy back shares. The lottery business is only mildly cyclical and has withstood the introduction of new forms of online gambling. The company operates in two primary geographies, U.S., where contracts are awarded at the state level, and in Italy, where it is done nationally.

My research suggests that the incumbent lottery operator is very hard to replace due to both perceived and real switching costs. No bureaucrat is going to be very excited to take on the massive career risk of something going wrong unless there is a compelling reason to do so. My understanding is that in the past decade only one major U.S. state contract has changed hands for this reason. Furthermore, this business is built around long-term contracts that expire at different times, which further mitigates the risk of something going wrong.

The company’s largest contract, in Italy, is coming up for renewal in 2025, which is a risk. The chances of them losing the contract are small, but there is a risk that Italy will attempt to extract additional concessions (e.g. a larger upfront payment) on the terms. This is a risk that I am monitoring, but I believe it to be manageable both in terms of magnitude and likelihood.

In about a year’s time, I expect us to have gotten a durable, modestly growing lottery business for under 10x earnings. That is substantially below the intrinsic value of the cash flow stream or comparable private market transactions in the industry.

The downside to the Worst case scenario in which Italy’s contract is lost and the U.S. business does not grow is less than 25%. This results in attractive risk/reward for a good business with a clear catalyst. While today the company is neglected due to its complexity, once it is a simple monoline business with good economic characteristics the gap between price and intrinsic value is more likely to close. If it doesn’t, the company should have ample capital to buy back a meaningful portion of its shares, further increasing the intrinsic value per share for the remaining owners. In the meantime, we get to collect a 3.5%+ dividend yield while we wait.

We have 6 more ideas for our paid subscribers below.