Welcome, subscribers!

We’ve been digging through second quarter investor letters, and we’re happy to share the best of what we read.

If you enjoy what we do, please consider forwarding to a friend or colleague who might also appreciate our work.

This week, we’re excited to highlight 6 new ideas, including:

An emerging player in the semiconductor industry, leveraging unique hardware and software to optimize manufacturing outcomes, with strong industry partnerships and commercial adoption of innovative technology.

A global specialty ingredients and nutrition company undergoing a transformative period, enhancing business quality while trading at attractive valuations compared to its peers.

An asset management firm that recently completed a transformative acquisition, providing attractive valuation and synergy potential, with a history of shareholder-friendly practices.

Keep reading to learn more.

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

In their most recent investor letter, Headwaters Capital provided a long and detailed thesis on their newest holding, PDF Solutions (PDFS). PDF is a small cap provider of software and services for the semiconductor industry, helping customers lower their total cost of semiconductor design and manufacturing. Enjoy their thesis below.

PDF Solutions ("PDFS"): They Didn’t Invent the Chicken (Electrical Characterization), Just the Chicken Sandwich (the Electrical Characterization Product)

Summary Thesis

1. Industry Leader in Semiconductor Yield and Process Automation Software

2. Technology at the Intersection of Multiple Secular Growth Themes, Driving Accelerating Revenue Growth

3. Completion of Business Model Transition Results in More Durable Revenue and Improved Profit Margins

4. Call Option on Unique, Emerging Technology That is Showing Early Signs of Commercial Traction

5. Founder Led Business with 10% Insider Ownership Aligns Management with Shareholders

Company Overview & History

PDF Solutions, headquartered in Santa Clara, CA, is a leading provider of software, hardware and professional services solutions that help customers optimize Process, Design and Fabrication (hence the PDF name). More specifically, PDF collects and analyzes data that helps customers lower the total cost of semiconductor design and manufacturing, accelerate time to market, and improve overall product quality and reliability. The company was co-founded in 1991 by current CEO, John Kibarian, and VP of Products and Services, Kimon Michaels upon completion of their PHDs at Carnegie Mellon. From the beginning, the company has relied on its expertise in electrical characterization to improve manufacturing yields for customers. Today, the company employs over 300 PHDs and has a customer base that spans the entire semiconductor value chain (fabs, fabless, IDMs, OSATs and tools companies). As Dr. Michaels noted at the Company’s 2016 Analyst Day, PDF “didn't invent test chips… didn't invent parametric testers, yet PDF managed…to product-ize electrical characterization.”

Prior to 2016, PDF sold its services through an Integrated Yield Ramp (IYR) model. This was effectively a consulting arrangement where PDF engaged in a fixed fee arrangement to improve manufacturing yields and collected a royalty (Gainshare) on any yield improvements. This royalty was earned over the life of the product and carried high margins. PDF enabled these yield improvements by installing custom electrical test machines into fabs and utilized internally developed software to collect data produced by the machines. PDF's staff of PHD's then analyzed the data and applied their expertise to improve the manufacturing process.

Over the last decade, the company has embarked on a monumental business overhaul. Since inception, the company's revenues have been highly concentrated with their top customers and consulting engagements were tied to specific products or nodes. This created significant business model risk. For example, in 2014, PDF's top customer accounted for 50% of revenue and the top three customers accounted for 75% of revenue. Around this time, PDF lost the IYR contract with its top customer and the Company realized that the business model of collecting royalties on yield improvements was structurally challenged due to a consolidating customer base combined with customer reluctance to pay a royalty on future production. However, management also realized that data complexity was increasing and that their unique hardware and software combination was ideally suited to analyze and process this data in a way that could optimize manufacturing outcomes for customers. They also correctly predicted that manufacturing complexity would continue to increase and the value of their electrical characterization expertise and products would grow. As a result, the company began a long business model transition away from Gainshare royalties to a model that sells a package of software, hardware and professional services without any accompanying yield improvement royalties. The result is a company that now has a more diversified customer base with more durable revenues that are tied to broader semiconductor manufacturing complexity as opposed to a single product or node with a specific customer. The core of the business remains the same: unique hardware and software that collects and analyzes data combined with an expertise in electrical characterization to drive improved yield outcomes for customers.

Exensio – Core Product Offering

Exensio, PDF's core software product, collects data directly from over 25,000 different tools used in semiconductor manufacturing to provide a real-time, unified view of everything occurring during the process. This data collection and real time monitoring enables companies to adjust processes during manufacturing to improve yields, efficiencies and time to market. PDF's value is the ability to ingest large amounts of data in disparate data formats and synthesize all of this into a common environment such that it can be analyzed and used in real time to improve manufacturing yields. As an independent third party, PDF is uniquely positioned to be the platform that can not only connect to these tools, but also analyze the data. While leading tools companies have similar software for their tools, these are walled gardens in the sense that each company is unwilling to enable connections to competing tools, which leads to coverage gaps. Given the increasing complexity of semiconductor manufacturing, yield improvement requires analyzing data from many different tools throughout the manufacturing process and coverage gaps dilute the value of the software. Outside of a handful of large foundries, companies throughout the manufacturing process (foundries, IDMs, OSATs, etc) lack the scale and experience required to develop internal software and even if they did, they suffer from the same walled garden problem in the sense that they are unwilling to share data with customers and other industry players. PDF’s neutrality with regards to both tools and customers combined with decades of industry knowledge enables the company to serve as the platform that consolidates and analyzes this data to drive process improvements. A former employee summarized the Exensio platform best:

“Exensio [is] a data analytics platform that spans basically the semiconductor manufacturing life cycle from infab through wafer sort through testing, assembly, packaging, and final test. Basically, their solution collects data from these different parts of the manufacturing flow, from tools in the fab, from testers, from the wafer itself, from assembly machines and final test equipment, to really give a unified view of all the data that's generated during the semiconductor manufacturing process. Why do you need that data? You need that data to both understand what might be driving yield excursions or yield crashes, as they call them, and to better predict how a wafer will do as it progresses through the manufacturing sector. Today, PDF has probably the broadest offering in that space. There's not a single company that owns those steps. PDF owns all those steps from fab, as I mentioned, wafer sort, etc., all the way through the process”1

PDF has additional hardware and software products that complement the core Exensio platform. PDF’s Cimetrix software takes data from equipment manufacturers and converts it into industry standard interfaces. The software is sold to equipment manufacturers and is installed on the hardware of these equipment suppliers. PDF’s Characterization Vehicle System includes test chips in addition to the hardware and software that enables new product yield enhancements.

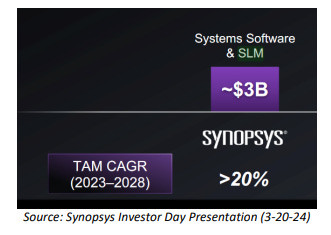

Competition in the industry is limited. PDF primarily competes with internally developed software and teams of engineers that seek to optimize manufacturing processes. Synopsys (“SNPS”) competes in the space through their Silicon Lifecycle Management group, but this is only a small division within the company.

DFI Opportunity

While the core platform business is an attractive investment on its own, there is an embedded call option within PDF that is finally showing some commercialization green shoots. In 2016, PDF began a significant investment period in a new eBeam inspection technology called Design for Inspection ("DFI"). Historically, semiconductor test companies have used optical inspection to test wafers for defects. PDF noticed that as wafers continued to shrink, optical inspection captured fewer defects. Vertical scaling of chip architectures (3D) also created a need for new technologies that could test chips below the surface area, a core limitation of optical inspection tools. Given PDF's expertise in electrical characterization, it developed an eBeam test tool that when combined with its software capabilities could provide better data and analytics to improve manufacturing yields. Early generation tools could only handle limited volumes and this lack of throughput capacity combined with unproven technology prevented adoption of the tool. Now on its third generation, DFI can handle significantly higher volumes than previous generations, which is leading to early signs of commercial adoption. While we don’t know specific customers, we do know that the first and only customer to utilize the second-generation tool recently ordered two thirdgeneration tools (this is likely INTC, although unconfirmed). PDF has also received initial orders of the thirdgeneration DFI tool from two other customers, providing further evidence of commercial viability (Rapidus and Samsung are logical candidates based on disclosures around geographic revenue and industry commentary). Note that for each of these customers, initial orders represent a fraction of total contract potential if the technology proves viable beyond the initial product ramp phase (discussed below).

While throughput capacity improvements have played an important role in recent orders, broader macro factors are also contributing to growing commercial success. The industry has seen the emergence of new foundries investing at the leading edge and these foundries need technology that can enable efficient yield ramps given a lack of internal capabilities and expertise. The growth of new foundry players also feeds into a broader nearshoring theme within the semiconductor industry post-COVID. Governments across the globe are subsidizing domestic fabs as the combination of COVID supply chain disruptions and more acute Chinese pressure on Taiwan both highlighted the economic dependence and geopolitical risk associated with the supply of semiconductor chips. Investments at the leading edge by new foundries should provide long-term tailwinds for PDF’s DFI tool (as well as Exensio).

Embedded within the emergence of new players investing at the leading edge is the question of whether optical inspection has reached its limit at the most advanced nodes. Today, eBeam is only used as a product development tool. Effectively, eBeam has tremendous sensitivity to measure defects, but is very slow. At some point in product development, the trade-off between sensitivity and speed reaches an inflection point where yields are sufficient that an optical inspection tool can be used to measure ongoing defects. Today, the eBeam inspection market is estimated to be ~$700mm while optical inspection is ~$3.5B given that it handles significantly higher volumes as part of the production process. It is unclear whether the adoption of PDF’s DFI tool by multiple industry players is purely related to product development ramps or represents the potential for the tool to be used further downstream in production. Faster throughput and the multiple orders from the first third-gen customer suggest that this technology may have reached an inflection point where eBeam can take a greater share of inspection revenue. At a minimum, DFI appears to have reached a point where foundries will utilize the tool for product ramps at advanced nodes. While eBeam technology is somewhat unproven, other leading players are investing in competing products, signaling a need for technology that can supplement and/or replace optical inspection at the leading edge. ASML made a significant investment in eBeam technology when it acquired Hermes Microvision (“HMI”) in 2016 for €2.8B. Interestingly, one of HMI’s leading customers at the time was rumored to be Intel. The quote below from ASML in 2022 does a great job of laying out the need for eBeam as well as the growing need for software in the manufacturing process.

“We think there's a case for [eBeam replacing optical]. The whole driver behind it is the extendability of the resolution of e-beam. The drawback that has kept it in R&D has been the productivity with multi-beam, that's where you start to get the productivity up. And certainly, they're extending the capabilities of brightfield inspection with a lot of software and AI, but we think the extendability of the resolution capability of multibeam -- of e-beam along with the productivity gains that we'll get with multi-beam will get it to a point where for layers, like EUV-type of layers. It will start to come into play for pattern wafer inspection. And then again, depending upon how high we get the productivity up, will dictate whether it could start to take… The reason we did the YieldStar and was again, our CTO realized a long time ago that these tools are big hunks of glass and metal, and they vary with temperature and pressure. And even if we made the perfect tool, it's only going to stay perfect for so long as you start pumping high power light through it. So if you relied on the overlay metrology and inspection, which is done on a statistical sample of wafer somewhere down the line, you could process a lot of wafers before you [calculate] the error. So we were looking to have an in-line metrology tool to your point because it's -- things are going to drift faster and you need to be able to control it real time. So the modeling software is an important part of that because it models the whole system and optical column and it knows what's going in and what should come out. And if it's not coming out the way it should, what knobs to turn. But you need the measurement capability, which is where YieldStar came in and where the HMI or the e-beam will come in. We didn't want to be a metrology company. We're an outsourced company. So we went to people that know how to do it best and we said, "Hey, this is what we want to do and how fast is your tool and at that time 50 wafers per hour. And we had a road map out to 300 wafers per hour, and we couldn't get anyone to sign up for that type. So we had to do it ourselves. Now it took a while. And now we have a tool that's in line. But to your point, I think you're going to see more in-line processing. But again, the differentiator is having that software that allows you to, knows what knobs to turn to control at real time.” - ASML 2022 Cowen TMT Conference Call (6-1-22)

Industry Partnerships

Additional evidence of the growing importance of PDF’s Exensio software can be seen in numerous industry partnership announcements over the last few years. In 2020, Advantest, the largest semiconductor test equipment company in the world, partnered with PDFS to white label the Exensio software as Advantest Cloud. The partnership increased the number of tools connected to Exensio and, more importantly, was a strategic validation of the value of Exensio's software. If one of the largest tools companies in the world foregoes developing their own software, it's unlikely other industry players will invest to develop a competing product. It also highlights the value of PDF's independence that it can connect with any tool, making it the industry platform of choice. Solidifying the partnership was the 9% equity stake that Advantest took in PDFS.

Other high-profile partnerships between PDF and industry players include SAP, Siemens and Kulicke & Sofa (“KLIC”). Each partnership brings unique value to the ecosystem with SAP providing a direct connection to financial planning ERPs, while Siemens and KLIC both provide additional tools connections in back-end test and assembly. These partnerships are additional evidence that the industry is coalescing around PDF as the dominant yield improvement platform. While the partnerships are validation of PDF’s products and value in the ecosystem, they also provide a new distribution point for PDF’s products. Given the Company’s roots as a consultant, improving distribution represents an important growth opportunity for PDF’s growing suite of products.

Financials

From both a product development standpoint as well as a financial perspective, PDF’s business model transition has taken a long time to evolve. Given the long tail on high margin Gainshare revenues (the life of a product), the industry's slow acceptance of new technology, and a need to heavily invest in this new business model, PDFS has effectively been a business in transition for nearly a decade. However, the model transition is now complete as Gainshare revenue only accounted for 8% of the Company's revenue in 2023 and investments to support the transition are largely complete.

Forecasting the forward growth profile of the business now that the transition is complete is difficult, but we have several industry data points combined with historical information that can inform some reasonable assumptions. Per Synopsys, the industry has grown at a 12% CAGR over the last five years and PDF has significantly outpaced this growth with a +29% organic revenue CAGR in their Analytics business over the same time. It’s worth reiterating that this strong growth has been masked by a -71% decline in PDF’s IYR revenue, but this headwind is behind us with IYR only representing a small percentage of revenue today. Increased complexity for chip designs and ongoing investment by new industry players should continue to drive growth rates that outpace the broader semiconductor market. Product lifecycle management in the semiconductor industry is also less well developed (SNPS describes themselves as being a pioneer) than in other industries, which provides further tailwinds for PDF’s software. The Company is forecasting a 20%+ long-term revenue CAGR, with potential upside likely driven by DFI’s ultimate success. SNPS has a similar growth forecast for their silicon lifecycle management group, which provides some verification of PDF’s outlook.

The ongoing maturity of recent industry partnerships are also supportive of PDF’s long-term revenue growth outlook as these have only provided a modest revenue tailwind over the last five years. Early evidence of accelerating revenue growth was demonstrated in Q4 ’23 and Q1 ’24 when the company recorded its third and second largest bookings quarters ever (both supported by the recent DFI orders). The last 18 months have also proven the durability of the analytics business as revenue has continued to grow despite the broader downturn for the semiconductor industry.

From an expense perspective, PDF incurred significant investments to convert their on-premise software to a SaaS product, R&D related to DFI and and increased spending on sales and marketing. Most of this spending is now in the rearview mirror. Gross margins, which troughed at 50% in 2018, have stabilized around 70% and should normalize in the 75-80% range depending on revenue mix. Based on the forecast for 20% revenue growth, PDF should be able to leverage the OPEX investments and easily achieve their targeted operating margin of 20%. Longer-term operating margins could normalize in the 25-30% range, again depending on revenue mix.

In terms of the balance sheet, the company currently has $122mm of cash and investments and no debt. Strong free cash flow going forward should lead to cash balances growing, which can support share repurchases or additional M&A.

Valuation

Valuing PDF is also difficult given a strong core software business, the emergence of the DFI hardware, and a lack of pure play comparables. PDF has an industry leading core software business that should grow in the ~20% range, without the benefit of DFI. SNPS and CDNS are the closest peers and using pre-COVID trading multiples suggests a valuation of 30x EBITDA (note both are currently trading at 35x EBITDA). SNPS also acquired ANSS for 36x EBITDA earlier this year, which provides another useful comp. Using a stand-alone multiple of 30x yields a $62 price target based on my 2027 forecast, or a +17% annualized return from the initial purchase price of $35.25. Using a 35x takeout multiple yields a $72 price target, or a +22% annualized return from the initial purchase price.

While this base case is a compelling investment opportunity on its own, it does not include full value for commercialization of DFI. PDF does not disclose DFI specific revenues, but we can make some assumptions to reach a reasonable estimate. Bookings for the DFI tool have averaged ~$50mm under 5 year lease agreements. I assume that the tool accounts for $40mm of the value of the lease agreement and that the software and services account for $10mm. The reality is that the tool and software are a package deal, so splitting out the exact value of each piece is very difficult, and management has not provided any guidance on these metrics. Based on the number of tools leased and timing of lease starts, I estimate that 2024 DFI revenues will approximate $30mm. The current leasing arrangement understates the full revenue of the tool if it were to be fully commercialized and sold as a capital equipment purchase given that the total cost is spread over multiple years (this further complicates the valuation analysis). PDF has noted that it is scaling production capacity for DFI tools and expects to meaningfully increase capacity in 2025 (current capacity is 4 tools/year). Assuming a $40mm outright sale price (different than the current lease structure) and capacity of 8 tools/year, this would suggest annual revenue potential of $320mm.

ASML purchased Hermes for €2.8B in 2016 when the company was generating €200mm of revenue, or a 14x revenue multiple. A 14x revenue multiple on $300mm of revenue would equate to $4.2B of value compared to PDF’s current valuation of $1.4B. Using a more conservative approach to valuing the DFI tool would be to assume that the tool has similar margin characteristics to KLAC’s optical inspection tools of 43% and would trade a similar multiple to tools peers KLAC/AMAT. Based on KLAC/AMAT’s 20x EBITDA multiple, this would imply $2.7B of value for the DFI tool, although it’s not unreasonable to assume that PDF would trade at a premium given a faster growth rate. This provides a rough framework for the potential value of the DFI business to the extent that PDF can fully commercialize the product and represents significant upside to the base case presented above. Making a bet on an emerging technology is difficult and comes with substantial risk. However, given the attractive upside in the core software opportunity by itself and the significant potential embedded value of DFI, the risk/reward skews positively.

Management & Ownership

As noted above, PDF is still run by the two co-founders who are both actively involved in the company. Collectively, these two founders own 10% of the company and neither has sold a share since 2007. This provides a strong alignment of interests between minority shareholders and management. Advantest, a potential strategic acquirer owns another 9% through its strategic investment in 2019.

The former CEO of SNPS joined PDF's board in 2023. At a minimum, his appointment is a valuable asset to PDFS.

Summary Thesis

While PDF is clearly a complicated investment, the reality is this Company is one of the scarcest assets in the semiconductor industry, an industry that I believe has structural growth characteristics for decades to come. PDF sits at the nexus of multiple different trends that are seemingly coalescing around PDF’s technology. Furthermore, the Company’s solutions are critical to ongoing advancements in semiconductor production. As the manufacturing of semiconductors has grown in complexity at more advanced nodes, PDF’s Exensio software is becoming an industry platform that can help industry players throughout the ecosystem improve yields and efficiencies. More complicated manufacturing requires a platform approach to monitor data all through the manufacturing process. Jensen Huang, president and CEO of NVIDIA, echoed that perspective at SNUG.

“Where the system starts and ends is just completely amorphous now,” said Huang. “We need to build the entire chip, which is this entire system, in silicon, in digital twins. And when we say, ‘Hit enter,’ we need to know that it’s perfect. It’s already lived inside the simulator, and it’s been living in that world for a couple years. And so when I finally say launch, I know every single bill of material, how everything’s going to get put together, and all the software has already been brought up.”2 - Jensen Huang, CEO NVDA.

PDF is differentiated in the industry given its position as an independent third party that can process and analyze vast amounts of data in real time to drive manufacturing efficiencies. PDF’s emerging eProbe tool, DFI, is also showing early signs of commercial success and represents a transformational opportunity for both the Company and the industry. While the thesis is not predicated on the success of this product, it is an exciting call option.

The timing of the investment also seems reasonable right now. PDF has discussed most of these trends going back as far as the Company’s 2016 Analyst Day. However, major evolutions in equipment and software take years to play out because these node transitions take so long to develop. The industry is finally moving significant volumes to nodes that PDF can target. Supply chain resilience post-COVID and sovereign investments to support domestic fabs are additional tailwinds for the Company, both of which have inflected positively over the last three years.

While I wish the business was easier to model and value, these positive investment attributes outweigh the opaqueness of the company's financials. Management ownership, the significant investment by a leading test company, net cash position and high ROIC provide further confidence around the investment opportunity. I have started the position at a smaller size than most initial positions to account for the complicated financials and limited visibility into orders. As I gain more confidence with the business, I hope to add to the position.

We have 5 more ideas below for our paid subscribers.