Welcome, subscribers!

We’re back with a lot of new investment ideas!

If you enjoy what we do, please consider forwarding to a friend or colleague who might also appreciate our work.

This week, we’re excited to highlight 10 new ideas, including:

A microcap precision parts manufacturer with a new, high-quality management team aiming to revitalize the company.

A midcap energy exploration consolidator in the Williston Basin with strong assets and a recently announced merger aimed at capital efficiency and shareholder alignment.

A small-cap utility navigating through infrastructure investments and inflation impacts, with a strategic rate increase proposal likely enhancing future earnings.

Keep reading to learn more.

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

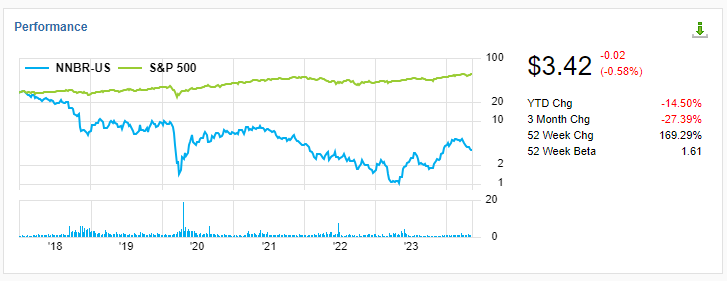

Greystone Capital Management highlighted their new position in NN, Inc. (NNBR), a microcap manufacturer of plastic and metal high-precision components. Greystone outlines the opportunity below.

NN, Inc. (NNBR)

For readers in the habit of using quantitative screens to identify investment ideas, NN will likely cause you to turn the other cheek. At first glance, this business does not look pretty. Under the hood, there is a lot to like. The fact patterns here along with management efforts are very similar to our investment in Bel Fuse. Like Bel Fuse, NNBR possesses strong technical expertise, a large manufacturing footprint, and long-dated customer relationships. Also, like Bel Fuse, NN was historically mismanaged, which shows up in the areas of pricing, manufacturing overhead and new business wins.

NN, Inc. is a precision parts manufacturer that specializes in the development of plastic and metal components for various end markets. The company operates through two segments, Mobile Solutions and Power Solutions. Mobile Solutions manufactures parts primarily for the automotive market in power steering, braking, and fuel systems, while Power Solutions makes parts for general industrial, electronics, and medical markets. Specifically, NNBR manufactures parts that help other machinery spin, turn, and rotate. This other machinery is made up of everything from power steering systems to surgical devices to aerospace components. The company has a history dating back to the 1980’s as a manufacturer of metal balls and rollers for the oil and gas industry, and today their precision capabilities and blue-chip customer base means they manufacture a wide variety of SKUs leading to a stable base of $500mm in revenues.

The performance and durability required of NNBR’s parts means that they have a high cost of failure, making them critical components despite their low cost to end customers. This has led to long-standing relationships with their customers, along with many of these components being sole source, making NNBR’s competitive position quite strong. This helps partially explain how, despite NN losing its way recently, the customer base has held up well, despite a history of poor acquisitions, too much leverage and an incredibly weak culture.

Thankfully, our involvement is recent, following multiple positive changes that the market has yet to price in, despite the ‘why now’ part of the investment thesis being more evident today than at any point in the past few years. As management continues to execute, I believe NNBR is rapidly approaching a more normalized cash flow profile that will reveal the future is going to be much different than the past. As you’ve likely seen with good businesses that besmirch their public market reputation, the prior management team took on significant leverage to make a string of bad acquisitions that didn’t contribute meaningfully to profitability nor provide any cost savings or manufacturing synergies. Companies can sometimes hide behind bad deals, but when COVID hit, NN was forced to take drastic action in the form of unfavorable capital raises along with the sale of one of their other business segments in order to pay down debt.

Today is a new day at NN as there is an incredibly high-quality management team and Board in place, spearheaded by two activist funds, also the largest shareholders of the business. Current CEO Harold Bevis is an industry veteran who has been there, done that in previous roles, having spent the last twelve years at two different public companies, Xerium (XRM) and Commercial Vehicle Group (CVGI), both of which left shareholders much better off than before he arrived. In line with my comments above about people and incentives, Harold recruited some old team members to join him at NN, where each have the opportunity to earn many multiples of their base salaries if successful. In fact, Harold dumped his prior role at CVGI to take the CEO job at NN, which should bode well for us as one source described Harold as someone who will ‘run you right over’ if you get in his way.

Since their hiring, management has laid out several key strategic pillars on which they will focus and have already made remarkable progress in a short period of time. These pillars include strengthening the leadership team, addressing unprofitable business, expanding margins, delivering consistent free cash flow, and increasing new business wins. While that sounds like a tall order, most of these initiatives only require adopting common sense operational tactics. Importantly, there is valuation upside even before new business wins take place or top line growth resumes. In other words, there is plenty of low-hanging fruit to lower costs and expand margins, the bulk of which is being undertaken as I write this letter. Some of these items include addressing unprofitable business, implementing better pricing practices, and instituting a more centralized system to purchase raw materials. If I am correct about the cost improvements for each one of these items, the permanent flow through to EBITDA would be tremendous.

While there is execution risk, and NNBR is still a show me story, I’m confident that in the nearterm that management’s efforts will start to show up in the company’s financials and reveal NNBR to have much greater earnings power than is currently being demonstrated.

Management has guided to $47-55mm of EBITDA for FY24, and there is likely a significant amount of upside to that figure as early as this year. Then, as new business wins contribute to improved top line growth, operating leverage should also kick in, presenting the opportunity for increased free cash flow conversion over time. This should help change the perception of NNBR, which will be very powerful for our returns.

This week, we include 9 more ideas for our paid subscribers.