Welcome, subscribers!

We’re back with more investment ideas!

If you enjoy what we do, please consider forwarding to a friend or colleague who might also appreciate our work.

This week, we’re excited to highlight 5 new ideas, including:

A small cap food distributor with a narrow (but quite profitable) niche

A cash-rich biotech company with a lot of shots on goal

A consulting firm focusing on defense contracting

Keep reading to learn more.

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

Sohra Peak Capital Partners released an extremely detailed and well-researched memo on Kitwave Group PLC (KITW-GB). Kitwave is a small cap, UK-domiciled food distributor. Sohra Peak sees in excess of 100% upside over the next 3-5 years. We include an excerpt from their lengthy write-up below but encourage you to read the whole thing.

Executive Summary

• Kitwave Group PLC (“Kitwave”) is a consumer staple U.K.-based food distributor that specializes in delivering impulse products, ambient foods, frozen & chilled foods, fresh foods, and alcohol to over 42,000 convenience stores and foodservice providers across the U.K.

• Kitwave is one of the U.K.’s largest food distributors that specializes in servicing “independents,” or mom & pop establishments and small chains including convenience stores and restaurants. In contrast, most of Kitwave’s larger distribution peers focus on high-volume, high-revenue distribution contracts (e.g. 500-location QSR chain) with typical minimum order values of £1,000- 2,000+. These larger peers don’t possess the infrastructure nor the desire to compete with Kitwave’s high-frequency, low £100 minimum order value drops in the independent segment of the market.

• Regional and local food distributors, Kitwave’s typical competitors within the independent segment, are unable to consistently provide better quality distribution service to customers than Kitwave. This is because Kitwave’s national scale allows it to earn greater bargaining power than its peers over food manufacturing suppliers, which Kitwave in turn reinvests into providing better service to its customers through a best-in-class 98-99% on-time and in-full delivery rate, more frequent deliveries to customers, lower minimum order values, and greater SKU selection.

• Since FY16 Kitwave has compounded EPS at a +22% CAGR largely through M&A.3 With over £10bn of Kitwave’s independent retail & convenience and foodservice TAM segments still fragmented, we believe Kitwave has a long runway to continue rolling-up smaller food distributors, particularly in the higher-margin and higher ROIC foodservice segment, and can continue compounding its profits at a +10-20% CAGR over the next 3-5 years. Kitwave should also benefit organically from the industry’s shift away from cash & carry procurement and towards delivered solutions as well as continued LSD-MSD industry growth for convenience stores and restaurants.

• Shares currently trade at NTM 13.1x P/E and NTM 7.9x EV/EBITDA based on our estimates of FY24 results which appear to be substantially lower than food wholesale peer valuations, despite Kitwave’s industry-leading growth rates and ROIC. 1 We believe Kitwave’s shares have room to appreciate from £3.85 today to £7.43 – £9.85 over the next 3-5 years.1 We also note that Kitwave is the U.K.’s largest pure-play delivered food distributor that is not already owned by a larger parent company which, when considering Kitwave’s large and increasing revenue base, could make Kitwave an attractive future acquisition target.

• CEO Ben Maxted and CFO David Brind have both been Kitwave executives for over 12 years and have together completed and integrated 14 acquisitions demonstrating a terrific M&A track record.

Introduction to Kitwave Group

Kitwave Group is a U.K.-listed small-cap delivered food wholesale business headquartered in Newcastle Upon Tyne, U.K. The company was founded in 1987 by 15% shareholder and former CEO Paul Young as a single-site confectionary wholesaler. Rather than compete on price with the cash & carry store giants, Paul was seeking to do something different. His goal was to offer a delivered food wholesale solution for convenience stores to whom he would sell impulse products with a focus on quality distribution service.

In the 37 years since, Kitwave through organic expansion and acquisitions has grown into a £600+ million revenue stalwart. Kitwave today sources its products from over 300 suppliers, has a network of 30 depots including 8 main depots and 22 satellite depots, operates 550 delivery vehicles, carries over 44,000 product SKUs, serves over 42,000 U.K. customers, and fulfills over 4,800 daily deliveries.

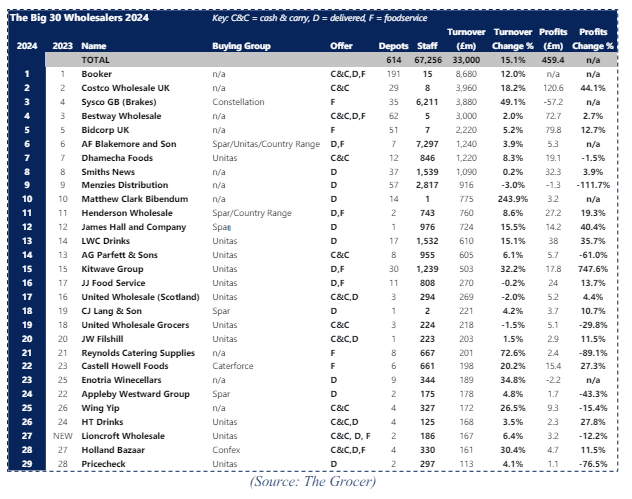

As of February 2024, Kitwave Group stood as the U.K.’s 15 th -largest food distributor.

In short, Kitwave Group is one of the U.K.’s largest food distributors that specializes in servicing “independent” customers, or mom & pop establishments and small local chains, that have food and beverage procurement needs. Kitwave’s primary customers include convenience stores and restaurants. Kitwave’s food distribution operations are entirely delivered, with cash & carry stores being the other common source of wholesale food procurement for these customers.

Our research into Kitwave Group, its industry, and its competitors over the past several months have led us to develop high-conviction in Kitwave as an investment opportunity. In this memo, we will discuss in detail the main industry segments that Kitwave serves, why we believe Kitwave possesses a sustainable competitive advantage within these industries, why we believe the industry’s largest distributors cannot and will not compete within Kitwave’s customer segments, why we think substantial long-term growth is likely for Kitwave, why we believe Kitwave is meaningfully undervalued, and why we believe this investment opportunity exists.

The large majority of Kitwave’s growth has occurred over the past 13 years, when its founder Paul commenced the company’s journey of rolling-up smaller food distributors to bolster the company’s products and capabilities, expand its geographic reach, win new customers, and ultimately grow profits in a way that creates shareholder value. Paul accepted the company’s first private equity partner NVM in 2011 to raise the capital required to pursue this roll-up approach.

It was also during this period in 2011 when current CFO David Brind and CEO Ben Maxted joined the company. Both executives have been heavily involved in the company’s 14 acquisitions over the past 13 years. Together, they have demonstrated an excellent track record of successful M&A, have built the company’s highly proficient frozen & chilled distribution capability from scratch, have exhibited early success in building the company’s foodservice business, and will soon own over 5% of the company’s shares following the receipt of equity incentive awards. Since 2016, its earliest publicly available period of financials, through 2023, Kitwave has compounded its earnings per share at a +22% CAGR.

In 2016, Kitwave transitioned to its second private equity partner Pricoa, and then in May 2021 completed its IPO. The company was actually preparing for an IPO with a target date of April 2020, but the rapid unfolding of COVID and its impact to both equity markets and the company’s operations shelved these plans for a little over a year.

Although the food wholesale industry appears to be boring and low-growth, the industry has presented tremendous winners over the years, largely through M&A. Consolidation is highly common among larger industry participants and, for reasons we will discuss, can be a smart way to add both strategic and economic value when done correctly. Food wholesalers such as Kitwave also operate highly recession-proof businesses with heavy exposure to consumer-staple goods (e.g., crisps, sodas, snack bars, alcohol) and customer segments (e.g., convenience stores and restaurants).

Today, we believe Kitwave represents an opportunity to own a high-quality business earning a 17% return on invested capital, containing a high likelihood of +10-20% annualized growth for the next 3-5 years, and currently trading at a valuation of 12.3x our estimate of FY24 earnings.1 While this investment likely won’t produce grand-slam returns, we do think this investment in Kitwave offers a strong probability of double digit investment returns while also carrying a low probability of losing money.

As we lay out in detail in the “Valuation” section, Kitwave’s current valuation reflects a substantial discount to comparable peers across Europe and the U.S. which we believe is unjustified. We believe this opportunity exists for several reasons, including Kitwave’s short-lived tenure as a public company with little coverage and awareness, and the fact that its only publishing sell-side research firm has perpetually underestimated the company’s forward-looking growth prospects to a significant degree and continues to do so, which may be masking the company’s true growth prospects from the public. We believe Kitwave’s share price has room to appreciate from £3.85 today to £7.43 – £9.85 or a +93-156% gain over the next 3-5 years.

We have 4 more ideas below for our paid subscribers.