Welcome, subscribers! Today, we share lengthy pitches for companies in pest control and aggregates— plus 5 quick hitter large cap ideas.

Read on to learn more. 📕👇

Your support is appreciated. If you enjoy this issue, please forward to a friend or colleague!

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

Andvari Associates purchased a new position in Rollins (ROL), the nearly $20 billion market cap pest control company. Andvari went deep on their thesis in their latest letter.

INTRODUCING ROLLINS

Rollins (ROL) is the holding company for multiple pest control businesses of which the largest and best-known is Orkin. After market close on September 6, the company announced the Rollins family would be selling up to $1.76 billion worth of its 50.5% ownership stake in Rollins. This caused the share price to decline nearly 10% the following morning. We decided to take advantage of this decline.

Andvari has admired Rollins for over a decade as the business has many attractive qualities. First, the company has the wind at its back as it operates primarily in the warmer climates of the southern states of America. This region is where bugs and other pests are most pernicious. This also happens to be the region where people continue to migrate for work and for retirement. This migration is a steady trend that will continue to drive the growth of Rollins at an above average rate for decades to come.

Second, Rollins is one of the largest companies that is consolidating a very fragmented industry. For context, there are 17,670 pest control companies in the U.S. with combined annual revenues of $11.04 billion.1 Over just the last three years, Rollins has acquired over 100 pest control businesses. Rollins’ annual revenues in the U.S. will be about $2.87 billion for 2023, so this means it has about a 26% market share. A tremendous opportunity to grow organically and through acquisitions still remains for the company.

Third, Rollins provides valuable services that are a small portion of the total cost of either owning a home or operating a business. For a business owner, rules and regulations make it so they must purchase pest control services from someone. This gives Rollins’ pest control brands the ability to raise prices 4%–5% a year very easily. We also view pest control services as non-discretionary and recession resistant. Few home or business owners will tolerate pests within their dwellings. Thus, revenues for Rollins are highly predictable: about 80% of revenues are recurring.

Fourth, the size and scale of Rollins gives it an advantage over smaller competitors on two fronts: purchasing supplies and acquiring other pest businesses. On the supplies front, scale enables Rollins to purchase at lower prices for its stable of pest brands. On the acquisition front, because Rollins has acquired hundreds and hundreds of businesses over the decades, it has become a very disciplined buyer that will walk away from deals that are too expensive. Further, when Rollins acquires a pest control business, it can easily improve the acquired company by helping them increase prices, modernize marketing tools, share best practices, and by providing capital for faster growth.

Fifth, the pest control business—like most service businesses—is one that does not require large capital expenditures. Over the last ten years, capex has ranged between $18 million and $42 million annually. This is all while annual revenues have increased from $1.3 billion to nearly $3 billion today. Rollins gushes free cash flows that it uses to acquire more businesses, pay an increasing dividend, and occasionally repurchase shares.

Finally, Andvari likes the fact this business is unlikely to ever become obsolete due to changes in technology. Rodents and pests will always be around and there will always be a need for pest control services. Methods used to combat critters and creepy crawlies in twenty or fifty years are unlikely to be much different than the methods of today.

When you put all the above together, you wind up with a business with excellent financial characteristics. Average annual revenue growth has been 8.2% over the last ten years. Profits have grown faster than revenues. Gross margins are above 50% and EBITDA margins are now at 22.3%. The incremental margins—the percentage of every additional dollar of revenue growth that is converted to EBITDA—are very good: they range from 30% to 40%. Andvari believes both gross and EBITDA margins can slowly go higher over the long term. We also believe we purchased Rollins at a reasonable price that will allow us to compound our money at above average rates.

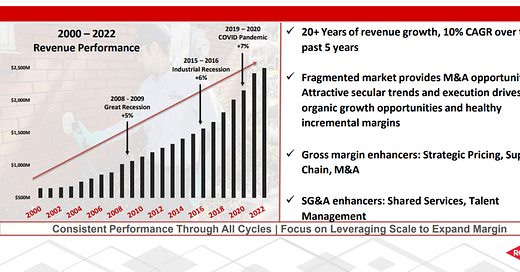

Voss Capital is attracted to building products company, CRH Plc (CRH), and recently made it one of their biggest positions. Their latest quarterly letter includes a detailed review of their thesis.

New Long: CRH Plc

While the market has recently been focused on GPU chips and AI scripts, our attention has been on cement blocks and crushed rocks. We've enthusiastically made CRH one of our largest positions ever at cost due to its limited downside. CRH is among the largest aggregates and infrastructure companies in the United States and Europe and has recently relisted to the NYSE from the LSE, which we believe will be a catalyst for the stock to rerate upwards towards peer valuations as its undeniable value hiding in plain sight becomes more widely discussed.

In 1970, Cement Limited and Roadstone Limited, two Irish infrastructure-focused companies, combined to form Cement and Roadstone Holdings, or "CRH.” An investment of $1 million into CRH upon its founding since that fateful merger ~53 years ago would have turned into ~$1.5 billion by mid-year 2023, an annualized total return to investors of 15.0%, a high rate of compounding we think can continue.

Half a century of success at CRH has been driven by disciplined operations and capital allocation that we believe derives from a company culture built around appropriate financial incentives. CRH’s M&A playbook has proven to be successful as an acquisitive company like CRH can't compound at a rate of 15% over 50 years unless acquisitions and divestitures have been executed at attractive prices. Over the last five years, CRH has spent $10.3 billion on acquisitions while receiving $10.5 billion in proceeds from divestitures across dozens of transactions, with the average acquisition multiple ranging from 7x – 8x EBITDA depending on the year and the average exit multiple clocking in at 11x EBITDA.

As currently constructed, the Company has four primary segments, with EBITDA contribution as follows:

The Materials Solutions segments are vertically integrated across construction products and services – producing and supplying aggregates, cement, ready mix concrete, asphalt, and related services such as road paving. The aggregates business has terrific economics, as most operate as local oligopolies or monopolies. If you are a user of aggregates, you will almost certainly use the closest quarry to your project because the cost to transport aggregates is such a high percentage of the value of the actual product. It doesn't make sense to try and get a discount from the quarry 15 miles further away because all the savings will be more than eaten up by increased transportation costs. The industry has historically enjoyed stable annual pricing increases, and over the last 52 years, aggregates annual pricing has only dropped year-over-year in three of those years (and only by -1.5% on average).13 CRH is sitting pretty with the largest aggregates mineral reserves in North America at 19B US tons – comfortably more than Martin Marietta (17B tons) and Vulcan Materials (16B tons).

On the cement side of the business, industry dynamics are like Greg Focker’s portfolio—strong to quite strong. It is very difficult to add cement capacity in the United States because of stringent environmental regulations, so the domestically produced supply is maxed out at around 100M metric tons per year. CRH has about ~11% market share across its 12 plants in North America. At the same time, even with depressed residential development as of late, US demand is running at ~120M metric tons per year. Excess demand is supplied by imports, which come at a significantly higher cost than domestically supplied cement. To state the obvious, this supply/demand dynamic has been very favorable for cement pricing, a trend we see continuing.

CRH is among the largest asphalt manufacturing and paving companies in the United States and has clear advantages of scale that help the Company produce best-in-class margins on this product. Bitumen is a key component in producing asphalt, and due to CRH's massive size, they have a "winter-fill" program that allows the Company to acquire bitumen cheaply in the winter months and store it for use during warmer construction months, which results in a cost advantage against smaller competitors that lack access to that kind of infrastructure.

A key differentiator for CRH is its vertical integration. Materials produced in the aggregates and cement business are supplied as components to downstream businesses like asphalt and ready-mix concrete. The integration between the Materials Solutions business and the Building Solutions business provides customers with end-to-end solutions whereby they only must deal with one vendor compared to a handful. We believe this improves logistics and helps projects get completed on time and on budget. CRH can construct components off-site and deliver them on an as-needed basis, reducing labor on-site and idle time from unorganized logistics scheduling between disparate third-party vendors.

The Building Solutions segments manufacture and supply outdoor products such as hardscapes, fencing, railing, masonry, packaged products, lawn and garden, pool finishes, and composite decking, in addition to concrete infrastructure, precast products, drainage systems, water management, and other construction components.

The first subsegment of Building Solutions is the Outdoor Living business. This business has one of the broadest offerings of products for public and private outdoor spaces - including Pebble Tech pool finishes, MoistureShield composite decking that competes with Trex, Barrette railing and fencing, and Belgard paver stones and outdoor kitchens. If you have recently remodeled your backyard, it is highly probable that you’ve installed at least one of their products.

The next subsegment of the Building Solutions segment is the Building & Infrastructure business. This business provides critical infrastructure for connecting, protecting, and transporting water, energy, and telecommunications infrastructure. This segment thrives on large complex projects and as mentioned, is fully integrated with the upstream Materials business. CRH is heavily involved early in a project's lifecycle, beginning with the design phase, and they develop customized solutions given their expertise and broad capabilities. Hereis an example of a stormwater upgrade in Tampa, FL, that the Company completed in 2022. A main thoroughfare was repeatedly flooded during storms in the area, and CRH's team was able to eliminate flooding and reduce pollution runoff associated with these weather events by installing a comprehensive stormwater management system—Lord knows Houston could use some of these.

Currently, about 75% of CRH's EBITDA is earned in North America (~10% higher than the average S&P 500 company), and the remaining 25% is earned in Europe and the rest of the world, with the Company having expectations that 90%+ of earnings will come from North America in the coming years.

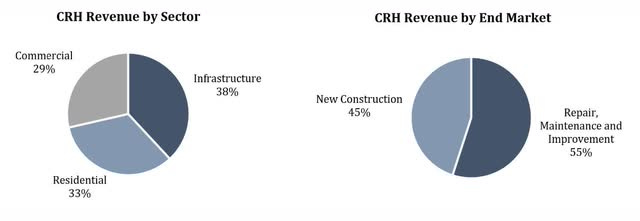

Across all CRH, 55% of revenue is derived from repair, maintenance & improvement, and 45% is derived from new construction. Revenue split by sector is ~40% infrastructure, ~30% residential, and ~30% non-residential.

US Infrastructure Tailwinds:

As one of the largest building materials businesses in North America, CRH may be the single largest beneficiary of the recent unprecedented government infrastructure spending programs, including the Infrastructure Investment and Jobs Act (IIJA), CHIPS and Science Act (CHIPS), and the Inflation Reduction Act (IRA). For instance, of the $1.2 trillion in IIJA funds, about $350B is allocated to Highway funding, and CRH is the #1 road paver. Throughout the 5year life of the spending bill, this would increase the federal spending on highways by about 50% above the baseline2021 spend, from ~$47B p.a. to north of $70B per year.14 The IIJA has been touted as the most transformative public investment program since the 1930's.

Perhaps equally as important as the IIJA spending is the onshoring of manufacturing that is occurring in the United States, with the support of the CHIPS and IRA. This has led to $200B+ of major commercial projects that have already been announced to bring critical manufacturing back to the US. These "mega projects" are squarely in the sweet spot for CRH, and they offer significant visibility for the infrastructure business through 2030. The Company has quantified the increase in annual manufacturing-related spending in the US as 2.5x higher than previous levels.

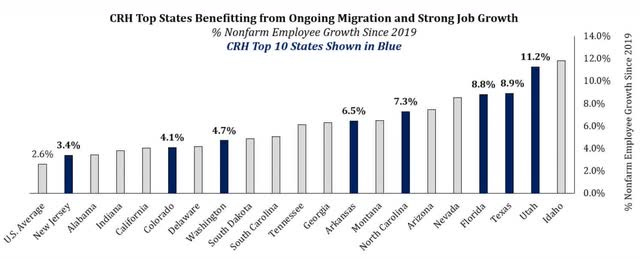

Many of CRH's top markets are benefiting from ongoing interstate migration and strong job growth, with three of CRH's top states ranking among the top four in terms of employment growth since 2019. Not only will strong local economies help to keep state budgets flush at their current record levels, but this growth necessitates increased infrastructure investment, and a significant piece of IIJA funding will go to these states. Note CRH still has exposure to other fast-growing states like AZ and NV that fall just out of its top 10 states.

Relisting:

As noted above, CRH completed a relisting to the US on September 25th and now maintains a primary listing on the NYSE, with a secondary listing on the London Stock Exchange. This relisting will entice more investors over the coming year to rerate the stock much closer to US peer valuations rather than languishing at European peer valuations. Once the sell side and US-based investors grow familiar with the name, we believe the inexplicable valuation gap will be too hard to ignore and the market will do its job of appropriately valuing CRH as the best-of-breed operator within an advantageous industry.

In addition to increased investor awareness, the Company has cited increased business opportunities as CRH will appeal more to customers who favor dealing with US-based companies, not the least of which are state and local governments. It will also provide better opportunities on the M&A side through better visibility and a strong currency in US company stock for potential acquirees.

CRH has a keen focus on being well represented in US-based indices and once the Company files its 2023 10-K around March 2024, they will be eligible to be included in the S&P 500, which provides another major catalyst from passive flows and index-constrained active managers alike.

Valuation:

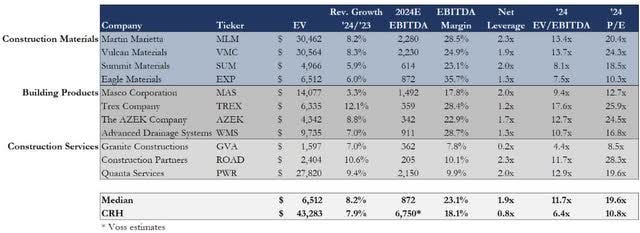

We believe the current valuation of CRH provides for limited downside and is significantly cheaper than peers, despite being a best-in-class operator across all the business segments the Company competes in. CRH trades at an 11.5x P/E based on the '24 consensus and 7.0x EV/EBITDA (6.4x our estimate). As shown below, the most relevant peers are trading around 10-15x 2024 EV/EBITDA and around 18-28x on an earnings basis, a significant premium to CRH despite it having much lower leverage and better cash flow conversion.

It is also worth highlighting the fact that the Company has provided guidance for $35B of cash generation over the next five years, an amount equal to >90% of the Company's current market cap. We estimate this is comprised of $25B of FCF generation and $10B from re-levering the balance sheet from 0.8x net debt/EBITDA to about ~2.0x.

Our price target, based on our 2025 estimates, uses a 10.3x EV/EBITDA multiple, which implies a ~20x P/E multiple. This equates to a ~$120 per share value (including dividends received), which is ~118% above the current price of $55. We would expect these estimates to be priced in about one year from now, by late 2024. These assumptions are conservative relative to historical comparable company valuations of around 20x – 30x NTM P/E.

Likewise, on an absolute valuation basis, we think US investors should soon recognize that a company with this level of stability in operations, an enviable capital allocation track record, and robust earnings growth visibility should not trade at just 11.0x earnings.

Vulcan Value Partners initiated 5 new positions across their various strategies in the third quarter. We include their brief theses on Diageo (DEO), Marriott (MAR), Texas Instruments (TXN), UnitedHealth (UNH), and Sealed Air (SEE) below.

Diageo is a global spirits and beer producer with over 200 brands, including Johnnie Walker, Crown Royal, Guinness, Smirnoff, Baileys, Don Julio, and Casamigos. Diageo’s spirits segment generates more than 80% of the company’s revenue, and the spirits segment has been taking share from beer and wine over the last decade. The company is diversified across geographies, brands, and alcohol categories. Diageo has strong margins and high returns on invested capital. Its management team has an excellent track record for brand and product innovation, moving into high-growth categories at the right time. The company has pricing power and performs well during recessions. Additionally, the premiumization trend has been a tailwind to Diageo’s revenue, and we believe this trend will continue, driven by an expanding global middle class and preference for higher quality spirits.

Marriott is a company that we have owned several times in the past. The company is an asset-light global lodging franchisor and operator that benefits from strong network effects. Approximately 99% of Marriott’s global rooms are managed or franchised which enables the company to generate high returns on capital. Marriott has an extensive portfolio of brands ranging from luxury brands such as The Ritz-Carlton, to premium brands such as Westin Hotels & Resorts, to select brands such as Residence Inn by Marriott. The company is doing an excellent job converting independent hotels into the Marriott system through its soft brands including the Luxury Collection, the Autograph Collection, and the Tribute Portfolio. This conversion opportunity should benefit Marriott’s net unit growth in a period when new hotel development could be challenging in North American and Europe. The company generates robust free cash flow through its long-term, contracted franchise fee and management fee revenue streams. Its competitive advantages include brand strength, operational scale, direct booking systems, and loyalty programs. We sold Marriott in the first quarter of 2020 because of our concerns about the company’s debt structure. Since then, Marriott has restructured its debt and improved its balance sheet. Additionally, average daily rates (ADR) on corporate travel have returned to pre-Covid levels.

Texas Instruments is the world’s largest designer and manufacturer of analog semiconductors. These semiconductors convert real-world signals, such as temperature, pressure, and sound, into digital data. Analog semiconductors are also used to manage power in electronic devices. We are drawn to this company because its products are mission critical, and product cost as a percentage of total system cost is low. Moreover, market positions are stable over long periods of time and barriers to entry are high. Its management team thinks strategically, in terms of decades, and focuses on maximizing free cash flow per share over the long term.

UnitedHealth Group is the largest health insurer in the country and also owns Optum, which is a rapidly growing healthcare services company. The health insurance business benefits from demographic tailwinds and network effects as more members attract more providers and vice versa, which reinforces United’s value proposition and bargaining power with each side of the network. Over the last five years, Optum has grown significantly and roughly half of United’s 2022 EBIT was generated from the Optum business. Optum Health provides care for 102 million consumers and serves more than 100 health payer partners. We expect Optum to continue to grow and be a significant contributor to UnitedHealth Group’s future successes.

Sealed Air is a global protective packaging company operating in the food and beverage, industrial, and e-commerce markets. The company sells both packaging equipment and consumable packaging. Sealed Air has a strong market position with leading technology and brands. In the food and beverage market, the Cryovac brand is the gold standard for packaging and shipping fresh, uncooked proteins. Food safety is critically important, and customers are willing to pay for quality and reliability. Additionally, switching costs are high and customer relationships are typically sticky and long term in nature. Sealed Air’s brands in e-commerce and industrial include Bubble Wrap and Instapax, and the competitive advantages in these markets are largely similar.

Until next time! - EP