Welcome, subscribers! Today, we share a deep dive on a complicated family of Canadian companies, then we head overseas for a logistics company discussed by two separate managers—plus 3 more quick hitters!

Read on to learn more. 📕👇

Your support is appreciated. If you enjoy this issue, please forward to a friend or colleague!

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

Emeth Value Capital did a deep dive on Brookfield Corporation (BN) and its spiderweb of ownership stakes across other public entities. It’s a complicated story, but one with a lot of potential upside, as Emeth articulates below. We include an excerpt of their lengthy post and encourage you to read the whole thing.

Brookfield Corporation (BN) Overview

Brookfield Corporation is a leading global alternative asset manager with more than $400 billion of assets under management. The group has a strong heritage as an owner and operator of real assets and is among the largest global investors in infrastructure, real estate, and renewable power. Since 2019, Brookfield has also been the majority owner of Oaktree Capital Management, a prominent credit-focused investment firm led by Howard Marks.

Brookfield Corporation is by far the largest balance sheet investor among alternative investment firms, with more than $50 billion in internal permanent capital invested alongside clients. Under the leadership of Bruce Flatt, who personally holds a shareholding of more than $2.5 billion, Brookfield has compounded at twenty percent per annum for three decades, equating to more than a 200x increase in shareholder value.

Company History Cont. - The Demerger

While most publicly traded asset managers derive value principally from fee income, Brookfield has long had two core drivers of value: internal invested capital and asset management fee income. However, in 2022 Brookfield announced its intention to spin off its asset management division into a separate public company, anticipating that pureplay exposure would highlight the value of the asset management franchise.

This transaction would create two public companies - the pureplay asset management business that would retain the name Brookfield Asset Management, and the remainco that would be renamed Brookfield Corporation. Management believed that, valued under a framework comparable to peer alternative asset managers, the new entity could be valued as high as $60 - $80 billion.

In addition, because Brookfield Corporation would retain seventy-five percent ownership of the asset manager, the transaction would serve as a revaluation catalyst for the remainco, as Brookfield Corporation would then own ± $50 billion of a publicly listed asset manager in addition to the ± $50 billion of operating assets it already owned.

One notable difference, however, was that in contrast to peers like Blackstone that earned significant fee income from carried interest, the transaction was structured such that Brookfield Corporation would keep all carried interest from the existing funds and one-third of all carried interest from all future funds. This was a significant component of value, as realized carried interest was expected to be approximately forty percent of all fee income going forward, and realized carry from existing funds would account for virtually all carry through 2030.

Brookfield Renewable Partners (BEP | 48%)

Brookfield Corporation has $9.2 billion invested through Brookfield Renewable Partners, a publicly traded permanent capital vehicle that invests in renewable power and decarbonization solutions. The partnership is Brookfield’s longest standing listed investment vehicle and over the past two decades has assembled one of the world’s largest portfolios of hydroelectric, wind, solar, and renewable storage assets.

The origins of Brookfield Renewable trace back to the Great Lakes Hydro Income Fund, which owned three hydroelectric generating stations located along the Lievre River that produced an annual average of 1,400 gigawatt hours (GWH) of electricity. Following its listing, Great Lakes Hydro under the leadership of Richard Legault acquired and developed an additional thirty-nine hydroelectric generating stations from 1999 to 2010, adding more than 4,000 GWh of annual electricity production.

Meanwhile, because Great Lakes Hydro was a controlled subsidiary of Brookfield, Richard Legault, alongside other executives at Brookfield, spearheaded efforts to assemble an extensive portfolio of hydroelectric power assets that were owned by Brookfield directly. By 2010, Brookfield Renewable Power Inc., a wholly owned subsidiary of Brookfield, had acquired 128 hydroelectric generating stations that it owned in addition to the assets owned via Great Lakes Hydro.

Shortly thereafter, in 2011, Brookfield opted to consolidate all its renewable power assets into one investment vehicle under what was already a unified management structure, which formed Brookfield Renewable Partners. The new entity owned and operated 170 hydroelectric generating stations in North America and Brazil that produced 15,200 GWh of annual electricity, or more than a 10x increase since inception.

This resulted from Brookfield’s strong value orientation and aversion to projects that relied heavily on subsidy markets. Today, Brookfield Renewable Partners owns and operates 229 hydroelectric power facilities that produce an annual average of 20,000 GWh of electricity. These hydro assets remain the bedrock of the current portfolio and account for approximately half of the partnership’s $1.4 billion in assetlevel cash flows.

What’s more, quality of cash flows varies greatly across the renewables sector. Hydro assets achieve the highest relative capacity factors, offer natural energy storage solutions in the form of reservoirs, and, in contrast to solar and wind assets that have a useful life of twenty-five years, are perpetual in nature. For example, the original Lievre River assets that were contributed to the Great Lakes Hydro Income Fund were constructed between 1929 and 1954. In 2022, Brookfield Renewable Partners signed a new forty year power purchase agreement (PPA) with the government of Quebec to offtake the power from these exact assets.

In other words, by the end of this term the oldest of these generating stations will have been revenue producing for more than 130 years. As a result, the capital required to sustain production from hydro is seven times less than that of wind and solar, resulting in a free cash flow conversion that is nearly fifty percent greater.

Nevertheless, as hydroelectric assets have become increasingly scarce and as the economics of other renewable technologies have improved in recent years, Brookfield Renewable Partners has been rapidly scaling its solar and wind portfolio. At present, the partnership owns 131 wind facilities, 156 utility scale solar facilities, and more than 6,000 distributed generation facilities, often in the form of commercial and industrial solar or community solar installations.

These non-hydro assets collectively produce more than 11,000 GWh of electricity and more than $700 million in cash flows per annum. Of note, development expertise has become increasingly important in these newer verticals. As such, Brookfield Renewable has acquired a number of world class development platforms over the last several years, including X-ELIO, Urban Grid, and Scout Clean Energy, where the transactions not only consisted of attractive operating assets but also substantial development pipelines.

From a standing start, the partnership now has a development pipeline of over 200,000 GWh of power projects, primarily in wind and solar, that offer accretive deployment opportunities, as greenfield projects target fifteen to twenty percent returns. Indeed, this development activity is now reaching an inflection point for the partnership. Over the next three years, Brookfield Renewable expects to bring online over 25,000 GWh of development that on a proportionate basis will contribute $170 million in annual cash flows.

In other words, this activity supports five percent per annum cash flow growth across the entire renewables portfolio, which Brookfield believes it can sustain given its depth of pipeline. In addition to this, the partnership has significant visibility into cash flow growth from re-contracting capacity as it becomes available and via production indexed to inflation. Brookfield Renewable Partners expects 5,500 GWh of generation to come available for re-contracting over the next five years that should fetch an average $25/MWh uplift as prices are rebased to market rates, which will contribute an additional $130 million in cash flow per annum or three percent annual growth.

Brookfield Infrastructure Partners (BIP | 27%)

Brookfield Corporation has $7.6 billion invested through Brookfield Infrastructure Partners, a publicly traded permanent capital vehicle that is one of the largest owners and operators of critical global infrastructure. The entity was demerged from Brookfield in 2008 and was seeded with interests in 1.2 million acres of timberlands in Canada and the United States and interests in 10,900 kilometers of electricity transmission assets in Chile, Brazil, and Canada.

The oldest of these assets, Great Lakes Power Transmission Co., an electricity transmission system based in Ontario, was acquired by Brascan in 1982. Brookfield Infrastructure Partners has significantly enhanced the quality, scale, and diversity of its portfolio over the last fifteen years. The timber assets were fully divested, and rail networks, toll roads, diversified terminals, last-mile utilities, midstream energy, and digital infrastructure were added.

The partnership now owns many of the world’s premier infrastructure assets, several of which were acquired for value during a dislocation. For example, in 2020 Brookfield Infrastructure Partners acquired a six percent ownership interest in Sabine Pass, the largest LNG export facility in the United States. The transaction occurred amid unprecedented lows in natural gas pricing and an oversupplied LNG market. The partnership paid $1 billion for its interest, which was funded with forty percent equity and sixty percent low cost debt.

In 2022, Sabine Pass generated $2.5 billion in earnings, or approximately $120 million in earnings against Brookfield Infrastructure Partners’ $400 million equity investment, equating to a thirty percent cash on cash yield. Moreover, in February 2023 Sabine Pass commenced planning on a large-scale brownfield capacity expansion of up to twenty million tons per annum (mtpa), representing a potential sixty-five percent increase in production.

Reverting to the broader portfolio, Brookfield Infrastructure Partners segments its operations into four areas: utilities, transport, midstream, and data. The utilities segment owns and operates a portfolio of regulated assets, including electricity and gas transmission assets, and last-mile utility interconnection and distribution infrastructure. The current rate base for these assets is $7.3 billion, and Brookfield Infrastructure Partners earns a blended twelve percent regulated return on this base, which equates to $870 million per annum, or thirty percent of aggregate cash flows.

The transport segment is comprised of infrastructure assets that are involved in the movement of freight, commodities, and passengers. This includes 32,000 kilometers of rail, 3,800 kilometers of toll roads, 11 diversified terminals (container, dry bulk, etc.), the largest LNG export facility in the United States, and the world’s largest metallurgical coal export facility. These assets charge fees for access or volumes processed and are ninety percent contracted for an average of ten years. They also account for $800 million in annual cash flows, or roughly thirty percent of the aggregate.

The midstream segment consists of natural gas transmission, processing, and storage systems. This includes 25,600 kilometers of pipelines, 17 natural gas and natural gas liquids processing plants, 600Bcf of natural gas storage, and the Heartland Petrochemical Complex. This segment produces $800 million in annual cash flows, or thirty percent of the aggregate, which are eighty percent contracted for an average of eleven years. Finally, the data segment encompasses infrastructure that supports the transmission, storage, and processing of data. This includes 209,000 telecom towers, 46,600 kilometers of fiber optic cable, 881,000 fiber-to-the-premise connections, and 50 data centers.

As Brookfield Infrastructure Partners’ newest vertical, the data segment currently generates $280 million in annual cash flows, or roughly ten percent of the partnership’s total. These cash flows are ninety-five percent contracted for an average of fourteen years. Notably, while the partnership has an expertise in acquiring quality infrastructure, development capabilities also play a key role. This can take the form of capacity additions or other strategic investments that are part of the value creation roadmap for an acquired asset or funding a de novo project.

For example, within the data segment Brookfield signed an agreement with Intel in August 2022 to jointly invest up to $30 billion in a leading semiconductor fabrication facility in Arizona. Brookfield Infrastructure Partners will invest $3.6 billion for their share of the project, with the remaining capital coming from Intel and Brookfield’s flagship infrastructure funds. This is one of many large-scale capital projects that could result from the reshoring of critical manufacturing in the United States.

Since inception, Brookfield Infrastructure Partners has compounded its unit value at fifteen percent per annum, or nearly nine hundred basis points per annum in excess of the global equity index. Today, Brookfield Corporation receives $320 million in distributions from its capital invested through Brookfield Infrastructure Partners, or a 4.2 percent yield. When married with organic growth underpinned by inflation-indexed cash flows, volume growth closely linked to GDP, and accretive capital recycling, this is expected to continue to deliver a low teens total return.

Brookfield Business Partners (BBU | 65%)

Brookfield Corporation has $5.5 billion invested through Brookfield Business Partners, a publicly traded permanent capital vehicle that invests in industrials and business services companies. The group spun off from Brookfield in 2016 and was seeded with sixteen existing private equity investments across industrials, construction, oil and gas, and business services. Notable holdings included GrafTech, the leading producer of graphite electrodes, and Multiplex, a prominent Australian construction company.

The portfolio value at inception was $2.5 billion, and Brookfield retained seventy-eight percent ownership. To date, under the leadership of Cyrus Madon, Brookfield Business Partners has realized $5.5 billion in proceeds while generating an average four times multiple on capital and thirty percent IRR across twelve concluded investments. In addition, the partnership has executed more than twenty new investments, totaling $8.0 billion in deployed capital, over the last seven years.

What’s more, the quality of portfolio companies improved meaningfully over this time as proceeds were recycled from the sale of smaller, more cyclical businesses to fund the acquisition of larger businesses with increased scale, significant barriers to entry, and more resilient cash flows. For instance, the four largest companies within the current portfolio - Nielsen, Clarios, Sagen, and CDK Global - generate over ten times the cash flow of the four largest companies in 2016.

However, what has remained unchanged over the years is Brookfield’s intense operational approach. At the outset of each investment, Brookfield crafts a detailed value creation plan, which, given the capital structure often employed in leveraged buyout transactions, has an outsized influence on shareholder outcomes. For example, over the last five years on an average equity capital base of less than $5.0 billion, Brookfield Business Partners has improved EBITDA at its underlying companies by $275 million.

In other words, these improvements, which are often implementable regardless of the macro environment, added $2.75 billion in net asset value at a ten times multiple. Likewise, Brookfield has plans in motion across its portfolio companies to surface an additional $500 million in EBITDA over the coming years, which has the potential to significantly increase the existing $8.5 billion net asset value. Indeed, when coupled with natural deleveraging, these initiatives provide visibility to a base return of 1.7x - 2.0x, or approaching $11 billion for Brookfield Corporation’s share over the coming monetization cycle.

Valuation

Brookfield Corporation’s invested capital growth is supercharged by profits from one of the best business models in the world, alternative asset management. The alternative asset management sector has tripled in size over the last decade, growing from approximately $5 trillion to $15 trillion in assets under management.

However, Brookfield and other large global platforms have managed to grow at nearly double this rate, or in excess of twenty percent per annum. Institutional investors (pensions, endowments, sovereign wealth funds, etc.) account for ~$100 trillion in global investable assets, and these groups have doubled their allocations to alternatives over the past decade. The rationale is simple: private markets have outperformed their public counterparts by 400 basis points per annum across both equity and credit.

Moreover, while private asset classes have traditionally been perceived as requiring an illiquidity premium, allocators are increasingly weighing the inconveniences of liquidity (i.e., career risk) in their decision making. If two investments are expected to have identical returns over the long term, is daily liquidity really worth the heartache of knowing that at some point you will have to explain to your board why an investment is down thirty percent in six months?

What’s more, the largest markets in global finance remain practically untouched by alternatives. Individual investors account for ~$170 trillion in global investable assets, and their exposure to alternative investments is negligible. The democratization of alternatives is reaching an inflection point, and it will be the platforms with the longest track records and best brands that will flourish in this new channel. Increasing institutional allocations aside, consider that if alternatives reach only ten percent penetration in retail portfolios, this would double the current market size.

This has set up the alternative investment sector for yet another robust decade of growth. To add to this, Brookfield in particular is well positioned. The group has strong franchises in asset classes that are growing immensely in investor demand, such as renewables and infrastructure, and its acquisition of Oaktree has supported the rapid scaling of its insurance business. Today, Brookfield oversees more than $400 billion in assets under management that generates $2.2 billion in fee related earnings.

Brookfield expects to raise more than $100 billion in new AUM per year over the next five years and grow fee related earnings at twenty percent per annum.

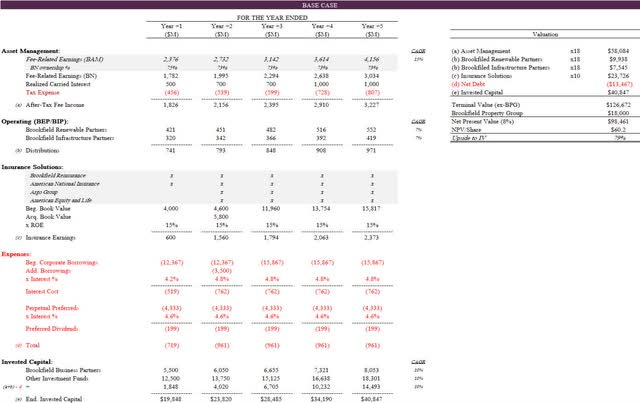

The base case scenario modeled above is conservative on several measures. First, these projections imply that Brookfield misses its 2027 fee related earnings target by twenty percent and that realized carried interest falls sixty percent below Brookfield’s own internal modeling. This would be a notable departure from Brookfield’s history of exceeding its five year plans. Furthermore, a blended after-tax multiple of 18x on asset management income represents a significant discount to peers that commonly value headline fee related earnings, a pre-tax figure, at a multiple of 25x or more.

Second, while Brookfield Renewable Partners and Brookfield Infrastructure Partners are expected to achieve their growth plans, an exit multiple of 18x implies minimal capital appreciation over the next five years. These platforms have traded between a four to six percent distribution yield over the last decade, and so, in addition to offering a low-teens prospective return, this valuation would fall at the low end of the historical range.

Third, a 10x multiple is used for the insurance solutions segment. Although some may note that this translates to a premium to book value, this is precisely what has attracted so much private equity capital to the space. For every dollar of capital retained in the insurance business, Brookfield believes it can generate fifteen cents of long-term recurring earnings that, while labeled insurance, are principally derived from its core competency - sourcing quality investments. It is also worth noting that the model gives no credit to inorganic activity in the insurance segment beyond those deals already announced.

Fourth, capital invested in Brookfield Business Partners and via Brookfield’s fund structures is expected to compound at ten percent per annum, a sizeable discount to prior fund results across asset type and vintage.

Finally, Brookfield Property Group is expected to decline in value by twenty-five percent over the five year period, while also producing zero distributions. This is likely overconservative, as less than half the net asset value relates to office and because rates are expected to fall meaningfully over this period while property-level cash flows will continue growing.

Bringing this all together, the result is a base case scenario of $60.2 per share, or seventy-nine percent upside to intrinsic value. Expressed another way, Brookfield Corporation is expected to reach $88 per share over the next five years, which would result in a 2.6x multiple on capital and twenty-one percent IRR from the current share price.

Conclusion

Our opportunity set of assets that are underappreciated, run by operators with high co-ownership, and available at attractive prices remains robust. As always, I am happy to speak with you at length about any of our companies, and I remain grateful for your trust and partnership.

Immersion Investments discussed three of their holdings in their 2Q letter. They went into the most depth on leadership training business, Franklin Covey (FC). We also include their quick hitter theses for IDT Corporation (IDT) and Potbelly (PBPB). Take a look.

Franklin Covey (FC – Ugly Duckling)

Despite significant fears surrounding exposure to cyclical corporate spending trends, Franklin Covey continues to post strong results, highlighting the durability of the business post-transition to its subscription model – the All Access Pass (AAP).

Franklin Covey is a consulting business that sells leadership training geared towards managers at mid-to-large corporations. We think of the FC business as “culture in a box”. Leveraging the lessons derived from Stephen Covey’s 7 Habits of Highly Effective People, Franklin Covey has grown into a $300 million revenue business serving companies across the globe. Today, the business offers nearly thirty different training modules from the original 7 Habits to the ‘4 Disciplines of Execution’, ‘Leading at the Speed of Trust’, ‘Change: How to Turn Uncertainty into Opportunity’, etc. The current customer list includes multiple multinational companies like PepsiCo, API Group, and Ferguson PLC. In addition to the Enterprise training division, Franklin Covey has crafted a leadership program for the education market called ‘Leader In Me’, which is currently used in more than 3,000 schools in the U.S. and Canada.

Historically, Franklin Covey was a lumpy, highly cyclical business, geared to one-time sales and training seminars. Starting in earnest in 2017, management began to bundle all of the company’s corporate trainings into a single package called the All Access Pass. The AAP program is deployed digitally through a web portal and customers agree to annual, seat-based contracts. Increasingly, customers are opting for multi-year contracts. Today, nearly 45% of the company’s consolidated revenue is derived from multi-year contracts vs. effectively 0% in 2016 (the year AAP was first introduced). AAP has the dual benefit of improving revenue visibility and margins, limiting the cost of deployment and lowering the amount of in-person travel and resources required to deliver trainings. Despite Franklin Covey’s progress towards improving the quality and durability of its business, FC continues to trade at an objectively low forward-looking valuation range of 12x EBITDA and 15x free cash flow. We think this valuation disparity persists over fears of a corporate spending slowdown, driven by global macroeconomic volatility, and the fact that most haven’t done the work to understand Franklin Covey’s transition from a lumpy, low-margin consulting shop to a highly recurring, high margin subscription business. There is also very little visibility on the name. Banking coverage is thin, and liquidity isn’t great for a company of its size. We’ve introduced the idea to several large funds and their initial reaction is usually, “Yeah, I worked on it a decade ago and it was pretty low-quality and lumpy. It didn’t seem like a very good business.” This perception takes time to fix but should become increasingly obvious over time. In the meantime, management is gobbling up shares. Year-to-date through June, the company has bought back 4% of outstanding shares.

IDT Corporation (IDT – Babushka Doll)

We substantially reduced our position in IDT in May, due to the upcoming Straight Path litigation verdict. The stock was sized at nearly 10% of NAV, which we felt was imprudent. Subsequently, we exited the stock shortly after the company announced its fiscal third quarter operating results in early June, which were mediocre. After conducting further diligence, we concluded that the next few quarters could be very weak. We moved down our profit estimates materially, no longer believing that NRS can continue its torrid pace of growth, coupled with accelerating declines in the Traditional Telecom business. Additionally, the company’s tone and commentary regarding the monetization of its growth businesses subtly shifted. We now think that management wants to hold on to net2phone and NRS for longer than we initially anticipated. These negative incremental developments, paired with the coin flip of the Straight Path Litigation outcome gave us no reason to continue holding the stock.

Potbelly (PBPB – Underdog)

A stock we started purchasing in December 2022, Potbelly was first introduced at our 2023 Annual Investor Meeting. The best way to describe the Potbelly opportunity is that of “low-hanging fruit”. We believe that the Potbelly brand is fundamentally strong but prior management proved subpar. The entire board and c-suite has been turned over in the last two years and the new team, led by Bob Wright (former Wendy’s COO), has embarked on a mission to realign the culture and basic operating practices of the organization with a medium-term goal of right-sizing unit economics and long-term goal of growing company-owned and franchised unit count. These efforts are paying off. As of the latest business update provided in June, annualized revenue per location is tracking to $1.35mm vs. pre-COVID levels of $950,000 and restaurant-level profit margins are rebounding very quickly to ~14% (vs. 15% pre-COVID). Over the last twelve months the company has announced the signing of 96 new locations and the sale of 20 company-operated locations to new and existing franchisees. Regardless of the progress made in the business and share price appreciation, the stock continues to trade at less than 10x EBITDA vs. 15x for Potbelly’s small-cap restaurant peers.

Maran Capital Management provided an update on Correios De Portugal (CTT-LIS), the UPS of Portugal, in their latest letter. We include their thoughts below.

Correios De Portugal, S.A. (Euronext Lisbon: CTT)

I wrote the following about CTT six months ago:

CTT is our Portuguese conglomerate that owns the monopoly postal business in the country, a pan-Iberian parcels business, a growing, profitable bank, and a large portfolio of excess real estate. CTT started to monetize its non-core assets and repurchase stock with excess cash last year. During the fourth quarter, CTT announced that it sold a 10% stake in its bank at a valuation of €285mm, or 1.1x book. Many investors had feared that the bank might only be worth one half of book value or less, so this transaction went a long way towards removing those fears. CTT continues on its path towards real estate monetization via both a yield vehicle and a development vehicle (which together have book value of €135mm and market value well north of that, in my opinion).

As I have discussed in recent letters, I think CTT’s bank and excess real estate value more than cover its recent market capitalization (€450mm at year-end), while its core postal/parcels business more than covers it as well. As value is growing in each division, I believe this still sets up as a potential “three-year double.”

Yes, CTT is far off the beaten path, and I occasionally get questions about whether investors will ever start “to care” and give the business a more appropriate valuation. In other words, they ask, “isn’t this a value trap?” While many sum-of-the-parts stories in smaller markets may be, I gain comfort in the aligned management team who have clearly demonstrated that they are doing the right things to unlock and grow value. Absent the plans to monetize the bank, monetize the real estate, buy back shares, cut costs, renegotiate the company’s government postal contract to allow for inflation passthroughs and volume decline offsets, and commit to a long-term plan predicated on double digit EBIT growth, this could be a value trap. But given all of those catalysts in place, I’m not worried about this stock being ignored for too long.

Yet while it continues to be ignored, the company will likely continue to utilize capital allocation as a tool to increase value per share. After repurchasing 5% of the shares outstanding last year, the company will likely continue to repurchase shares this year, as its balance sheet is clean.

CTT has made additional progress on many fronts this year. In May, it announced solid 1Q results well ahead of expectations and raised its full-year guidance. 1Q EBITDA was €40 million, and full-year guidance, which appears conservative, implies EBITDA of €140 million. Again, this EBITDA compares to a roughly €500 million market cap, and enterprise value, adjusting for the bank and real estate, of close to zero. Also in May, CTT formalized its real estate monetization plan, entering into a series of agreements to sell assets. It started by announcing a €40 million-plus asset sale at valuations in line with my estimates for the portfolio (€200 million).

In June, CTT announced the resumption of its share buyback program. CTT has been buying back approximately 10% of the daily trading volume in its stock, every day, since then. The company has also seen recent insider buying.

And just this week, it announced another solid earnings report in which it announced that first half EBITDA came in at €80 million and first half free cash flow was approximately €50 million. Yes, this company is trading at around a 10% free cash flow yield on just first half results! And that is despite having almost all of its market cap covered by its real estate and bank holdings.

CTT is making progress executing on its operating and capital allocation plans, yet the market seems to be snoozing. Ongoing buybacks, the closing of the first real estate transaction, and continued operating improvements are all potential catalysts for the stock in the second half of the year.

GreenWood Investors also discussed CTT in their most recent update. We think it’s worth reading their thoughts on the name, too.

When talking with one of our largest partners this past month, this topic came up. When speaking of our efforts at our first coinvestment (CTT), he mentioned it was a bit like a tree falling in the forest - was anyone there to witness it? Using the metaphor, he said that we’ve been able to succeed in most everything we set out to do, but the returns have been still under our hurdle rate. So how are we to evaluate this constructive activist performance, if not by the share price? We’re very comfortable sticking to the stock price for our benchmark. And we believe the best way to judge our efforts on all of our coinvestments will be to measure by both equity benchmarks as well as the industry benchmark.

While CTT is the second fastest growing parcel/post company by earnings, with UPS being the toughest to displace, the stock has lagged the fundamentals, and it remains deeply undervalued.

As another partner also encouraged during the quarter, “don’t get mad, buy more.” We are pleased the CTT board joined us in supporting a third share repurchase program. Given our strong belief in the deliverability of management’s ambitious 2025 target, to roughly double operating income, we see the current buyback program as extremely accretive to both current and future shareholder returns.

As first half 2023 results have demonstrated, using trailing twelve months, the company has already come close to achieving the low end of its guidance range for 2025. And the team maintains a high sense of urgency in continuing to grow better, faster, and greener than the rest of the industry. That’s right- industry-leading growth and quality of service, paired with a net zero carbon footprint by 2030. As Jeff Bezos has said of his own service, “you’d be irresponsible” for the planet and pocket book for Iberian households to not use CTT’s services for their every day purchase needs. Increasingly, more are doing so.

The 13% post-tax FCF yield remains incredibly supportive, and as e-commerce is re-accelerating in Iberia, we are excited that we were able to use the opportunity to add this position to our separate account portfolios during the quarter. Now each of our composites have all three coinvestments generating returns for the portfolio. And now with the third repurchase program active, like RH and Bolloré, we continue to own a bit more of the business every day.

The sense of urgency remains very high at CTT.

Until next time! - EP