Welcome, subscribers! Today, we share pitches for three special situations—two recent spin-offs and an abandoned merger. This collection runs the gamut from ~$350 million in market cap up to $30+ billion.

Read on to learn more. 📕👇

Your support is appreciated. If you enjoy this issue, please forward to a friend or colleague!

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

Sohra Peak Capital Partners recently released an extensive review of American Coast Insurance Corporation (UIHC, but soon to be ACIC). A tiny property & casualty insurance carrier in the state of Florida, the company is getting some fresh eyes on it after deconsolidating from its parent. We include Sohra Peak’s executive summary and brief overview but encourage our readers to click through and read the full 59 page memo.

Executive Summary

• American Coastal Insurance Corporation (“American Coastal” or “AmCo”) is a commercial property & casualty insurance carrier in the state of Florida that exclusively insures garden-style condominium and homeowner association properties against hurricanes and other catastrophe risks.

• American Coastal is a gem of a business hiding in plain sight. Since its founding in 2007, American Coastal has dominated its niche and captured 40% of its TAM. It has also delivered an average ROE of 23.1%, has demonstrated exceptional loss and profitability ratios, and has never had an unprofitable year despite withstanding several major hurricanes. 1

• This opportunity exists chiefly because until several months ago, American Coastal was a subsidiary within publicly traded United Insurance Holdings Company (“UIHC”), whose primary business was selling personal homeowner’s insurance policies under its main subsidiary United Property & Casualty Insurance Company (“UPC”). In April 2023, The Florida Department of Financial Services memorialized the “GoodCo-BadCo” deconsolidation of UIHC and took “BadCo” UPC into receivership, leaving shareholders today with “GoodCo” American Coastal. 2

• American Coastal’s #1 market share position is firmly protected by a set of competitive advantages and barriers to entry that are borne from its exclusive relationship with AmRisc, the largest catastrophe-focused MGA in the U.S. and with whom for all intents and purposes American Coastal is vertically integrated. 1 These competitive advantages translate to pricing power over competitors, strong customer retention rates, higher margins, and high customer switching costs.

• Shares appear exceptionally undervalued based on our EPS estimates of $1.89-$2.86/share over FY24-29 vs. today’s share price of $5.63. Our estimates imply a FY24E P/E of 2.9x, FY25E P/E of 1.9x, and a P/BV and P/TBV of <1x by mid-FY25 while delivering 53% ROE. 1 From FY25 onward, with a healthy capital surplus, American Coastal should return 100% of its incremental net profits to shareholders, which at today’s price would imply a ~50% dividend yield and/or significant share repurchases. 1 We see an asymmetric path for American Coastal’s share price to appreciate from $5.63 today to $16.00 – $22.00 over the next 24-36 months.1

• Founder and CEO Dan Peed owns 48% of shares outstanding and has an impressive track record of not only building American Coastal, but also co-founding AmRisc in 2000 which is the nation’s largest catastrophe-focused MGA. Based on our channel checks, Dan has an excellent, revered reputation in the industry. Notably, now that the UPC deconsolidation is finally complete, Dan is eager to launch a new MGA under the American Coastal public company, which we view as a free call option that could be valued at $400MM in and of itself by FY27.

American Coastal: Overview

American Coastal is a U.S.-listed small-cap commercial property & casualty (P&C) insurer headquartered in St. Petersburg, Florida. Since its founding in 2007, the company has exclusively been in the business of selling windstorm insurance policies to the specific niche of garden style condominium and homeowner association properties within the state of Florida.

As most readers will know, all properties in the state of Florida, whether personal or commercial, must insure against one particular type of property risk that is not as relevant in other states, which is hurricane windstorm risk. While the thought of evaluating a hurricane insurance company can seem daunting, I firmly believe that learning more about the opportunity at American Coastal will prove to be worthwhile, and I will try my best to illustrate a clear picture of the company and its industry.

Perhaps unsurprisingly, many Florida property insurers have a poor reputation, not only among their customers but among Wall Street as well. In the early-mid 2010s, a “trio” of Florida homeowner’s insurance carriers Universal Insurance Holdings (UVE), HCI Group (HCI), and Heritage Insurance Holdings (HRTG) became subjects of short reports, primarily because all three were engaging in a now-defunct practice of cherry-picking insurance policies from Florida’s state-owned insurance provider Citizen’s. UVE in particular caught the attention of investor Anthony Bazzo, who at the 2015 Robin Hood Investors Conference presented a short pitch on UVE so compelling that Lee Ainslie of Maverick Capital deemed it “the best short pitch he’s ever seen in 25+ years in the industry.” 5

I mention this because, in stark contrast to the “trio,” American Coastal in terms of both its business model and business quality is worlds apart and incomparable in just about every respect. While the personal lines “trio” generated its profits by exploiting an unsustainable, commoditized policy acquisition mechanism, had no proprietary underwriting advantages, and eventually suffered net losses, American Coastal operates in a different sector altogether, has established a deeply entrenched set of competitive advantages, has maintained 30% or greater market share within its niche since 2014, has developed a loyal customer base that loves doing business with them, and has never sustained an operating loss in its entire 16-year operating history despite weathering several major hurricanes over the years.1 Simply put, AmCo is a much better, more durable business than any of the aforementioned personal lines, or homeowner’s insurance, carriers.1

For those glancing at ACIC/UIHC’s financial statements for the first time, one should understand that much has transpired in recent years, and that the historical GAAP financial statements prior to 2023 do not reflect American Coastal’s financial history, but rather that of “BadCo” UPC, a business which is no longer owned by or associated with ACIC/UIHC. To summarize the history of events among these entities, UIHC, the public holding company, was primarily a personal lines insurer through its owned entity UPC. UIHC acquired private company AmCo in 2016. But, in the years that followed, executive decisions at UPC caused it to perform so poorly that in June 2020, AmCo founder Dan Peed ousted then-CEO of UIHC John Forney and assumed the role of CEO in an attempt to save the company. 1 His first order of business was to begin trying to save UPC, which at the time represented 69% of the company’s policies, by exiting certain states and salvaging others. 6 Fast forwarding several years and many developments later, UPC was placed into runoff in August 2022, and in April 2023 UPC finally became legally deconsolidated from UIHC, as memorialized by the Florida Department of Financial Services (DFS). This has left shareholders today with simply AmCo and an immaterial subsidiary Interboro that is likely to be sold in the coming months.

As a result, for the first time in its history, American Coastal is now a standalone public company, and as of Q1 2023 its GAAP financials have begun reflecting American Coastal without the burden of UPC. In fact, to signify this milestone, in recent weeks the company announced the change of its corporate name from United Insurance Holdings Corporation to American Coastal Insurance Corporation, and a change of its ticker from UIHC to ACIC, both of which will take effect on August 15, 2023.

Today, shareholders are left with a gem of a business that we are convinced will continue dominating its customer niche over the long-term, and that should generate profits during typical hurricane seasons that would represent a 33-52% earnings yield to today’s share price. 1 In addition, our analysis and management’s estimates of the company’s future capital surplus suggests that beginning in FY25, AmCo should be in a position to begin incrementally returning all net profits to shareholders. 1,4 If theoretically returned as a dividend, these sums would imply a ~50% annual dividend yield to today’s share price, and if theoretically returned through share repurchases, could dramatically reduce AmCo’s share count and add meaningful per-share intrinsic value to the company.

We believe this opportunity exists because of how recently the series of deconsolidation events has occurred, the lack of research coverage on the sell-side and buy-side, the lack of relevant historical GAAP financial statements on AmCo (statutory annual filings from 2008-2022 can be found at www.naic.org), the negative bias against Florida insurers, misperceptions around how to think about hurricane risk, and the tendency for investors to place insurance companies into the “too hard” pile. Now that UIHC/ACIC has shifted from a complex situation to clean one, we think it is only a matter of time before the market recognizes the opportunity at hand. We see a clear path to American Coastal’s share price appreciating from $5.63 today to a range of $16.00 – $22.00 or a +180-290% gain over the next 24-36 months.

Tidefall Capital initiated a position in First Horizon Corporation (FHN), a small cap bank headquartered in Nashville, Tennessee. The bank was set to be acquired by Canadian TD Bank, but TD got cold feet and abandoned the deal in May. We include Tidefall’s thesis below.

Thankfully, there are many old economy, small cap stocks that are trading at attractive valuations. Last quarter we took a small position in First Horizon Bank. Although the stock only has a $6b market capitalization, the name might be familiar to some Canadian investors since it was an acquisition target of TD Bank which agreed to purchase the company in February 2022 at $25 per share.

The rapid rise in interest rates over the past year, reduced the value of long term bonds, creating a massive drop in the equity of some regional banks which led to fears of a bank run because customer accounts are only officially insured to $250,000. The large depositors at the most vulnerable regionals rapidly moved their savings to the larger “too big to fail” national banks. The resulting turmoil saw TD get cold feet and walk away from the acquisition of First Horizon (although TD officially blamed it on “regulatory uncertainty”). With the TD deal off, First Horizon stock then crashed alongside the regional bank sector to $10 per share; less than its tangible book value.

We believe First Horizon is being unfairly grouped in with its more troubled peers, despite having industry leading metrics and capital ratios (which are further improved by TD’s $225m break fee payment). The bank is well funded with only 1/3rd of deposits uninsured and well diversified with the top 15 depositors representing just 1% of the total. First Horizon is focused in the US southeast, which is experiencing 2.6x GDP growth and 4x the population growth versus the US national average. The two biggest investor concerns of US regional banks today are their bond portfolio losses and their exposure to office real estate (due to work from home). First Horizon performs excellently on both measures.

As previously mentioned, the US regional banking crisis was primarily caused by falling bond values. Thankfully, unlike recent bank failures, First Horizon has no significant bond losses hidden by held to maturity accounting (fair value vs book value for all assets is just a $383m difference or 4% of equity). With the termination of the TD acquisition, deposits have rebounded strongly with the company having its best month in May with deposits increasing by nearly half a billion dollars.

In regards to wider regional banking concerns, we do not believe that US regulators and both political parties are willing to risk a widespread banking collapse and should even larger fears reemerge, they will quickly step into preemptively insure all deposits. In regards to commercial real estate, First Horizon has minimal exposure with just $2.8b in office loans outstanding, representing 21% of their CRE loan portfolio and 3% of total assets. Nearly half of this exposure is medical offices which have traditionally been recession resistant. Furthermore, the remaining non-medical office loans are also conservatively financed with a 59% loan to value ratio.

We acquired our shares in First Horizon below tangible book value and at 6x trailing earnings. With the exception of the depths of the GFC in 2008 and the initial covid panic in 2020, this is the cheapest the stock has traded on these metrics in the past 30 years. Even with the Fed tightening and a possible recession, we believe this is an attractive valuation in light of our expected long term mid-teens return on equity. Five directors have acquired shares in the open market since the merger was called off in May, with no insider sales.

VGI Partners reviewed their thesis in GE HealthCare (GEHC), which was recently spun out of General Electric (late 2022). The company is now one of the biggest positions in VGI’s fund (~9% as of 2Q23).

Stock in Focus - GE Healthcare

One of our recent new investments is GE HealthCare (GEHC), which was spun out from General Electric (GE) in late 2022. Currently it is our third largest position due to a combination of strong performance and growing the weight (we initiated a position when the company was spun off).

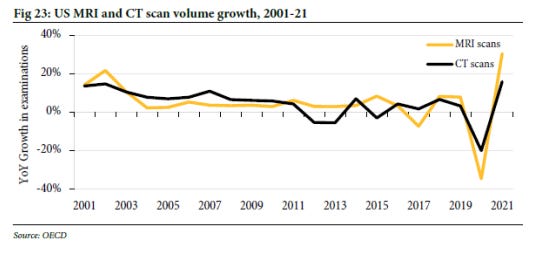

GEHC is a leader in Imaging and Ultrasound machines, which includes PET and CT scans, MRI, X-Ray and ultrasounds – these account for nearly three quarters of revenues. GEHC is a global business with revenues well spread between the US, Europe, China and emerging markets. The business model is both predictable and resilient in our view:

• Predictable because 50% of revenues are recurring in nature, coming from servicing the machines, selling spare parts and consumables – giving the business attractive razor & razorblade economics.

• Resilient because Imaging is a mission-critical category for GEHC’s customers - it is the most important revenue driving category for hospitals and one that is prioritised irrespective of the economic environment.

We like the Imaging industry because it is effectively a three-player market between GEHC, Siemens Healthineers and Phillips, and the industry has continued to consolidate over the last 10 years. Scale gives the large players the ability to reinvest in R&D and to entrench their position through close relationships with hospitals.

Our GEHC investment thesis is based on an under-appreciated margin opportunity as a newly independent company. We often see this with spin-off situations:

1. A hidden asset with a renewed focus on capturing market share;

2. A bloated cost structure that can be better optimised; and

3. A newly independent and aligned management team.

All of these are in place at GEHC. For a long time, the company has been run within the larger GE conglomerate and milked for its cashflows, with GE’s investment priority being its Aerospace business (prior to COVID, we were investors in GE so have followed the company closely for a long time). However now as a newly independent entity, GEHC can focus on its core business with a fully independent and aligned management team that we expect will act with more urgency.

The margin opportunity stands out when comparing GEHC to its closest peer Siemens Healthineers, whose Imaging business generates operating margins in the low 20s percentage compared to GEHC in the mid-teens. Our diligence suggests that there are no structural reasons for this margin differential – therefore we think GEHC will close the margin gap over time by addressing the low-hanging fruit in the cost base while also launching new, higher-margin products (resulting from the recent step up in R&D spend). We believe market expectations for GEHC’s margins are too low and therefore see meaningful room to surprise to the upside - leading to high-teens earnings growth over the next few years.

Another important tailwind for margins we expect will be the growing penetration of digital tools in Imaging, which GE has been investing behind. GEHC’s large global install base of >4m machines gives them a strong advantage in terms of data collection, even more so today when data is extremely valuable and can be overlayed with software applications. We have already started to see strong demand from hospitals for these software applications because they can meaningfully reduce costs – for example by allowing doctors to read and analyse imaging scans in much shorter time windows, addressing both staffing issues and costs. The adoption of digital services will support growth, better service attach rates and ultimately improve margins – and importantly we do not think we have to underwrite this to get upside to the current valuation.

We view GEHC’s valuation as compelling at current levels, particularly with the meaningful improvement in free cashflow (FCF) generation we expect over the next 3 years. On current metrics, which we think still only reflect a depressed earnings base, the stock is trading at a discount to most medtech peers despite having a more attractive growth profile. On a more normalised basis, the stock is on a FCF yield of over 6%, which we think is very appealing. Being a newly independent company, there is still some scepticism with regards to management execution but we think the market will start to become more comfortable as the company starts to deliver on its margin opportunity.

As a closing comment, the medtech industry is one we like and one where we have had some successful investments in recent years (Intuitive Surgical and Olympus). We expect to continue looking for opportunities in the sector.

Until next time! - EP