Welcome, subscribers!

Today we share pitches for an Australian microcap, a UK-based seller of kitchen gear—plus two large cap quick hitters.

If you like what you see, please forward to a friend or colleague!

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter if you’d like to be included in a future issue.

Let’s get to it.

Sohra Peak Capital Partners re-underwrote their thesis in Duratec Limited (DUR.AX), a microcap, Australian-listed provider of infrastructure maintenance to the oil & gas, mining, defense, and other “hard asset” industries. Despite a recent run, Sohra Peak still sees a lot of upside. Their detailed thesis is below.

Duratec Limited (DUR.AX)

In a memo released earlier this year, which you can find here, I organized my thoughts as to why I believed Duratec represented a compelling investment opportunity. Since then, the company’s shares have performed well, and through continued research my conviction in the long-term prospects of Duratec has grown stronger.

MEnD Consulting as a Competitive Advantage

One aspect that received relatively less attention in our initial memo than it should have, but deserves further discussion given its importance to the overall business, is Duratec’s subsidiary MEnD Consulting. I thought it would be worthwhile to provide a more comprehensive overview of MEnD Consulting in order to better complete the discussion on Duratec.

As a brief refresher, Duratec is an Australian company specializing in infrastructure remediation services for asset owners with a roster of over 900 project staff and engineers. MEnD Consulting, a wholly owned subsidiary and division of Duratec, provides value-added services to Duratec’s prospective and existing clients in the form of comprehensive asset evaluations and laboratory petrography.

Of all of the components that comprise Duratec, management considers MEnD as its most valuable asset and the component that gives Duratec a true competitive advantage within its industry. 12 Historically, MEnD’s value to both Duratec and its clients have appeared evident: 80% of MEnD’s clients have converted into Duratec clients, every $1 of MEnD revenue has converted into $25 (and increasing) of Duratec revenue, and the retention rates of clients who transition from MEnD to Duratec have been aboveaverage. 12 Moreover, MEnD’s state-of-the-art technological capabilities have helped to reduce project remediation risk and costs for its typical client.

This last item, MEnD’s industry-leading technological capabilities, is worth expanding upon, given its importance to Duratec’s business along with the lack of communication that I have found regarding the advantages that MEnD Consulting provides Duratec.

Proprietary 3D Geospatial Modeling Software

MEnD’s crown jewel, AnnoView, is the consultancy’s proprietary 3D geospatial modeling software. To fully appreciate AnnoView’s significance to MEnD and Duratec’s competitive standing, it is key to fist understand exactly what is being modeled, and how MEnD obtains this information.

When MEnD begins its work with a client, its objective is to ultimately provide the client with a comprehensive, complete assessment of the client’s asset in order to identify all existing and potential defects requiring remediation in order to prevent structural damage. An asset may include a bridge, a military wharf, a port, a mining plant, or an aircraft hangar.

Once the client accepts MEnD’s services, MEnD employees will show up to the client’s site and begin to deploy airborne drones equipped with high-resolution cameras. The purpose of these drones is to capture every square inch of the client’s asset, from multiple angles, in order to gather a complete set of data needed to later re-create the client’s asset in MEnD’s proprietary 3D software.

Once the drones capture the data they need, MEnD uploads this data to AnnoView, which then re-creates the asset with remarkable accuracy. Actual samples of AnnoView’s models can be found here. At this point, MEnD’s in-house PhDs utilize AnnoView to analyze the asset, identifying and flagging defects directly within the software itself. Following this analysis, MEnD returns to the client, they jointly review the AnnoView model together, and MEnD provides a copy of the model to the client which they can use in collaboration with their chosen asset remediator. 80% of the time, that remediator turns out to be Duratec.12

The outcome of this process, in my view, is exceedingly valuable to the client for several reasons:

1. First, MEnD’s comprehensive analysis allows the client to de-risk the asset as much as reasonably possible. With a comprehensive 360-degree virtual model of the asset, the client can rest assured that all identifiable defects will be addressed, regardless of whether they hire Duratec or another contractor for the remediation project,. Additionally, the remediator benefits from higher margins as MEnD’s work helps minimize the number of “surprise” defects that were not specified in the initial contract, which are also a common source of cost overruns for the remediation contractor.12

2. Second, MEnD’s work often saves the client a great deal of time and money. Due to the lack of 3D-modeling offered in the industry, the inspection phase for many asset owners consists of a traditional manual inspection process. This requires field engineers to spend significant time, often months for more complex assets, before a complete assessment can be made. MEnD’s technology, on the other hand, allows clients to substantially complement or substitute this process.12

In a recent example, Duratec purports to have begun a project with mining giant BHP which they had won following successful client conversion from MEnD. After BHP and MEnD had reviewed BHP’s 3D asset model together, BHP apparently found the model so thorough that they felt comfortable proceeding directly to the asset remediation phase with Duratec and skipped the traditional inspection stage entirely. 12 BHP mentioned that skipping this phase saved them ~$1MM in cost and 12 months of work that they would have otherwise spent on engineers.12 Given these savings and the positive experience BHP had with MEnD, what is the likelihood that BHP’s site manager in this example will continue hiring MEnD and Duratec for future asset remediation projects? I would wager quite high.

3. Third and lastly, MEnD’s services hold particular value for its clients for the reason that there are very few other firms that offer MEnD’s capabilities within the asset remediation space in all of Australia, and there are no other companies of its kind that are also vertically integrated with an asset remediator such as Duratec.11,12 The combination of MEnD and Duratec is the only vertically integrated company of its kind in Australia. 11

Within the industry, the other firms who offer 3D-modeling solutions of comparable quality to MEnD are standalone consultancy firms.12 In my view, having a vertically integrated, highly reputable asset remediator in Duratec is beneficial for the client, because it allows the client to seamlessly transition between two firms that work smoothly together, which minimizes coordination costs. The alternative scenario, where an asset owner is handed a model from a standalone consultancy and is left to contact asset remediators, is by all means a workable method. However, it appears to add friction to the client experience, and could add unnecessary risk to the project if there were any misinterpretation of the consultancy’s model by the third-party remediator.

Aside from the comparable standalone consultancies, there are other “competitors” who attempt to offer similar drone and 3D-modeling solutions like MEnD, but their offerings are reportedly inferior, with their 3D-modeling not nearly as high-quality as AnnoView’s, and therefore lacking a compelling value proposition to the client.11,12

As a recent anecdote and evidence of MEnD’s services being at the frontier of its industry, Duratec recently met with a U.S.-based 3D geospatial data software firm who informed them that, based on the geospatial models they have seen working with their multi-national clients, MEnD is “doing the biggest, most complex structures anywhere in the world at the moment.”12 Whether or not this is precisely accurate, it appears to further the viewpoint that MEnD is providing unique, valuable work for its clients, to the ultimate benefit of Duratec and the entire combined company.

MEnD’s contribution to Duratec’s revenues and profits has historically been strong, and only appears to be increasing. According to management, of Duratec’s $310MM of revenue in FY 2022, roughly $100MM was generated through projects that began by working with MEnD, and every $1 in MEnD revenue translated into $25 in Duratec asset remediation revenue. This implies $4MM in MEnD revenue for the year FY 2022, which management believes is on track to grow to $6MM in FY 2023. 12

In addition, as Duratec’s size allows it to scale to bigger projects and work with bigger clients, MEnD’s services are being introduced to industry stalwarts such as the Department of Defense (DoD), BHP, Rio Tinto, and others. For instance, a $600,000 revenue project for MEnD recently converted into an $80MM contract for Duratec, or a $1 to $80 conversion ratio.12 This has included stealing contracts from other leading asset remediators, such as Monadelphous, which suggests that Duratec is becoming increasingly viewed as a high-quality alternative to other leading brand names in the asset remediation space.

Laboratory Petrography Services

Aside from its 3D geospatial modeling, MEnD Consulting’s other valuable offering is its laboratory petrography service it providers for third-party clients across Australia. Petrography as applied by MEnD is the study of rock and mineral samples from infrastructure assets under a specialized microscope.

Before or during an asset remediation project, one helpful tool that project engineers use to make decisions is a petrography analysis of the asset’s rock or mineral samples. For instance, a petrographer can help conclude whether a crack is benign and surface-level, or a more serious structural issue; or, to help confirm the identity of the underlying substance present in a portion of the asset.

While MEnD’s petrography services may not add distinct value to the typical client in the way its 3Dmodeling does, the petrography lab’s true value to Duratec lies in its capacity as a robust client lead generator. Presently, MEnD captures 10-15% of the entire Australian petrography market for infrastructure assets, meaning that 10-15% of all infrastructure asset samples in Australia are analyzed through MEnD’s labs.12 This is powerful, because by analyzing these samples, Duratec has amassed a database that it can use to effectively determine when any given asset within this database might be due, even years in advance, for a remediation project. This allows Duratec the ability to engage with prospective clients before competitors can, even before the client themselves may be aware that their asset is due for maintenance.

Within the large total addressable market of Duratec’s asset maintenance industry, which we estimate to be $50B, this lead generation tool at Duratec’s disposal could provide them with insights into the remediation schedule for a substantial number of projects, amounting to $5.0-7.5B.11 It is easy to see how this strategic advantage could further give Duratec a leg up over its competitors. According to MEnD, they have built this market share by focusing on high-end, specialized petrography, rather than commodity petrography sampling which most petrography labs focus on. For instance, MEnD’s in-house lab recently became the first lab in Australia to receive NATA-accreditation (Australia’s leading national accreditation body for laboratories) for concrete petgrography.13 In addition, MEnD points out that there are only two other petrography labs in Australia capable of analyzing high-end, expensive concrete samples to the degree they can, and that both are independent labs not owned by Duratec’s competitors.12

Tying all of the above together, Duratec and MEnD Consulting appear to complement one another to create a unique, dominant vertically-integrated business in Australia’s asset remediation industry. While there are subsets of quality competitors that exist within each vertical of 3D-modeling, laboratory petrography, and contractors who provide remediation services, no other Australian firms combine all three under one roof. As noted in my initial memo, too, executives at both Duratec and MEnD feel strongly that it would take years for any competitor to replicate Duratec’s current setup with any degree of success.

Valuation

At the moment, at a price of $0.93 per share, Duratec’s market cap stands at AUD $227MM. After subtracting $33MM of net excess cash, we arrive at a market cap of $194MM.

Based on management’s recent upgrade to guidance for FY 2023 ending June 30, I expect the company to produce $20MM of net income, $25MM of Owner’s Earnings, and EBIT of $28MM. This implies a 13% Owner’s Earnings yield, P/E of 9.7x, and EV/EBIT of 6.9x.

Although shares are not cheaply priced as they were five months ago, I think Duratec’s shares still contain substantial long-term upside. From a fundamental perspective, my view is that profits should continue to grow at high rates for a number of years to come, for a variety of reasons:

• Management is confident that FY 2024 will see continued growth over FY 2023, which is supported by Duratec’s current order book and tenders. As stated in the company’s most recent update on April 24, their orderbook stood at $495MM and tenders at $748MM.14 Given order book projects must be completed within 1-2 years and tenders historically have a ~1 in 3 win rate, this suggests that the lion’s share of FY 2024 revenue and profits may already be secured, with a whole year ahead during which the company can pick up additional projects. Given this visibility, I would not be surprised to see revenue growth of +20-30% or greater next year.

• Department of Defense business continues to grow strongly, most recently growing +104% YoY as of 1H FY 2023, and shows no signs of slowing down. Duratec is winning greater market share with the DoD in an expanding pie as the Australian government has budgeted sustainment spend to almost double over the span of this decade. Additional DoD tailwinds continue to surface, such as the AUKUS military alliance which has guaranteed $8B of DoD maintenance spend at the HMAS Stirling navy base, which Duratec has been servicing since 2015 and which management believes could easily lead to an additional $500MM-1B of revenue for Duratec over that span.15

• Annual growth is generally contained due to the importance of avoiding high levels of project concentration, implying that Duratec generally has the ability to win more business in any given year, and therefore in future years, than any given year’s revenue growth rate might suggest.11

• Duratec has recently been winning more, and larger, contracts with blue chip clients (e.g., DoD, BHP, Rio Tinto), and occasionally at the expense of larger, respected competitors, suggesting Duratec is establishing important future revenue streams along with a strong brand name for itself.

• The runway for buildings & façades refurbishment remains lengthy, with billions of dollars in mandatory remediation required across the sector. Duratec’s revenues in this segment have expanded at a +65% CAGR since FY 2019 and should continue to grow.

• MEnD Consulting’s services have not yet penetrated much of Australia’s east coast, which the company views as a significant opportunity over the intermediate-term.12

• Wilson's Pipe Fabrication has, in my view, been by all measures a home run of an acquisition. Duratec expects Wilson’s to trigger its full contingent consideration threshold, which suggests Duratec will have paid AUD $18MM all-in for Wilson’s which is expected to deliver over $5MM of EBITDA for FY 2023. Duratec expects strong continued growth ahead for Wilson’s through geographic expansion across Australia, cross-selling its capabilities to the DoD, layering MEnD’s entire set of value-adds to Wilson’s clients, and organic growth within its segment. The success of this acquisition also fosters confidence in management’s ability to run this playbook for any future tuck-in acquisitions that would allow it to efficiently enter new remediation sectors.

• DDR, which has grown revenue rapidly from $10MM in FY 2019 to $73MM in FY 2022, should continue to expand its profit contribution to Duratec over time.

• Approximately 80% of Duratec’s business each year is derived from repeat clients, suggesting that the company should continue to maintain a lumpy but fairly stable existing book of business going forward, to which it can continually add new clients.12

• As speculation entirely on my part, future optionality could exist for Duratec to leverage MEnD’s best-in-class 3D-modeling and laboratory services on a global scale, given a large portion of these processes can be performed remotely. Whether Duratec would decide to expand its core engineering and contracting business beyond Australia’s borders makes for a separate discussion, but with respect to MEnD, it could become a high-end consultant to international clients through its 3D-modeling service or partner with select asset remediators to serve as a lead generator and earn a share of remediation economics. MEnD’s laboratory petrography business can be performed completely remote with the option of also somehow monetizing its lead generating capability.

Considering the various ways that we believe Duratec can continue expanding its business, it is reasonable to us to see how this business could do quite well in the foreseeable future, and we think demonstrates why paying a 7.8x multiple of Owner’s Earnings for this business today could prove to be a bargain in retrospect.

It is worth noting that despite its upward valuation re-rating over recent months, Duratec still maintains the lowest set of valuation multiples among its peer group of Australian E&C companies Monadelphous Group, SRG Global, and Saunders International.

Examining Monadelphous specifically, with whom Duratec competes directly in mining and now oil and gas, Monadelphous trades at 24x P/E. This is despite having arguably a lower quality business given its 50- 50 split with remediation (higher quality)-construction (lower quality), and despite Duratec possessing what I consider a competitive advantage over Monadelphous in its MEnD Consulting business. Surely, Monadelphous having a revenue base 4-5x larger than Duratec’s and a market cap higher up on the liquidity spectrum are of benefit to Monadelphous. Though, it gives you a sense of where Duratec’s valuation multiples could be headed as the company continues to grow in size.

Bonsai Partners outlined their thesis on Howden Joinery (HWDN-GB), a UK provider of all things kitchen, including cabinets, drawers, countertops, appliances, and so on. Bonsai detailed their thesis in their most recent letter, which we include in full below.

New Investment: Howden Joinery Group plc (LSE: HWDN)

Howden Joinery, or Howdens, as it is more commonly known, sells kitchens in the United Kingdom. Put another way, Howdens sells a complete assortment of everything needed to build a new kitchen, from cabinets to drawers, countertops, appliances, sinks, etcetera.

What caught my attention about Howdens was how much their financial performance diverged from my expectations of a kitchen company. I would not have guessed that Howdens’ gross margins are consistently above 60%–meaning the items they sell for $100 cost $40 to procure. These are unusually high margins for a company selling physical goods. Similarly, Howdens consistently earned a greater than 20% return on its invested capital (ROIC) over the past decade (excluding 2020), with ROIC approaching 30% over the past couple of years. These data points indicate that something interesting is going on beneath the surface. Howdens might not be a stodgy kitchen company after all.

I was also drawn to Howdens' conservative financial positioning. The company’s balance sheet holds hundreds of millions of pounds in cash, no outstanding debt (outside its store leases), and generates significant cash flow. These cash flows are reinvested to fund the company’s growth initiatives, and excess cash is returned to shareholders through dividends and share repurchases. Despite its attractive characteristics, Howdens was available for ~10x trailing earnings.

I wanted to know how such an unassuming company could have such appealing business characteristics. Fortunately for us, Howdens shares some of the same attributes present in a few of our other investments: Ferguson and XPEL. This made pattern recognition easier.

How Can Selling Kitchens Be Such Good Business?

Three elements of Howdens make it an unusually high-performing business:

1) Friendly intermediaries: Howdens does not have to pay for an expensive sales force or distributor network to get its products into the end customer’s home. Instead, the contractors who install Howden kitchens promote its products on their behalf. Howdens’ business model involves selling its products indirectly through hundreds of thousands of independent kitchen installers throughout the U.K., which we refer to as ‘tradespeople.’ These tradespeople act as a massive unpaid sales force since they evangelize the Howden product line for free. Tradespeople are typically considered trusted experts by homeowners, and this gives them considerable influence over where the kitchen is ultimately purchased. Kitchen installers recommend Howdens frequently because Howdens makes the tradesperson’s life significantly easier, its products rank at the top of the price-to-quality spectrum, and the tradesperson earns more installing a Howdens kitchen—more on these factors below. As a result, Howdens does not have to waste money on distribution or marketing to attract end customers, resulting in a very efficient sales cycle.

2) Vertical integration: Howdens carefully absorbs high-value segments of the kitchen value chain through vertical integration. This allows Howdens to have better control over its supply of products while also retaining more of the profits within each kitchen they sell.

3) De-centralized decision making, combined with aligned incentives: each of Howdens’ ~850 store managers run autonomous local businesses. This structure allows for local decision-making and re-calibration as conditions on-the-ground change. Such a strategy is more resilient and adaptive than relying on headquarters executives anticipating the needs of their stores.

Further, Howdens’ store managers and employees earn a fixed percentage of their store's profits, incentivizing employees to maximize store-level profitability. This compensation structure ensures that natural alignment exists between on-the-ground employees and shareholders.

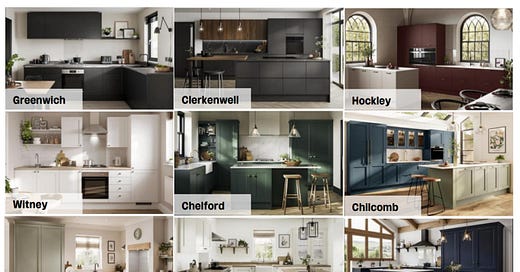

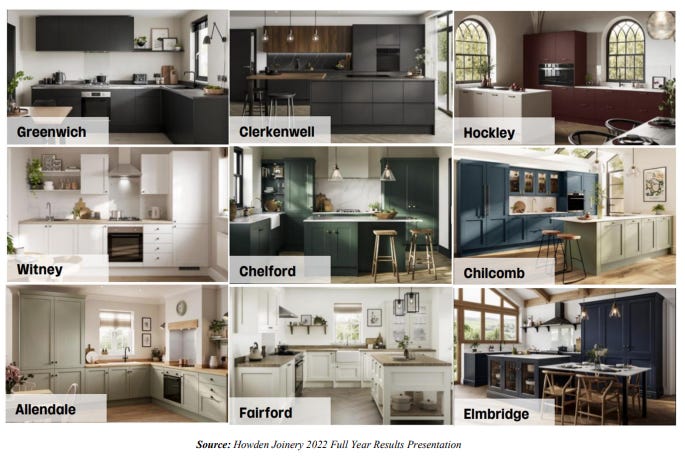

Some Of Howdens’ Kitchen Lines:

Howdens, an Overview

Howdens may not be a revolutionary idea, but it is unique. Howden Joinery was founded in 1995 by Matthew Ingle, a descendant of "U.K. kitchen royalty,” if you can imagine such a thing. Matthew’s grandfather Tom Duxbury founded the leading U.K. kitchen maker at the time: Magnet, where Matthew worked up the corporate ladder to become the managing director of its trade business. Matthew was later pushed out of the company when Magnet fell into self-inflicted financial distress due to a combination of excessive debt and a U.K. recession. After leaving the company, Matthew wanted to re-create a standalone version of the trade business he built inside Magnet. The central premise of what would eventually become Howdens was that a company focused exclusively on tradespeople would best serve these customers and win their repeated stream of business.

Howdens is valuable to tradespeople because they offer the following:

1) Superior service: Howdens’ network of >800 small depots across the U.K. means that ~85% of their trade customers are within five miles of their local store. They can quickly get whatever they need from someone they know and trust. Howdens offers white glove service and delayed payment terms so tradespeople can pay for a kitchen after the installation is complete. This saves tradespeople from worrying about their cash flow.

2) Product availability: Howdens’ “in-stock” model means that kitchen installers can get what they need quickly and replace parts without hassle if something goes wrong or a change is necessary. Such rapid product availability saves time and allows a tradesperson to complete more jobs each year.

3) Aligned interests: Tradespeople earn more working with Howdens. Howdens’ confidential pricing model allows tradespeople to mark up the products they install, allowing them to earn from the Howden products they sell in addition to charging for their labor. Retail customers cannot go around the tradesperson to buy directly from Howdens, and this gives the tradesperson a proprietary product offering. These elements create alignment between Howdens and the tradesperson.

4) Great Kitchen Value: Most importantly, Howden kitchens are top quality for the money. An installer knows that if they choose Howdens, their customer will be happy with the result; the kitchen looks nice, it was provided at a fair price, the installation went smoothly, and it will last a long time. Howdens offers competitive pricing due to scale advantages and vertical integration.

Assuming ~80% of Howdens' revenue is kitchen-related (the remainder is joinery, doors, and other traderelated accessories), the company has approximately 25% kitchen revenue share in the U.K. According to the research firm JKMR, Howdens sells roughly ~40% of all U.K. kitchens by volume due to its high exposure to low to mid-range kitchens.

Unlike selling kitchens to consumers in a retail setting, selling to tradespeople through small local depots is a far more attractive business model. Homeowners are fickle and only buy kitchens infrequently, which makes acquiring them as customers less attractive. On the other hand, tradespeople are sticky, repeat customers that will return to Howdens as long as they continue offering the best place to buy kitchens.

As mentioned earlier, Howdens maintains hundreds of thousands of accounts with tradespeople across the U.K. and its brand is well-known among installers. Howdens strong market position is evidenced by the struggles of its closest competitor: Benchmarx Kitchens (a subsidiary of Travis Perkins plc). Benchmarx tried to copy Howdens’ trade-only business model while also undercutting their pricing, but failed to gain any meaningful market share. Howdens trade customers are loyal and sticky.

Howdens stocks and sells its ~90 different kitchen ranges via its network of ~800 small format depots across the United Kingdom and ~60 continental European locations concentrated in France. Howdens’ depot model is powerful because each depot manager runs the branch in the way they think is best for their local economy. Managers stock the products they think their customers want, price them based on local supply and demand trends, offer discounts as they see fit, and service customers in a high-touch way that keeps them coming back. This autonomy works because managers are incentivized simply: they earn 5% of the net store-level profit (assuming they meet their basic margin requirements). Pushing decisionmaking authority out to the depots removes the need for headquarters to make brilliant decisions and see around every corner consistently. Instead, depots can naturally adapt and respond to conditions as they see them, resulting in better operating performance.

Behind each depot is a strong manufacturing footprint based at their Runcorn and Howden sites, as well as two sites dedicated to manufacturing quartz countertops. Howdens’ manufacturing strategy emphasizes only making products in-house that are simple, high-volume, and represent an outsized portion of a kitchen’s profitability. As a result, Howdens today manufactures roughly one-third of the products it sells, with the rest outsourced to specialists who can do it better. From these manufacturing criteria, Howdens today makes its wood cabinets, kitchen frontals (drawers, facias), solid work surfaces, and a small variety of other wood-based products such as skirting and architrave.

Put together, the above factors allowed Howdens to become the largest kitchen supplier in the U.K. while earning industry-leading gross margins and returns on invested capital. In 2022, Howdens generated nearly £400m of operating cash flows and, after subtracting depreciation (a proxy for maintenance capex), approximately £350m of look-through "free cash flow." This compares with the company’s current enterprise value of approximately £3.6b, which represents a ~10% free cash flow yield despite the attractive nature of the business. Howdens has no debt, pays an attractive dividend, and aggressively repurchases its shares.

Opportunities for Growth

While Howdens does not have an infinite growth runway, there are many logical places it can invest in to increase future profitability meaningfully. Regarding its depot base, Howdens has ~800 depots in the U.K. today, with aspirations to reach ~1,000 depots over time. Further, outside of the U.K., Howdens started to see signs of success in its store clusters in France. Howdens expects 60 operational depots in France by the end of 2023. While I was initially quite skeptical of their French expansion–British companies don’t typically succeed there–my research indicates they are gaining momentum. I was encouraged to learn that they assembled a high-performing local French management team, which, combined with their autonomous depots, allows them to be nimble and adapt to the nuances of the French market. Over time, France could provide an opportunity for hundreds of additional new depot locations and serve as the prototype for expanding into other continental European markets.

In addition to new store growth, there are multiple opportunities for Howdens to make its existing depots more profitable. First, Howdens is refreshing its store base to its updated depot format. This investment makes existing locations more appealing to visit (driving increased store traffic) and more efficient to operate.

Next, Howdens is making significant investments in its digital capabilities due to its historical underinvestment in this area. To illustrate this point, Matthew Ingle, who was Howdens' founder and CEO until 2018, did not have a computer or smartphone during his 23 years running the company. Virtually all customer interactions today happen over the phone or in person, with only basic IT systems behind each order. By creating a digital offering designed for customers, a tradesperson can see what’s in stock locally, place orders online, and get notified when their products arrive. This will save depot managers significant amounts of time, which they can reinvest in offering better service and generating new business.

Howdens is also working to build higher brand awareness with homeowners to continue the trend of stealing share from traditional kitchen retailers that represent the majority of the U.K. market. While Howdens maintains significant brand awareness among tradespeople, less than one in four British consumers is familiar with the Howden brand today. Through targeted investments in marketing, Howdens is attempting to entice consumers to seek out their products directly, either via their website or stores, thereby closing the customer loop. In our portfolio, XPEL is an example of a company that built a desirable consumer brand that funnels customer leads back to its network of skilled installers. If Howdens can attract customers and refer those leads back to its tradespeople, it will further reinforce its value proposition while also driving additional market share gains.

As mentioned earlier, Howdens improves its profitability by continuously capturing more of the kitchen value chain through vertical integration. Historically, the company only manufactured cabinets, a limited selection of frontals, and some wood-based laminate countertops. Today, Howdens is investing in additional manufacturing capabilities for a more comprehensive array of drawers, facias, quartz work surfaces, skirting, and architrave.

Through the acquisition of Sheridan Fabrications and the acquisition of the assets of J. Rotherham out of administration, Howdens acquired two of the largest manufacturers of quartz countertops in the U.K. While Howdens only manufactured laminate wood countertops in the past, these acquisitions offer Howdens the ability also to manufacture higher-end work surfaces that resemble natural stone countertops at an attractive price. Unlike traditional stone surfaces that are difficult to manufacture consistently due to the constraints of rock sizes and shapes extracted from the ground, these highly manufacturable man-made stone surfaces cater to Howdens' ethos of high-volume manufacturing at consistent quality levels.

High-end stone countertops can represent 20-40% of the total value of a new kitchen, which means these acquisitions materially increase Howdens’ reach of a kitchen’s ‘bill of materials.’ Offering quartz countertops also gives Howdens a more competitive offering in the higher-end kitchen market, where the company is historically underrepresented. Howdens continues moving upmarket through its refreshed premium kitchen offering.

In short, Howdens has multiple pathways to grow its profitability over time, all funded through internal cash flows without relying on the capital markets. After investing in its growth initiatives, the company returns excess cash to shareholders through its nearly 3% dividend, and last year alone repurchased ~6.2% of its total outstanding shares. When valuations are depressed, these repurchases accelerate value creation for shareholders. Between investments in its core business, accretive M&A, dividends, and repurchasing shares, Howdens has multiple pathways to compound shareholder capital.

Conclusion

Howdens is attractive because of its robust business model, straightforward means to grow its profitability, fortress balance sheet, strong cash flows, and opportunity to return capital to shareholders, all at an undemanding valuation.

Of course, we contend with the obvious question of how much COVID pull-forward the company faces or whether the U.K. faces a recession. Investors hate such uncertainty, which is partly why the shares are so cheap. While it is possible, if not probable, that the company will see declining revenue in the short term, there are many reasons to be optimistic over the medium to longer term. Given the maturity of the housing market in the U.K. and its aging housing stock, 95% of Howdens’ business is tied to repair, maintenance, and improvement, which is more resilient to economic cycles. Further, with more time spent at home and accelerated home purchases due to the COVID period, homeowners are likely to continue investing in their homes instead of buying new properties.

Lastly, while inflation continues to be a concern, Howdens has significant pricing power due to its business model, which relies on the goodwill of the tradesperson combined with its confidential pricing practices. There has been limited sensitivity to Howdens’ price increases to date. Howdens appears well-suited to handle whatever lies ahead.

RiverPark’s Large Growth Fund initiated positions in Canadian athletic apparel company, Lululemon (LULU), and health insurer, UnitedHealthcare (UNH), this quarter. We include their brief theses below.

Lululemon: We initiated a position in athletic apparel company Lululemon in the quarter. COVID-related supply chain bottlenecks led to over buying in 2022 resulting in a short-term inventory glut. This temporary issue gave us an opportunity to buy LULU’s stock at a historically low valuation.

LULU is a vertically integrated athletic apparel vendor focused on living a healthy and mindful lifestyle. The company, through its 655 stores and strong online presence (40% of sales), caters to affluent customers searching for both function and fashion. LULU has been a consistent innovator since its founding as a yoga brand in 1998 and currently offers an extensive array of men’s and women’s clothing options as well as yoga and fitness-related accessories. We believe that continued growth in the core women’s fitness category coupled with store growth, international expansion, and increased men’s sales can drive mid-teens revenue growth for the foreseeable future. The company’s vertical integration allows it to manage all aspects of the product cycle from design to manufacturing to sales, including when and how to discount excess inventory, which is a current focus. This vertical orientation also yields some of the best margins and free cash flow in the industry. We believe LULU can double revenue in the coming five years, which should lead to 150% EPS and free cash flow growth.

UnitedHealthcare: We re-initiated a position in UnitedHealthcare, a position we last held in January of 2022. The company’s stock price had fallen roughly 17% from its peak in October 2021 on fears about Medicare reimbursement rates, and we used this dislocation to start purchasing shares of what we believe to be the most dominant and complete managed care company in the industry.

With several at-scale and interconnected businesses, UNH occupies a unique position within the U.S. healthcare system. UnitedHealth has (a) a dominant managed care organization in commercial, Medicare and Medicaid markets, (b) a large and growing presence in local care delivery (OptumHealth’s physicians and ambulatory service centers), (c) one of only three atscale pharmacy benefits managers (OptumRx’s PBM) and (d) a fast-growing healthcareinformation technology (HCIT), consulting and revenue cycle management (RCM) business (OptumInsight). The combination of the largest MCO (UnitedHealth) with the faster-growing, higher-margin Optum services businesses positions the company to capture a large portion of the future growth opportunities in the U.S. healthcare services industry. We expect balanced growth from both health insurance and health services leading to consistent high-single-digit revenue growth for the company. With margin expansion from scale, share buybacks from its strong cash generating ability (the company currently has $30 billion in net cash), and continued strategic acquisitions, we believe the company can generate mid-teens or better earnings growth for the foreseeable future.

Until next time! - EP