Welcome new subscribers!

This week, we venture outside of the United States with pitches for a Canadian retailer and two German companies: an asset manager and a defense contractor.

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter if you’d like to be included in a future issue.

Let’s get to it.

Greenhaven Road added two new holdings in 4Q22: the German asset manager, Patrizia (PAT.DE) and outdoor equipment company, Clarus (CLAR). Typical of Greenhaven holdings, both companies are small and not included in major indices.

NEW INVESTMENT: PATRIZIA (XTRA: PAT)

Another company where the Greenhaven Road view is decidedly different than other market participants is a new investment in a German asset manager, Patrizia. My view is so different that I have feared it is wrong, but after extensive review of financial statements and time talking to the company, I think I have identified a hidden asset. The question is, how big is it?

Patrizia is a German real estate business that has transitioned from being “asset heavy,” owning large stakes in several property developments, to an asset light manager with $57B in AUM. When it was an asset heavy property developer, valuation metrics like price to book made a lot of sense. As it has transitioned to asset management and away from ownership, these metrics make little sense and it’s no longer appropriate for the company to be covered by REIT analysts. There are a lot of parallels between KKR and Patrizia, including what I believe is the market’s underappreciation for the strength of its balance sheet.

In very round numbers, Patrizia was valued at €700M at the time of our first purchases. We were paying less than €8 per share for a company with €2.4 of cash per share, just under €2 per share for their ownership share of a large housing development in Berlin called Dawonia, and €3.85 per share for their earned but not yet realized incentive fee for the portion of Dawonia they do not own but have developed and managed for investors. I realize that property values in Berlin have likely declined and a haircut should be applied to the value of the real estate and the incentive fee, but it is hard to argue that we were paying more than a couple hundred million euros for the asset management business.

The asset management business has three sources of revenue. The largest and most durable is management fees: the €57B in AUM generated approximately €245M in management fees in 2022. The smallest source is transaction fees, which relate to fees earned when a property is bought or sold. These fees are estimated to total approximately €30M in 2022, down as uncertainty has slowed transactions. For the final source of revenue, the company has guided to 2022 performance fees of €55M.

Now, here is where we return to arcane accounting. Under international accounting rules, as I understand it, for its funds in which Patrizia itself owns less than 5%, performance fees are only recognized upon exit. This applies to every fund except the one that holds Dawonia, which recognizes fees prior to exit.

The result? The incentive fees that will crystallize upon exit appear nowhere in the financial statements. KKR, which operates under U.S. accounting rules, discloses incentive fees that are earned but not yet realized, but Patrizia, which operates under European accounting rules, cannot.

If European real estate returns to 1990s levels, this earned but unrealized incentive fee asset is effectively nonexistent, but Patrizia has earned tens of millions of euros per year in performance fees, indicating a history of profitable investing and a history of realizing fees. I don’t have an exact valuation for the net present value of the performance fees that have been earned but not yet realized, but I am comfortable that it is greater than zero and likely hundreds of millions of euros. Patrizia’s share prices has been highly correlated to German REITs, but I think an asset manager generating hundreds of millions of euros in management fees with an invisible asset of embedded incentive fees should not be valued using book value. In the end, fundamentals matter and I think they are on our side with Patrizia.

I was made aware of Patrizia because of a presentation on MOI Global by Gokul Raj Ponnuraj of Bavaria Industries Group.

NEW INVESTMENT: CLARUS (NASDAQ: CLAR)

The 2022 price chart for Clarus (CLAR) looks a bit unusual, bouncing around $20 per share for most of the year, spiking up to $28, and then plummeting to less than $8, a level not seen since 2019. The short interest in Clarus exploded, as did trading volumes. There were approximately 37.3M shares outstanding in July 2022. In August, 87M shares traded – 20 times what traded in several previous months. In the last 4 days of August, more than 37M shares traded hands on no obvious news. It’s typically an enormous waste of time to try to explain short-term moves in stocks, but here we can find some breadcrumbs. A Brazilian hedge fund seems to have blown up (link) and a large quantitative options fund seems to have inadvertently acquired enough shares of stock (4.3M) and call options (3.9M) by the end of July that fully exercising them would have resulted in the firm owning 21.9% of the company. By the end of August, that firm sold all but 300k shares but grew its options position to 11.8M which, if fully exercised, would have resulted in 32.4% ownership. We will come back to this massive options position, but the main point here is that a large portion of the buyers and sellers were one fund being margin called (seller) and a fund that quickly acquired and divested a disproportionately large exposure to Clarus.

Our purchase prices were around $8 per share, which implies a market capitalization of roughly $300M. The company does have debt, which should have been approximately $135M as of year-end, and also should have ended the year with $100M+ of inventory. What does Clarus do? I suspect that the options firm had no idea, but this is how Clarus describes itself:

“Clarus Corporation is a global leading designer, developer, manufacturer and distributor of best-in-class outdoor equipment and lifestyle products focused on the outdoor and consumer enthusiast markets. Our mission is to identify, acquire and grow outdoor ‘super fan’ brands through our unique ‘innovate and accelerate’ strategy. We define a ‘super fan’ brand as a brand that creates the world’s pre-eminent, performance-defining product that the best-in-class user cannot live without.”

Clarus has been built by Warren Kanders, who owns approximately 15% of the company. He has allocated capital well and has pursued a buy-and-build strategy of improving underlying brands through better distribution and availability of capital. His first acquisition and highest profile brand is Black Diamond, a leading brand for rock climbers. Most recently, Clarus purchased an Australian company, Rhino Rack, which builds roof racks for SUVs for off-road adventures (think Thule on steroids).

In round numbers, Clarus’ $300M + debt is substantially less than the prices paid to acquire Black Diamond ($90M), Sierra ($79M), Barnes ($31M), and Rhino Rack ($197M). The valuation also appears quite reasonable relative to the $60M+ in EBITDA I expect the company to generate in 2023. There is a “better” case scenario three or four years out where supply chain issues moderate, valuation multiples revert to closer to historical levels, and the stock becomes a three-or four-bagger.

Coming back to the options firm that acquired exposure to 32% of Clarus – in the U.S., if an entity acquires more than 10% of a company, they must hold those shares for at least six months. If not, the company (or, if the company refuses, its shareholders) can sue for the profits under the “short swing profit rule.” There are also exceptions for market makers and arbitragers, both of which have been invoked by the firm in question.

This is also not my area of expertise but, in my opinion, the short swing profits, could easily be $2 per share or >25% of the prices we were paying. The company has filed suit. This potential windfall does not appear on the company’s balance sheet nor is it discussed or valued in the marketplace, as far as I can tell. The short swing profit opportunity is not the reason to buy the shares, but at sub-7X EBITDA that should be growing, it is a potential cherry on top.

In the end, fundamentals matter and I think they are on our side with Clarus.

VGI Partners Global Investments initiated positions in two stocks this past quarter: Walt Disney (DIS) and Rheinmetall AG (RHM.DE). Can returning CEO Bob Iger successfully complete the business model transition he started years ago?

New LONG Position: Walt Disney Co. (~4% weighting)

The Walt Disney Company is a diversified media conglomerate operating media networks, theme parks, film and TV studios and direct-to-consumer streaming services. It is the global leader in theme parks with hotels and cruise lines aimed at families. Key assets within Disney are the instantly recognisable entertainment franchises that have multiple avenues of monetisation such as Mickey Mouse, Star Wars, ABC and Marvel’s Avengers.

Disney’s share price declined due to a number of factors in 2022, presenting us the chance to purchase a long-admired business and its unique collection of valuable intellectual property assets at what we consider to be a very attractive valuation. Summarily, the EPS of Disney has declined from US$7 in 2018 to ~US$2.60 in 2022 but we believe that the earnings power of the assets has not diminished to anywhere near this extent.

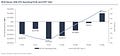

Disney is currently undergoing a business transition within the Media and Entertainment Distribution division (DMED) from traditional media property distribution via third parties (i.e. cinemas and broadcast networks) to a Direct-To-Consumer (DTC) model via the Disney+ streaming service. A key element of our thesis is that the earnings power of the company is currently being masked by the marketing and content investments within Disney+ and that this will normalise over the next several years. To put this in perspective, Disney+ (DTC sub-segment) currently generates operating losses of over US$3.3bn (a negative 14% operating margin) compared to operating margins at its nearest streaming competitor, Netflix, of +15.5%.

A secondary concern around Disney has been the CEO leadership transition from Bob Iger to Bob Chapek that occurred in February 2020. As well documented in the media, the changes that Bob Chapek made to the organisational structure of the business affecting the creative output at Disney did not resonate with senior executives nor investors and he was ultimately removed by the board. Hollywood loves a sequel – Bob Iger was sensationally reinstated to the CEO role in November of 2022. During his original tenure as CEO, Mr Iger was a well-respected leader, overseeing successful acquisitions of Pixar, Marvel Entertainment and Lucasfilm. We view the board actions as supportive of long-term shareholder value creation as Mr Iger seeks to unify the executive team and navigate the company through the current challenges.

The resilient cashflows of the Disney components have allowed it to invest heavily in the DTC content space and give the management team the necessary flexibility to prove out the earnings power of the business. In this context, it would be remiss of us to not discuss the Parks, Experiences and Products division (PEP) of Disney, which makes up 35% of revenue and 49% of operating profits (ex DTC losses) but has been overlooked recently given the intense focus on the media business. PEP is a solid business, with the opportunity to invest alongside the core franchises in a ‘flywheel’ of value creation (i.e. Star Wars and Avengers attractions at Parks). After suffering as a result of COVID, the business has bounced back remarkably well, with operating profit now 8% above the FY19 level. Further upside will come from the full re-opening of International Parks – prior to COVID these represented 10% of operating profit of the division. Contrary to conventional wisdom, Return on Invested Capital (ROIC) in this business is estimated at 18% and there is further opportunity to invest material amounts of capital at high rates of return.

When we built our stake, Disney was trading at more than a 35% discount to fair value, and we could underwrite the valuation if the streaming business simply broke even. On our FY26 estimates, Disney is trading on a 7% FCFF (free cashflow) yield, despite profitability still being depressed and continuing to reinvest aggressively as highlighted. Using conservative profitability assumptions, we expect the stock to re-rate back to a 4-5% free cashflow yield in FY26.

New LONG Position: Rheinmetall AG (~4% weighting)

Increased geopolitical tensions in 2022 have created a renewed willingness by nations to invest in defence capabilities and energy security. Whilst not traditionally an area of focus for VGI, team members have been conscious of this theme and on the lookout for any investment opportunities that may arise as a result. The return of travel in a post-COVID world enabled several members of the team to get back on the road and do one thing we love as part of the investing process – meet in-person with management teams and extensively tour company facilities. After several preliminary calls, we were able to meet with Rheinmetall management in person in late 2022 and came away impressed with the management team and their shareholder alignment, with incentive compensation linked to Return on Capital Employed (ROCE) and operating cashflow, unique in the European market.

Rheinmetall is an international systems provider for defence products, with regional leadership positions in weapons and ammunition, vehicle systems and electronic solutions. There are a number of elements to the moat of the business: a) the currently approved production facilities in a highly sensitive areas (air defence systems, weapons and vehicle systems) where barriers to entry are high, b) technological capabilities and c) relationships with key customers.

The conflict in Ukraine has provided the catalyst for a significant renewal of defence capabilities across the European region, with NATO signatories having committed to significantly increase their spending after a long period of material under-investment; Rheinmetall will grow with these commitments. The current war is seeing supplies rapidly diminish through direct/indirect transfers and it is estimated that 10 years could be required to replenish German stocks to NATO commitment levels in Rheinmetall’s ‘home’ market. In light of this, the German government has increased its defence spending commitment to 2% of GDP and established a 100bn euro special fund. New members have joined NATO and other countries have also committed larger percentages of budget spending to defence (Spain and Italy: 1.4% to 2%; UK: 2.2% to 3%). These commitments provide a strong multi-year tailwind to the Rheinmetall business.

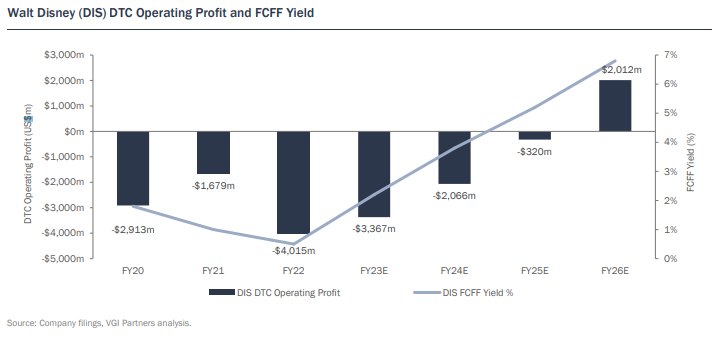

Over the last several years, Rheinmetall has been undergoing a portfolio transformation process as it seeks to become a pure play defence technology business. Traditionally, the business has had a large exposure to Auto Original Equipment Manufacturer (OEM) customers (and Internal Combustion Engine (ICE) vehicles in particular) with ~50% of the revenue and operating profits in the business coming from the auto division in 2018. Whilst the company has made investments to capture component revenue from EVs, their exposure to the ICE supply chain has been a drag on the trading multiple and sentiment. Recent portfolio management activities have created a ‘cleaner’ business with higher expected ROIC. Disposal of the pistons unit removes automotive revenue exposure and we project that, following a shrewd recent acquisition in the ammunition space (Expal), by FY25 ~70% of sales and over 80% of profits will come from the defence division.

From a valuation perspective, we believe that there are a number of areas supporting valuation. Rheinmetall has a strong history of dividend payments, with dividends increasing at an 18% CAGR from FY17-22. At the FY22 Investor Day, Rheinmetall committed to increasing the dividend payout ratio from 35% to 40% – at expected FY25 dividend of 7.5 per share and assuming the business trades in line with historical dividend yields, we believe the shares are trading at a more than 20% discount to fair value. Historically Rheinmetall has traded in a range of 5x-7x EV/EBITDA – with a chance to re-rate to 6x-8x EV/EBITDA on a significantly higher earnings base.

European defence names generally trade at a significant discount to their US peers, but with such strong budgetary commitments, we see optionality here for a re-rate. The US defence landscape re-rated post a budgetary change from 2011-2020. The French defence budget markedly increased post the annexation of Crimea by Russia in 2014, providing a tailwind to Thales.

Potential risks here stem from the lumpiness of defence sector contracts – indeed we have already seen during our ownership period a delay in several contract awards, but we view these as short-term setbacks vs the longer arc of renewed defence spending in Europe. Further risks are in the relationship with key customers, such as the German government, highlighted by a recent issue with PUMA tanks malfunctioning in live fire exercises. Any export controls would also be a cause of concern given the business has 35% ex Europe revenue exposure and cause us to review the investment thesis.

Donville Kent initiated a position in the Canadian women’s retailer Reitmans (RET.V). The company restructured after COVID lockdowns pushed them into the confines of CCAA protection. With a clean balance sheet and renegotiated leases, is now the time to buy? Donville Kent laid out a very detailed thesis in their latest later. We excerpt a portion below.

Reitmans

EXECUTIVE SUMMARY

Covid lockdowns proved to be a decisive moment for Reitmans. Due to government forced store closures, Reitmans strategically entered CCAA protection and restructured their business. They exited this process in 2022 after closing over 30% of their stores, consolidating their banners from 5 to 3, laying off 1,600 employees, and paying 50 cents on the dollar to settle debt and liabilities. This process gave them cover, and a cheaper way to close unprofitable stores and renegotiate retail leases at an opportune time. We estimate they saved 10% on lease costs across their high-tier locations, and over 60% on their second-tier locations.

Now the business carries $68m of cash, no debt, has reported Net Income of ~$60m in the last 12 months, owns roughly $240m of real estate in Montreal1 , all while trading at a $146m market cap. Add in a quickly growing ecommerce segment, now representing 25% of sales, positive online search trends, increasing revenue per square foot, and decreasing cost per square foot, we think the profitability is sustainable.

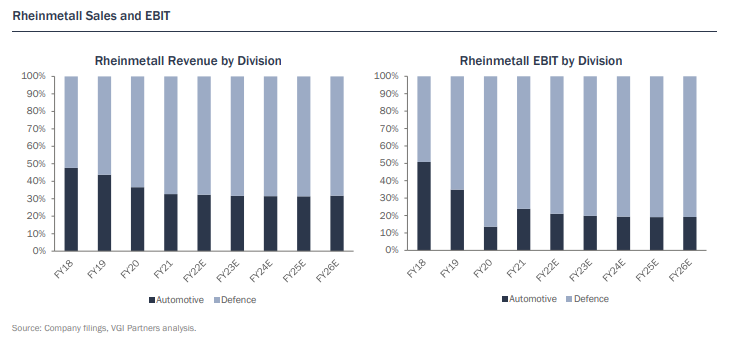

In past recessions, like 2001/2002 and 2008/2009, the business remained profitable, as they are a value brand, plus they are one of the few retailers with a growing customer base. We estimate their target market is growing 3.3% per year. We think the stock will see a massive re-rating in 2023 as it gets back onto investors’ radars and reinstates dividends & buybacks, plus gets a push to monetize real estate.

VALUATION

Reitmans’ valuation is the most compelling aspect of the story from an investment standpoint. We believe the stock is as cheap as it is mainly due to the complexity and confusion of the CCAA proceedings. In addition, there is no analyst coverage, and many institutional investors cannot invest on the TSX Venture, especially not in something that’s currently this small ($146m market cap).

From 2010-2019, the stock traded on an average price to cashflow of 7.7x, and we currently estimate it is trading on 2-2.5x cashflow. Plus, the company is currently sitting on $68m of cash and no debt as of last quarter, and has about $240m of real estate assets. 1

Equity

• Over the trailing 9 months, Reitmans has reported over $60m in operating cash flow

• Based on costs savings and resilient revenue described above, we believe the business can conservatively generate $57-$62m in cash flow over the next 12 months.

• Factoring interest rates, we believe the equity value of the stock should trade on at least a 7x cashflow. 1

• This values the operating business at $8.16-$8.88 per share. 1

Cash

• In Reitmans’ most recent quarter they reported $68m of cash.

• Their quarter ending January 31st, 2023 should increase this amount by roughly $90m. 1 This accounts for approximately $1.84 per share but we highly discount this amount in our value because management is known to be conservative and maintain large sums of cash on the balance sheet.

• A portion of cash should be used for a stock buyback which would be significantly accretive at a 40% cashflow yield.

Real Estate

• As referenced in the history timeline, Reitmans moved into their current office building in 1965, added two floors plus additional space.

o We estimate the building is currently worth $118,400,000. 4

• Reitmans started construction on their distribution facility in 2001 and opened it in 2003. o The facility has 40 shipping and receiving docks, capable of processing more than 55m units of merchandise per year. o We estimate the building is currently worth $123,490,000. 5 This is most likely conservative because it doesn’t factor in the 1.1m sq.ft of total land the building operates on

• Much like the comments around cash on the balance sheet, a discount needs to be applied to the real estate value because the probability is much less than 100% that value for shareholders will be realized here.

• We believe Reitmans will be asked by shareholders to complete a sale and leaseback of this real estate.

o The Reitman family should purchase this land from Reitmans the corporation, and enter in a long-term lease.

o This allows investors to invest solely in the operating business (retail business).

o We believe the current office space is underutilized by the company.

o The value of both assets is much more separate than together and allows public shareholders to invest in the retail business outright.

o This is becoming a fairly regular occurrence in public markets. In 2003, Reitmans did a sale and leaseback on their distribution center handling equipment. Some other companies that currently have are currently doing a sale/leaseback, or have recently completed one include: Firan Technology (FTG), McCoy Global (MCB), Bally’s Corp (BALY), Life Time (LTH), Kohl’s (KSS), Sherwin-Williams (SHW), and Six Flags (SIX).

• We believe after fees, taxes and applying a conservative discount, a real estate divestiture could yield the company over $3.50/share.

Until next time! - EP

It was Iger responsible for destroying Disney with non-stop hateful woke BS. "The Critical Drinker" on YT is a must-watch channel for film fans, and he put it best on Iger's return.