Welcome new subscribers! Today, we have 5 more new ideas to share.

If you find value in these pitches, please consider forwarding to a friend or colleague.

If this post was shared with you, make sure to subscribe below so you don’t miss future issues.

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

Let’s get started.

XPEL (XPEL) from Bonsai Partners: (compounder)

New Investment: XPEL (Nasdaq: XPEL)

XPEL Overview

XPEL is a provider of high-performance automotive and architectural films. XPEL’s films protect painted automotive surfaces as well as add tint to automotive and architectural windows. Paint protection film (PPF) represents a majority of XPEL’s sales.

XPEL’s end customers buy paint protection film to protect their cars from chips and scuffs caused by rocks and other debris. Rather than repaint a car’s front end multiple times over its life, PPF offers an invisible layer of protection that absorbs these impacts to ensure a vehicle looks like new. Although customer awareness of PPF is still relatively low, the PPF market rapidly expanded over the past five years due to improved product performance and customer adoption reaching a tipping point.

Anyone who takes pride in the appearance of their vehicle is a potential customer of PPF. While protection film initially gained traction in high-end cars, today, some of XPEL’s most common installations include mass-market models such as Toyota Corolla and Ford F-150.

Consumers who want to apply PPF to their vehicles typically purchase the product through an independent film installer. Installers are required for this product because PPF installation is labor intensive, and its application is highly technical. The variability of different car models makes defect-free installation a challenge for even the most experienced film installers. XPEL views its network of installers as its customer base since they are the direct buyers of XPEL products.

In addition to its line of films and coatings, XPEL also sells to installers its software and database of film patterns, known as their Design Access Program (DAP). The DAP offers installers the most extensive library of automotive patterns, with over 80,000 designs. This system allows a film installer to precisely print film cutouts that match the precise size and shape of most vehicle makes, models, and years. The Design Access Program offers XPEL a significant advantage over its PPF competition, which includes Eastman Chemical (through its Llumar and Suntek brands) and 3M. XPEL’s software is a key reason the company enjoys a leading position with installers.

XPEL earns money in three ways: 1) by selling films and coatings to its network of installers (~84% of revenue), 2) by collecting software access fees and "cutbank" credits (6%), and 3) by offering installation services directly through its self-owned installation centers (~10%).

Finally, XPEL developed a robust growth playbook to execute against, which includes: 1) authorizing more XPEL authorized dealers to open in North America, 2) introducing new product lines and increasing product utilization across their installer base, 3) expanding their presence outside of North America, 4) moving further upstream to sell their products through automotive OEMs and 5) acquiring existing installation shops or opening new XPEL branded installation centers. XPEL's growth runway remains significant as customer adoption of PPF remains in its early days.

What Makes XPEL an Enduring Business?

While XPEL primarily makes money selling performance films, do not be fooled; the properties of XPEL’s films are not their core differentiator. I view XPEL’s success in film as a byproduct of something else entirely: its ability to create the most valuable ecosystem for film installers.

While XPEL's performance films are market-leading products, comparing XPEL's films to competing products misses the bigger picture. While XPEL and Apple are not comparable, I don’t think one gains a good sense of Apple’s competitive advantage just by comparing the iPhone’s technical specifications against those of competing Android devices. The value of the iPhone lies in Apple’s ecosystem, and Apple monetizes its ecosystem through smartphone sales and high-margin app store royalties. XPEL operates similarly: they monetize their ecosystem through performance film sales and high margin "cutbank" credits.

XPEL’s ecosystem value originates from the company’s leadership in three areas: marketing (brand awareness with end consumers), distribution (high-touch service to installers), and software (their proprietary library of designs).

XPEL’s lead in marketing, distribution, and software allows the company to funnel the most high-value film jobs to its network of installers while also increasing the amount of profit its installers earn per job through technology and white glove service. By driving the most value to installers than anyone else, more installers want to work exclusively with XPEL, driving film and software sales back to the company. Let’s discuss each of XPEL’s three differentiators in turn.

On the marketing side, XPEL built the cognitive referent within the PPF industry. Put differently, what “Kleenex” is to tissues, XPEL is to paint protection film. Customers who want paint protection often don't know the term "paint protection film" at all. Instead, when they visit a film installer, they often ask installers to "XPEL" their car, regardless of the brand the installer is affiliated with.

While XPEL's product is an indistinguishable invisible film, the company did a remarkable job building an aspirational brand for auto enthusiasts. XPEL accomplished this by partnering with leading car brands, race clubs, and auto enthusiast groups. These organizations likely weren’t interested in partnering with stodgy brands like Eastman Chemical or 3M, allowing XPEL to step in and become the aspirational product for protecting one’s vehicle. By building the market-leading brand, more customers search for XPEL branded products and affiliated installers than any other. This makes XPEL’s dealer locator tool quite valuable. More film installers want to work exclusively with XPEL due to their control of access to the customer from multiple angles.

From a distribution perspective, XPEL built a high-performance service organization. Rather than extract as much value possible from its installers, XPEL is service-focused, offering high in-stock availability, products delivered quickly, a leading warranty, and a direct line to resolve issues fast. XPEL would rather eat the cost of a problem installation than squeeze their installers for everything they are worth. This level of service helps installers service more cars in any given month while also delivering peace of mind that XPEL has their back. I discuss the importance of this attribute in more detail in the following section.

Finally, XPEL's software is essential to installers because they are forced to cut film by hand without it. This process of ‘bulk cutting’ creates significantly more film waste (paint protection film is expensive), wastes installer time, increases human error, and the installer might damage the vehicle underneath. XPEL's DAP software linked with a film printer ensures consistent film shapes, faster application times, and repeatable results due to their library of vetted designs that installers grow to trust.

As mentioned earlier, XPEL holds a clear advantage in its Direct Access Program library. The company stands out in this area because XPEL didn't start as a film company. Instead, XPEL began as a software company and only later in its life expanded outward to sell its own brand of film and other products. While XPEL engineers each of its products, they outsource virtually all of its manufacturing to third parties.

Due to their software focus, XPEL’s library of patterns is the most extensive and accurate. This is difficult to replicate. While their well-capitalized competitors have tried, their design libraries are incomplete and inaccurate. It takes a significant investment to create designs for each new vehicle model and trim while also curating a catalog of historical models spanning decades. XPEL's competitors have too many other business lines to devote the resources necessary to compete in this niche industry effectively.

From our research, XPEL's competitors admit that after spending millions of dollars building new versions of their software, XPEL is still at least a decade ahead. Finally, since XPEL also runs some of its own installation shops, it can test new patterns and software features before releasing them to others. This arrangement allows XPEL to iterate faster while avoiding installer frustration.

In summary, by driving more leads to installers and offering a more efficient system to service those leads, PPF dealers earn the most money when they choose to partner with XPEL. As a result, XPEL’s installer base is incredibly loyal and often ecstatic to join the XPEL network when offered. Importantly, this system creates a quasi-franchise business model for XPEL; they're not just a film supplier, but they earn film and software "royalties" on the customer leads they pass through to their installers.

I cannot overstate the importance of controlling distribution in the PPF industry. I explain this dynamic further in the section below.

The “Friendly” Installer

Under the right conditions, the seller of a product is the critical point of an industry’s value chain. I find this occurs in infrequently purchased, high-value products. In these specific cases, customers tend to rely on expert opinions to avoid buyer’s remorse. This dynamic creates a favorable environment for sellers since they hold considerable sway over which products the customer ultimately buys.

For example, an orthodontist not only installs braces but also acts as a salesperson that guides the patient to pick the "right” orthodontic system for them. By acting as a subject matter expert and salesperson simultaneously, customers rely heavily on the orthodontist's opinion, giving the dentist significant control over which products are purchased.

In the case of paint protection film, this dynamic also exists for film installers. A car owner is making a significant investment in their vehicle, often thousands of dollars, and to the naked eye, each film is indistinguishable. Customers want to know from the installer which product will best protect their automobile over its life. Film installers, therefore, exert significant influence over which film brand and SKU are sold. By cornering the PPF industry’s installer base through the means mentioned above, installers recommend XPEL products more than any other.

While installers are highly interested in end customer satisfaction, they do not have a perfect alignment of incentives. To the installer, the best product is not just the film with the highest quality at the lowest price. Instead, installers also consider a product's commercial attributes: is the product the easiest and fastest to install? Is the product always in stock? Can I get the product delivered quickly? Will the company replace the product for free if something goes wrong? Etc. On these attributes, the scale tips heavily in XPEL’s favor.

XPEL isn't just growing quickly because it has some of the best performing films (they do), but also because it offers the best platform for an installer to make money running an auto film business. Building deep alignment with installers gives XPEL control over the industry. XPEL has a long waitlist of installers clamoring to become an exclusive XPEL distributor, and this scarcity creates a sense of pride for those chosen to join their network.

If XPEL continues to deliver the most value to installers through its software, marketing, and distribution layers, its control over the fast-growing PPF industry will remain intact.

Conclusion

XPEL controls two customer chokepoints: they have the market-leading brand, and they maintain control over distribution. By cornering these channels of the PPF market, XPEL outfoxed its better-capitalized competition and now leads this fast-growing and attractive industry. I believe the arrangement they created with installers is enduring, and they will be able to execute their growth playbook for many years.

Equitrans Midstream Corp (ETRN) and Unit Corporation (UNTC) from Steel City Capital, L.P.:

Equitrans Midstream Corp (ETRN) is a new long position for the Partnership. ETRN is the former midstream arm of Marcellus natural gas producer EQT. They own gathering assets (small diameter pipelines that directly connect to the wellhead) and long haul transportation assets (larger diameter pipelines that move gas over long distances, usually under take-or-pay contracts). The company formally separated from EQT via spin-off in late 2018. At the time, the capital structure was pretty complicated – there was a collection of three (yes, THREE) publicly traded currencies that held various ownership interests in the core assets, but this was simplified in a combination of asset swaps over the years so that there is now only one publicly traded vehicle (ETRN).

The stock has been a poor performer since its separation due to missed financial targets and increasing debt-levels, both owing to the company’s struggle to complete the Mountain Valley Pipeline (MVP). The MVP is intended to provide much needed takeaway capacity from the Appalachian Basin to markets in the U.S. Southeast (where there is growing gas demand for power generation) as well as the Gulf Coast (for eventual export). The project has been an utter disaster for the company because of continued opposition from the environmentalist community. Originally targeted to come online in late 2018 at a total cost of $3.5 billion, today we're looking at a best case scenario of mid2023 at a total cost of $6.2 billion. In support of the expanding price tag, ETRN has had to take on increasing amounts of debt. At the same time, the company has pulled the rug out from under dividend-oriented investors, first in the form of revised guidance for no growth vs. 8-12% at the time of separation, and second in the form of a (backdoor) dividend cut. So it's sort of easy to see why investors have been sour on the stock.

The Partnership began acquiring shares in late June / early July when ETRN was trading around $6.00. As a general matter, I disdain using DCF for valuation purposes, as it’s a silly exercise that involves a lot of bullshit guessing about the future. But there are exceptions to every rule, and ETRN is one of them. This is a business that is fairly simple to model. Certain volumes are contractually set. Non-contractual volumes should continue flowing even in a depressed natural gas price environment (and today’s price environment is anything but weak). And prices for volumes are known variables (again, with a significant portion being contractually set).

The way I went about modeling the business was as follows: First, there is a “core” or “base” business that will generate cash flows independent of MVP being placed into service. Second, there is a set of “contingent” cash flows that will be generated in the event of MVP being placed into service. Applying a 10% (equity) discount rate to expected free cash flow1 from the base business yielded a price in the low-to-mid $6.00 range. So at our purchase price, I felt comfortable we were able to lock in an attractive return with limited downside. At this level, we also became the owners of an “option” on potential upside from the contingent cash flow stream. At the time, I estimated upside from this cash flow stream to be worth anywhere from $3.50-$4.00. Of course, the “option” is worth less than 1 At the time, ETRN’s recently issued long-term debt yielded around 8%. The yield has subsequently tightened to 6.5%. There is a strong argument to be made for an even lower discount rate, as ETRN’s heavy reliance on take-or-pay contracts with EQT makes this a story of “look-through” credit risk. EQT’s bonds trade in the 4.5-5.5% range. that (because of the probability tree associated with MVP), but at $6.00/share, we were getting the option for free. Who doesn’t like a free option?

Since initially establishing a position, there has been a major development with respect to the prospects of MVP. In exchange for his support of the proposed “Inflation Reduction Act,” West Virginia Senator Joe Manchin secured commitments from congressional leadership and the President to support a bill that would, among other things, clear a path for MVP to be completed. As it stands today, the market appears to be pricing in roughly 50/50 odds of completion, but I think the probability is much higher.

What could go wrong? The biggest risk to completion is no longer judicial, but political. The path forward for the legislation that would support MVP’s completion is a “side agreement” to the reconciliation bill. This means it can’t pass with a simple majority, and instead needs a filibuster-proof 60+ votes. Republicans are a tad salty about the Democrats’ recent legislative success(es) and I wouldn’t put it outside the realm of possibilities that they thwart the legislation out of pure spite2 . Time will tell, but given our purchase price, I think it’s highly unlikely that we end up losing money on our position even in the event of a “worst case” scenario.

Unit Corporation (UNTC) is another new long for the Partnership. UNTC is a diversified energy company with three segments: 1) exploration and production, 2) contract rigs, and 3) midstream. I stumbled onto the company on my own but have come to realize it is somewhat popular among the “FinTwit” community. This actually has me a tad on guard, as I’ve been burned by the group-think and unbridled enthusiasm that often accompanies this type of popularity (yes, we once owned GAIA, and no, I’m not proud of it).

At the end of the day, I’m attracted to UNTC because of what I perceive to be a fairly large margin of safety at our purchase price. Similar to ETRN, it’s hard to see how we lose money on this investment. The company has no debt and is currently sitting on $161 million of cash3 . Subject to commodity pricing, I think the company could reasonably generate another $70 million through the end of the year. On top of this, UNTC owns 14 super-spec rigs that are fully utilized. The best bogey available for the rigs’ valuation is last year’s acquisition of Pioneer Energy by Patterson UTI, which valued similar rigs at $13-$14 million each. This implies the rig business is conservatively worth $140-$150 million. Against a market cap of $590 million, $140 million is covered by rigs and another $230 million will be covered by cash by year-end. Depending on production and price assumptions for 2023, the E&P assets trade at an implied multiple between 1-2x cash flow.

Management has telegraphed the potential for increased capital returns going forward, which I certainly wouldn’t argue with. But I’d also like to see the company reinvest in production growth (potentially even selling the rig operations to support more drilling) which would change the dynamic of valuation. It’s one thing to be a low-multiple E&P operator in run-off mode – it’s completely different to be a low-multiple E&P operator with production growth coming down the pike.

Heritage-Crystal Clean (HCCI) from Mittleman Global Value: (value)

MIM bought a 2.5% weighting in a leading environmental services company that Chris Mittleman has admired for many years, Heritage-Crystal Clean Inc. (HCCI), at an average cost of $26.77 in the waning days of June, with ~49% upside to MIM’s estimate of fair value at $40. As at 1 August the shares are $34, up recently on a stronger than expected quarterly report announced on 27 July, and a large insider buy of 150,000 shares on that same day at $27.00 ($4.05M), bringing CEO Brian Recatto’s total shares directly held to 820,505 ($28M).

MIM’s estimate of fair value for HCCI of $40 is based on a $901M EV = 8.6x EBITDAaL (est. for CY2022) of $105M (17.5% margin on $600M sales) = 18x FCF est. of $50M. Closest competitor, Clean Harbors / Safety-Kleen (CLH $90) trades at 8.5x EBITDA (est. 2022) and 18x FCF (CLH has roughly same EBITDA margin as HCCI, despite being 8x larger).

Below a description of the company from the most recent 10-Q:

Heritage-Crystal Clean, Inc., a Delaware corporation and its subsidiaries (collectively the “Company”), provide parts cleaning, hazardous and non-hazardous containerized waste, used oil collection, wastewater vacuum, antifreeze recycling and field services primarily to small and mid-sized industrial and vehicle maintenance customers. The Company owns and operates a used oil re-refinery where it re-refines used oils and sells high quality base oil for use in the manufacture of finished lubricants as well as other rerefinery products. The Company also has multiple locations where it dehydrates used oil. The oil processed at these locations is primarily sold as recycled fuel oil. The Company also operates multiple non-hazardous waste processing facilities as well as antifreeze recycling facilities at which it produces virgin-quality antifreeze. The Company’s locations are in the United States and Ontario, Canada. The Company conducts its primary business operations through Heritage-Crystal Clean, LLC, its wholly owned subsidiary, and all intercompany balances have been eliminated in consolidation.

The Company has two reportable segments: “Environmental Services” and “Oil Business.” The Environmental Services segment consists of the Company’s parts cleaning, containerized waste management, wastewater vacuum, antifreeze recycling activities, and field services. The Oil Business segment consists of the Company’s used oil collection, recycled fuel oil sales, used oil rerefining activities, and used oil filter removal and disposal services. No customer represented greater than 10% of consolidated revenues for any of the periods presented. There were no intersegment revenues. Both segments operate in the United States and, to an immaterial degree, in Ontario, Canada. As such, the Company is not disclosing operating results by geographic segment.

For those seeking more detail, the company’s website is highly informative: www.crystal-clean.com

This is a growth/cyclical business, with about 40% of sales from re-refining of used oil, and 60% from less cyclical environmental services. MIM thinks the valuation is penalised too much by the cyclical exposure with not enough credit for the great track record and prospect of continued growth.

The oil re-refining business is operating at an all-time high for HCCI recently, so that is likely to flatten out and with the obvious risk that it might more severely revert to the mean. But then again, if energy prices stay somewhat elevated the better than normal spread HCCI’s re-refining business has enjoyed recently might persist for some time. The cost of the used motor oil that HCCI collects from its various customers has risen, but not as much as the re-refined products which HCCI sells, mostly Group 2 Base Oil that goes into various lubricants.

Also, IMO 2020 (International Maritime Organization) regulations implemented on 1 January 2020 impose stricter sulfur limits on marine fuel, which increases demand for HCCI’s clean (low sulfur) fuel output.

MIM’s willingness to endure the risk that the oil re-refining business is unsustainably over-earning is because the environmental services side of the business (60%) holds a more than offsetting amount of appeal, both from organic growth expectations and from acquisitions, like the $156M purchase of Patriot Environmental Services announced on 30 June 2022: https://www.fuelsandlubes. com/flo-article/heritage-crystal-clean-acquires-patriotenvironmental-services/

On the 28 July Q2 earnings report conference call, HCCI’s management quantified the valuation paid for Patriot Environmental as 5.5x actual 2021 EBITDA, but 9x normalised 2021 EBITDA (excluding one big unusual contract). But, after cost saving synergies expected in year 1 of $7M, the post-synergies multiple paid drops back to 6.5x. A seemingly smart deal that is a continuation of their 22-year track record of growing organically and with accretive M&A.

There is also a large valuation gap, not just between HCCI and its larger peer, CLH, but between their sector and the large solid waste companies, which do have much higher EBITDA margins but still the valuation gap seems excessive. MIM’s suspect larger solid waste haulers may seek to buy out specialty environmental services companies like HCCI and CLH.

Lastly, controlling shareholder, Heritage Group Inc. (Fred Fehsenfeld Jr., 71 years old), which owns 20.6% of the HCCI shares outstanding, registered their shares for sale last year. That may be meaningless, but it might indicate an openness or preparation for potential sale. Fehsenfeld also controls Calumet Specialty Products, which is somewhat similar to HCCI’s oil re-refining business. His 20.7% stake in HCCI is worth $168M, and his 15% stake in CLMT is worth $146M, both at today’s (August 1st) share prices.

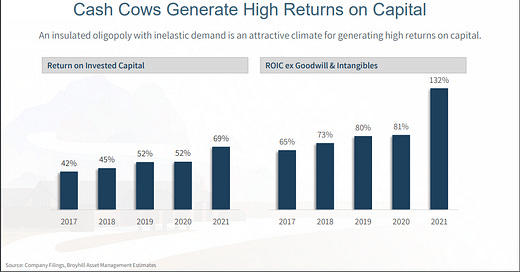

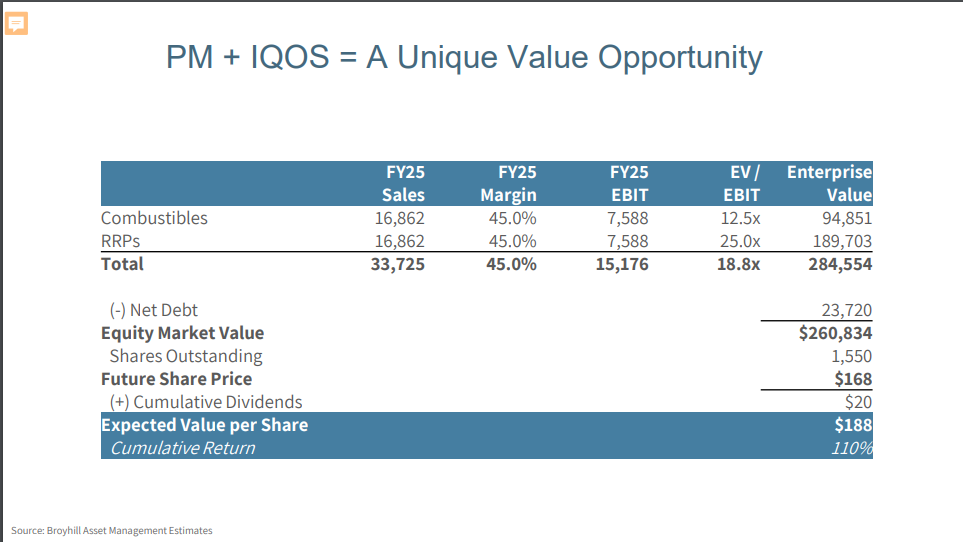

We finish with a few slides from Broyhill Asset Management’s informative (and entertaining!) presentation on Philip Morris. Please click through to read & enjoy the entire pitch.

Philip Morris (PM) from Broyhill Asset Management: (quality at a reasonable price)

Until next time! - EP

You are doing a great job here. Congrats. If you don't mind me asking, how do you get the documents from all these companies?