Welcome, subscribers!

While our name might be Elevator Pitches, that doesn’t mean we don’t also enjoy getting in the weeds with meatier investment write-ups. This week, we’re happy to share three lengthy stock write-ups from highly respected investment managers.

If you enjoy what we do, please consider forwarding to a friend or colleague who might also appreciate our work.

This week, we’re excited to highlight 3 new ideas, including:

A special situations microcap REIT with significant upside

A legacy payments company trading at a near record low valuation

A vertical SaaS company tethered to a secularly growing end market

Keep reading to learn more.

Disclaimer: Nothing here constitutes professional and/or financial advice. You alone assume any risk with the use of any information contained herein. We may own positions in the securities listed. Please do your own due diligence.

To the investment managers who read this, you can send us your letters at elevatorpitches@substack.com or on Twitter (and Threads!) if you’d like to be included in a future issue.

Let’s get to it.

Alluvial Capital Management delivered a lengthy look at their thesis for Peakstone Realty Trust (PKST). The REIT is a hodgepodge of industrial and office properties of varying quality. Alluvial sees upside in excess of 100%.

As promised, I am back with a writeup of a REIT I think is extremely cheap. Be forewarned: my thesis doesn’t rest on this REIT owning A+ assets and riding to glory on economic tailwinds. Rather, this is the equivalent of buying a beat-up but fundamentally roadworthy 2005 Honda Civic. Sure it’s ugly and uncool, but the cost-per-mile can’t be beat. Just ignore that funny clicking sound.

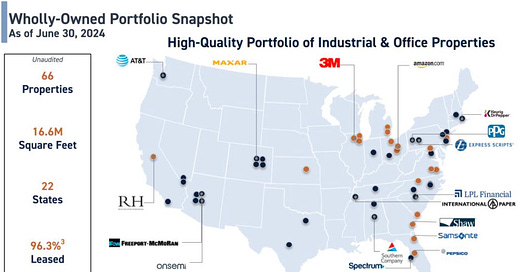

Peakstone Realty Trust trades at less than half my estimate of asset value, offers an exceptional free cash flow yield, and will benefit from simplification and repositioning. Peakstone owns 16.6 million square feet of industrial and office real estate. Their properties are 96.3% occupied with a weighted average lease term of 6.6 years and produce $187 million in annual net rents. Peakstone’s current enterprise value of $1.43 billion yields an implied cap rate of 13.1%. Shares trade around $12.50 as I write, but I believe a conservative estimate of asset value puts fair value at no less than $25.

There are multiple reasons that Peakstone trades so cheaply. The biggest is its high exposure to office, the most challenged real estate sector. Peakstone was also a private REIT until last year and has yet to attract much institutional attention given its small size and short track record as a public company. As the office segment begins to turn the corner and as Peakstone builds credibility, I think the discount to fair value will diminish.

Assets

Peakstone divides its properties into 3 segments: industrial, office, and other. I will tackle each in order of its quality. First, industrial.

Peakstone’s industrial assets consist of 19 properties, located mostly in the Mid-Atlantic, Midwestern, and Southeastern markets. These properties are distribution centers, warehouses, and light industrial/R&D focused. The majority of tenants are investment grade lessees.

Industrial is a hot sector. Rents are up nationwide, with in-place rents averaging $8 per square foot and newly-signed leases exceeding $10 per square foot. Newer properties in the most supply-constrained areas are regularly trading with 5 handle cap rates. Peakstone’s industrial properties are bringing in just $5.49 per square foot, indicating plenty of potential for increased rents on re-leasing. And that is exactly what has been happening. In the second quarter, Peakstone signed a one year extension on a property in Columbus, OH at $6.50 per square foot, a 63% premium over the previous lease. It also secured a lease renewal on a Jacksonville warehouse at a 28% premium. So while Peakstone won’t be capturing premium rents from its industrial assets, I believe we can expect to see industrial rents increasing at a mid-single digit annual pace as below-market leases gradually renew. Peakstone’s industrial properties currently produce annual net rents of $49.3 million. Valuing this segment at a 6.3% cap rate would value the industrial portfolio at $789 million. Just as a sanity check on that cap rate, investment grade industrial REITs are trading at cap rates of 4-5%.

Next, office. Peakstone owns 36 office properties in many different metro areas nationwide. These properties are largely suburban. The challenges facing the office sector are well-known so I won’t spend time laboring the point. Fortunately for Peakstone, its office portfolio is better situated than most office REITS.

Long average lease terms - the weighted average lease term on Peakstone’s office properties exceeds 7 years. Only 5% of lease revenue rolls off in the next 3 years. This lack of short-term lease expirations means Peakstone is not stuck trying to secure lease renewals in the current depressed office market and can wait until better times arrive (hopefully.)

Large percentage of “critical” facilities - most of Peakstone’s office properties are home to company headquarters or house resources like company data centers that make moving costlier or more disruptive to operations.

Relatively new buildings - the weighted average age since construction or last renovation for Peakstone’s office portfolio is 13 years. Not gleaming new, but not likely to require extensive capital expenditures prior to re-leasing.

These 36 properties produce $112.4 million in annual net rents. So, what’s that worth? I have, of course, gone through each property and applied what I believe is a conservative cap rate to each. Feel free to check out the results here. I arrive at a fair cap rate for the portfolio of 9.5%, valuing the collection of $1,176 million. As a reality check, office REIT peer (and large Alluvial holding) Net Lease Office Properties has been selling properties with 6-8 year leases at 8-10% cap rates.

Last, there is the “other” bucket. This is is a collection of 14 non-core properties that Peakstone is in the process of divesting. For the most part, these properties are part of non-recourse loan pools. The first of these pools is the “AIG Loan” bucket. The AIG Loan has a principal balance of $91.2 million. There are 4 office properties in this pool. While a couple have decent tenants and loan terms, I don’t think the asset value here exceeds the loan value and I ascribe zero value to Peakstone from these assets.

The second pool is “AIG Loan II” bucket. This loan has a principal balance of $105.6 million. There are 7 properties in this bucket, with 4 having decent tenants and remaining lease terms. There may be some value to these properties, depending on if Peakstone can secure good lease renewals or new tenants for the buildings with leases expiring in <12 months. Still, I don’t see the net value of these properties to Peakstone exceeding $23 million. Could be less.

Last, there are 3 unencumbered properties in the “other” category. Only 1 has a decent tenant. The others are vacant or nearly so. Valuing those properties at $50/square foot and the occupied property with a normal cap rate yields value of $47 million.

That yields total value of $70 million for the “others.” Keep in mind this value is squishy and depends a lot on leasing activity and/or successful divestitures. It could be higher or lower. Regardless, it’s not a major determinant of value here.

Liabilities

Now to the liability side of the picture. Thanks to the well-timed sale of some office buildings in 2022, Peakstone is flush with cash. The REIT recently paid down a portion of its term loan and pushed the maturity on term loan and its revolving credit agreement to 2028. The term loan has a $210 million balance and the revolver has a $400 million balance. Peakstone has another term loan with an April 2026 maturity and a $150 million balance. There is also a $250 million mortgage due 2028 backed by certain properties. (These properties are worth well more than the mortgage balance, so I include this mortgage in enterprise value.) Finally, there’s a small $17 million mortgage against a single industrial property. This sums to $1,027 million in debt. Pro forma for the term loan pay-down, Peakstone has $257 million in unrestricted cash for a net debt of $770 million, a very comfortable 4.8x the net rents of the core office and industrial properties. This analysis excludes the non-recourse debt associated with the “other” segment. Total annual cash interest expense, pro forma for the refinancing and including the non-recourse debt, is $48 million.

Thanks to a well-timed rate swap, the interest on $750 million in borrowings is fixed at a low rate until July 2025. With the Federal Reserve poised to begin cutting rates, Peakstone appears set to continue enjoying moderate borrowing costs.

Value

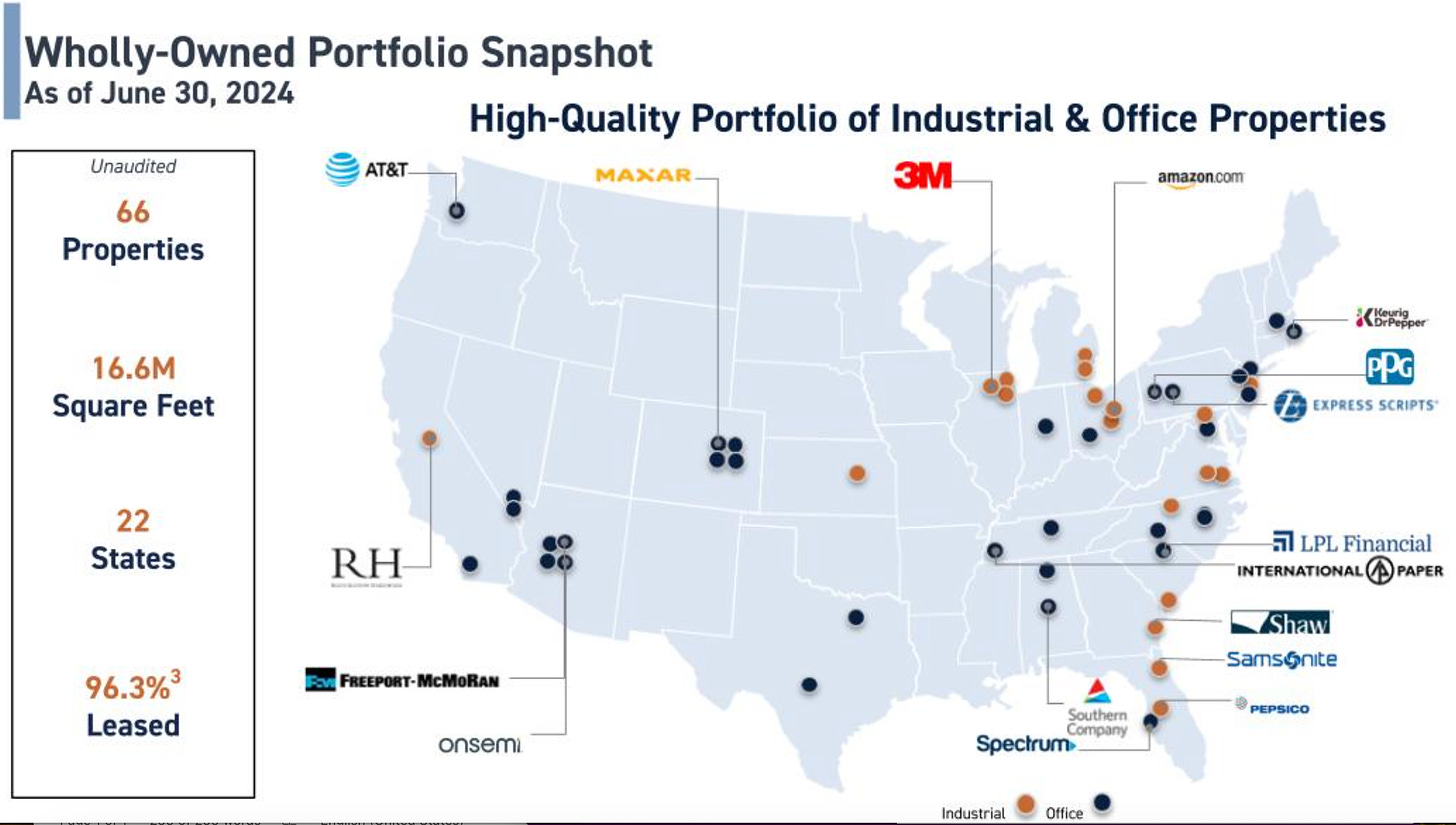

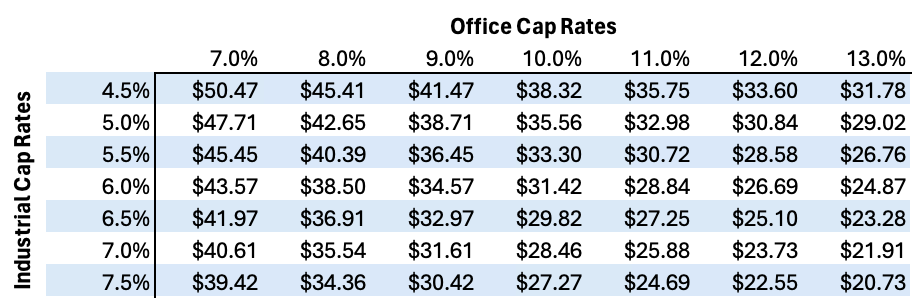

Putting it all together, I arrive at net asset value of $1,265 million, or $31.90 per diluted share. Below is a sensitivity table of per-share value at various office and industrial cap rates.

Readers can apply their own opinion of fair cap rates for office and industrial properties, but I think any reasonable figures create asset values for Peakstone in the high-$20s to mid-$30s. It almost goes without saying that the actual trading price around $12.50 implies cap rates grossly divorced from on-the-ground market prices.

Now, what about overhead? A valuation based on assets and liabilities alone is incomplete. After all, it costs money to run Peakstone, and that overhead directly reduces the value that Peakstone shareholders receive. In my experience with REITs, the market is basically willing to ignore the drag that company overhead produces, provided that 1. the overhead is reasonable, 2. the company management team creates value in the long run, and 3. annual overhead grows no faster than inflation or the rate at which the REIT balance sheet grows, whichever is higher. If there’s currently a knock against Peakstone (other than them having the audacity to own offices) it’s that overhead is too high at around $40 million annually. Despite owning fewer properties now than in years past, the company retains a cost structure more appropriate to a larger REIT. There are early signs of progress. Second quarter 2024 general and administrative costs were down 24% year-over-year and down $500k from the first quarter to a $36.4 million annual run rate. I hope the company continues making progress, but for now it’s reasonable to apply some sort of discount to adjust for the top-heaviness of the REITs operations. Assuming two thirds or $24 million of Peakstone’s overhead is pure drag and valuing that at 10x reduces Peakstone’s value by $240 million, equal to $6.05 per share. In sum, I combine net asset value of $31.90 per share, less the value of overhead drag of $6.05 per share, to arrive at a fair value of $25.85 per share.

Cash Flow

Asset value is nice, but at the end of the day, it’s cash flow that drives returns. I am not adverse to investing based on discount to asset value, but I’m a LOT more comfortable with the prospects when I have a fat free cash flow yield to collapse the discount. Peakstone has cash flow in spades. Peakstone collects net annual rents of $187 million. $36 million goes out the door to keep the corporate entity’s lights on and employees coming back. Peakstone is currently paying $48 million on its borrowings and earning $12 million in interest income for net cost of $36 million. Capex is nearly a non-factor at maybe $5 annually. That nets to $110 million in annual free cash flow or $2.77 per share. Not bad on a $12.50 share.

Management

Peakstone’s management team is experienced and clearly capable of managing a public REIT. They successfully steered the REIT through the beginnings of the downturn in office real estate, executing a timely sale to the joint venture that brought in substantial cash and reduced exposure. I am less convinced management is optimally incentivized given their minimal stock ownership. Management compensation is variable and depends on achieving certain concrete goals, but there is no substitute for ownership to drive outcomes. This would be more of an issue for me in a less discounted “compounder” type investment where forward returns depend more on capital allocation decisions and less on mean reversion. I am more willing to overlook lack of alignment in a severely dislocated stock like Peakstone. Management is a neutral factor here.

Strategy

Peakstone’s strategy is simple and achievable. The REIT will continue selling properties from the “other” segment and paying off related debt, and using the cash flow from its core office and industrial segments to reinvest in industrial properties. As the number of properties in the troubled “other” segment declines, the balance of value shifts from office to industrial, and the office segment bottoms and begins to inflect, I think the market will re-evaluate how it categorizes Peakstone and stop assigning a punitive valuation framework. I expect this process will take another 12-24 months to play out, but the company is actively working toward this goal.

In Summary

So, how does Peakstone get from $12.50 today to a more reasonable value in the mid-$20s? The answer is probably as simple as “time.” With each passing quarter, Peakstone will continue selling non-core assets, generating substantial cash, and maybe even picking up a solid industrial asset or 3. The office sector will gradually lose its stigma, if only for the fact that the net square footage of office space is likely to decline for years to come and at some point, the market will clear. In the mean time, shareholders will enjoy a 22% free cash flow yield. At some point, Peakstone’s highly fractured, largely retail ownership will begin to consolidate into institutional hands as small holders who bought the private REIT run out of shares to sell. I wish I knew exactly how long this process will take, but I’m willing to wait around when my investment is supported by such strong asset value and corresponding cash flow.

We have 2 more ideas for our paid subscribers below.